I. Overview of US Stock Index Options

Trading volume in the US stock index options market is currently rising slightly, while the put/call ratio is declining.

The volume distribution of S&P 500 index options expiring today shows a divergence between call and put order distributions, with put orders peaking at 6870 points and call orders peaking at 6930 points.

Nasdaq contracts expiring today 100 Index Options Trading Volume Distribution: Call single peak at 25800, Put single peak at 25200.

II. US Stock Options Trading Volume Ranking

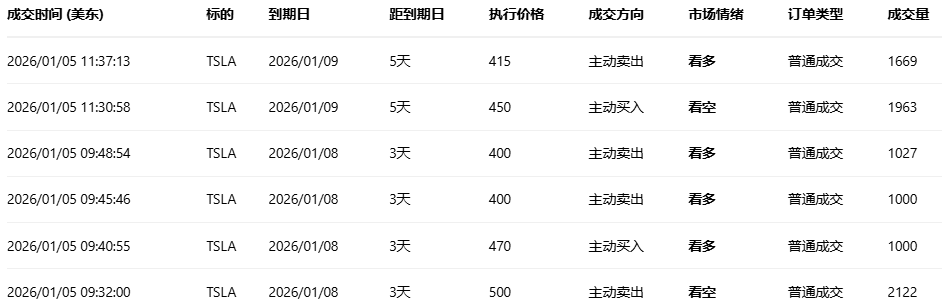

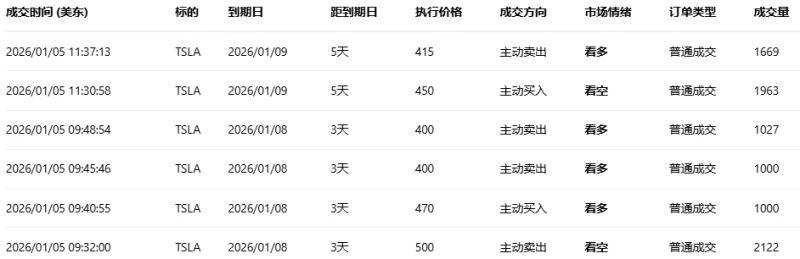

1. Tesla The stock rose 3.1% in the previous trading day, with the put/call ratio declining and trading volume decreasing the day before.

Observing the large orders with unusual activity in options trading, it was found that large investors were mostly bearish before the market closed.

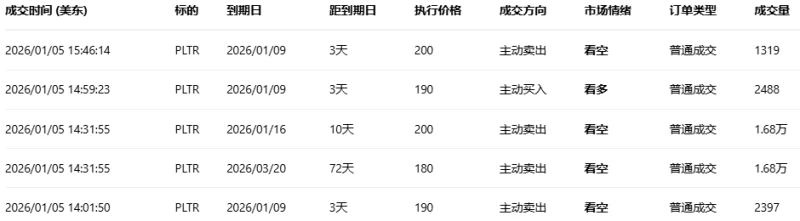

2. Palantir rose 3.68% in the previous trading day, with the put/call ratio declining and trading volume decreasing the day before.

Observing the large orders with unusual activity in options trading, it was found that large investors were mostly bearish before the market closed.

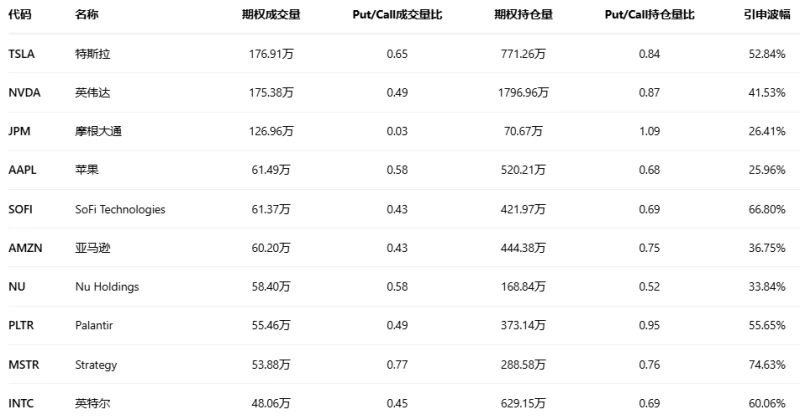

Top 10 US Stock Options Trading Volume Ranking

Top 10 most volatile US stock options (underlying asset market capitalization > $10 billion and option trading volume > 100,000 contracts)

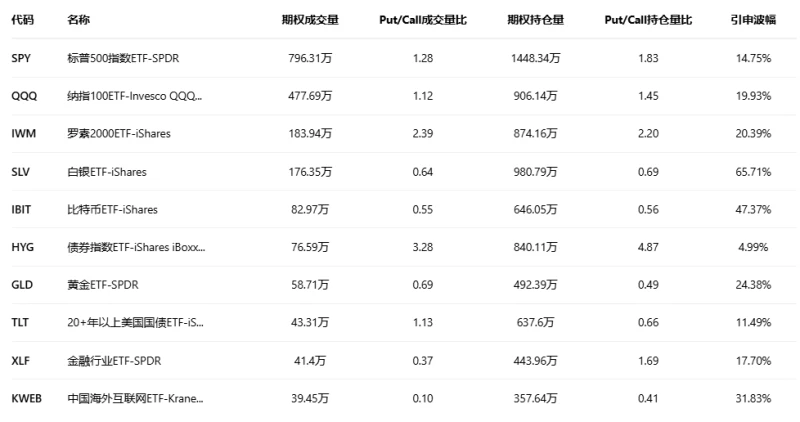

III. Top Ten US Stock ETF Options Trading Volume Ranking

Top 10 US Stock ETFs by Implied Volatility (Based on: Market Cap > $10 billion)

(Article source: Hafu Securities) )