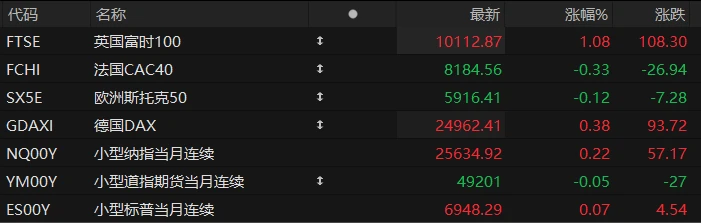

U.S. stock index futures traded in a narrow range in pre-market trading on Tuesday, while major European indices showed mixed results. As of press time, Nasdaq... S&P 500 futures rose 0.22%, Dow Jones futures fell 0.05%, and S&P 500 futures rose 0.07%.

In terms of individual stocks, most prominent tech stocks rose in pre-market trading, with Micron Technology among them. Nvidia Prices rose for companies like AMD.

Popular Chinese concept stocks generally rose in pre-market trading, with Hesai... Pony.ai surges nearly 7% NIO rose more than 2%. XPeng Motors rose nearly 2%. JD.com A slight increase is expected. TSMC With a gain of over 2%, it is poised to open at a new high.

On January 6th, the International Consumer Electronics Show, often referred to as the "Spring Festival Gala of Technology,"... The exhibition (CES 2026) kicked off in Las Vegas, USA.

In response to concerns in global capital markets about the impending bursting of the AI bubble and anxieties about the gradual obsolescence of Moore's Law, Jensen Huang presented a new rack-mounted AI GPU computing infrastructure platform called Vera Rubin. This, coupled with AMD CEO Lisa Su's presentation of the MI455X AI GPU at CES, boasting a 10x performance improvement over the MI355X and previewing the MI500 with its promise of a "thousand-fold performance leap," collectively sent a positive signal to global investors: the demand for AI computing power continues to expand exponentially, and the construction of AI infrastructure is still in its early to mid-stages.

Hot News

A phenomenal start to the year! The 2026 gold and silver bull market will continue its "violent aesthetics."

Since the beginning of 2026, the global financial market appears to have remained largely unchanged compared to the overall landscape of 2025. In addition to the soaring global stock markets, gold and silver have also seen continued strong gains since the start of the year, extending their historic bull market run.

Market data shows that spot gold prices had a strong start to the first full trading week of the new year, rising sharply by 2.7% on Monday to $4,444.52 per ounce. During the session, it touched its highest level since December 29 last year, not far from the record high of $4,550 set on December 26.

Silver prices have been nothing short of frenzied since overnight: spot silver prices jumped 5.1% on Monday alone, and surged more than 3% during Asian trading hours on Tuesday, once again approaching the $80 mark. The main Shanghai silver contract even surged 8.00% at one point during the day, reaching 19,452.00 yuan/kg.

Many industry insiders are currently viewing the "black swan" event that occurred in Venezuela at the beginning of the new year as the main reason for the rise in gold and silver prices, as it has once again stimulated interest in precious metals. Demand for safe-haven assets.

Of course, given that gold prices had already surged by 64% and silver prices by a staggering 147% last year, the current situation in Venezuela is at best just another catalyst for the continued rise in gold and silver prices.

In fact, from multiple perspectives, including technical analysis, speculative positions, volatility indicators, and ETF buying, the bullish sentiment for precious metals remains quite strong.

Will the high valuations of SpaceX, OpenAI, and Anthropic, which are preparing for IPOs, be accepted by the market?

Several high-profile companies that investors are eagerly anticipating going public this year, including space exploration technology company SpaceX and artificial intelligence companies . (AI) companies OpenAI and Anthropic, but it remains to be seen whether investors will be willing to pay their high valuations.

According to previous media reports, SpaceX, owned by Elon Musk, the world's richest man, was valued at $800 billion in a secondary market share sale last December. Previously, it was widely rumored that this aerospace technology company... The company plans to go public in 2026, a fact Musk confirmed last month.

OpenAI completed a secondary stock transaction last October, valuing the company at $500 billion, and market rumors suggest that its goal is to achieve a valuation of $1 trillion when it goes public.

Anthropic is also believed to be preparing for an initial public offering (IPO), which was announced by Microsoft last November. In a funding round backed by Nvidia , its valuation reached a peak of $350 billion.

Samuel Kerr, head of equity capital markets at Mergermarket, said any listing of this size would be "a major market event."

Goldman Sachs Strategists are optimistic about the performance of European stocks this year, as their low valuations may attract inflows of US funds.

Strategists at top investment bank Goldman Sachs say European stocks are poised for a boost this year as investors seek to diversify their over-reliance on the U.S. market and its overvalued tech stocks.

Goldman Sachs' team, including Sharon Bell and Peter Oppenheimer, raised its year-end target for the pan-European Stoxx 600 index to 625 points, about 4% higher than the record closing high reached this Monday, while the average target price of its peers is around 620 points.

Goldman Sachs strategists wrote in a report, "Given the high valuations and concentration in the U.S. market, we recommend that investors diversify their asset allocation." They also noted that U.S. investors, concerned about the risks posed by a weakening dollar, are seeking alternative sources of growth in other parts of the world.

While European stocks are not the most undervalued—their forward price-to-earnings ratios are currently above 15—they are still significantly lower than the S&P 500's approximately 22. Strategists suggest that this roughly 30% valuation discount, coupled with expectations of an improving European economy, could drive capital inflows into the region.

US Stocks Focus

Samsung unveils its first crease-free foldable screen panel, potentially for use with Apple. New machine

For foldable phones, the biggest design pain point has always been the unavoidable crease in the middle of the screen. Now, it seems that some manufacturers have found a solution.

At CES 2026, Samsung Display showcased a foldable OLED display without creases. The panel claims to achieve "seamless text transitions across the entire foldable screen," thus providing a "seamless viewing experience."

Samsung also set up a "crease test" area at the event, displaying the new panel side-by-side with the panel used in the Galaxy Z Fold 7, and the difference was extremely significant. The Fold 7 released last year had greatly reduced the visibility of the crease, but the crease was still visible at certain angles, while the new panel had almost no visible crease.

Samsung has not yet confirmed which models this panel will be used in, but it is very likely to appear in the Fold 8, which will be released in the second half of this year. More importantly, the capital market is watching closely, as this panel is very likely to be used in Apple's first foldable iPhone.

Following the announcement of its first foldable screen product, Apple may launch a second-generation foldable iPhone in 2027, while an iPad equipped with an OLED foldable screen is also in development. Similar to the highly anticipated but ultimately unsuccessful Vision Pro, Apple's foldable phone will also face the test of consumer acceptance. Several well-known leakers and securities analysts predict that the first "iPhone Fold" will be priced between $2,000 and $2,500 , roughly double the price of the flagship iPhone Pro Max.

Bank of America: AI Chips Stocks will continue to rise, with Nvidia and Broadcom leading the way. AMD is the preferred target.

Against the backdrop of the continued rapid development of artificial intelligence (AI), the global semiconductor industry... The market is rapidly approaching the historic trillion-dollar milestone. Both Wall Street tycoons and retail investors are closely watching the "winners" of this wave.

In its latest outlook report, Bank of America The report lists seven AI chip companies that it believes have a bright future in 2026. Nvidia, Broadcom , and AMD are specifically named "top picks," as the bank expects them to benefit from the $1 trillion AI chip market.

Bank of America analysts, led by Vivek Arya, wrote: "We are currently only halfway through a decade-long transformation. Despite anticipated volatility, we remain bullish on semiconductor , memory, and semiconductor equipment stocks related to artificial intelligence."

Arya predicts that global semiconductor sales are expected to grow by approximately 30% year-on-year by 2026, ultimately pushing the industry's annual sales past the $1 trillion mark. The report states, "This is not incremental growth, but a fundamental shift in how global computing power is consumed."

Morgan Stanley: The US stock market bull run will continue in 2026, benefiting from "six catalysts".

According to Morgan Stanley Morgan Stanley 's latest view is that the U.S. stock market will continue to rise, driven by multiple bullish catalysts. "We believe the current consensus still underestimates the combined impact of a range of positive factors," wrote Mike Wilson, chief U.S. equity strategist at Morgan Stanley, in a report on Monday (January 5).

Here are six key factors Morgan Stanley believes will drive US stocks higher in 2026: Earnings : The bank expects earnings per share for listed companies to grow by approximately 15% in 2026; Regulatory easing : The financial sector will particularly benefit from regulatory easing; Federal Reserve policy : Wilson stated that the Fed expects to cut interest rates in January and April, and the 10-year Treasury yield should fall below 3.75%; AI adoption : According to Morgan Stanley's analysis, the proportion of companies achieving higher profit margins through the adoption of AI is increasing; Oil prices and the dollar may continue to fall : A weaker dollar will increase US companies' overseas profits, while lower oil prices will lead to lower gasoline prices for everyday consumer goods; Valuations should rise further : Morgan Stanley stated that although overall stock market valuations are already high, several factors suggest that valuations could continue to rise, including: 1) When earnings per share growth is above the long-term average and monetary policy is loose, the S&P 500... (1) The forward P/E ratio of the S&P 500 will expand 90% of the time; (2) The median market capitalization of stocks in the S&P 500 is 3 times lower than the market capitalization weighted index.

In his report, Wilson also stated that his top stock investment recommendations include financial stocks, healthcare stocks, consumer discretionary stocks, industrial stocks, and small-cap stocks.

(Article source: Hafu Securities) )