As we enter 2026, Warren Buffett's retirement from frontline management marks the end of an era for Berkshire Hathaway, as he formally hands over this legendary business empire to Greg Abel.

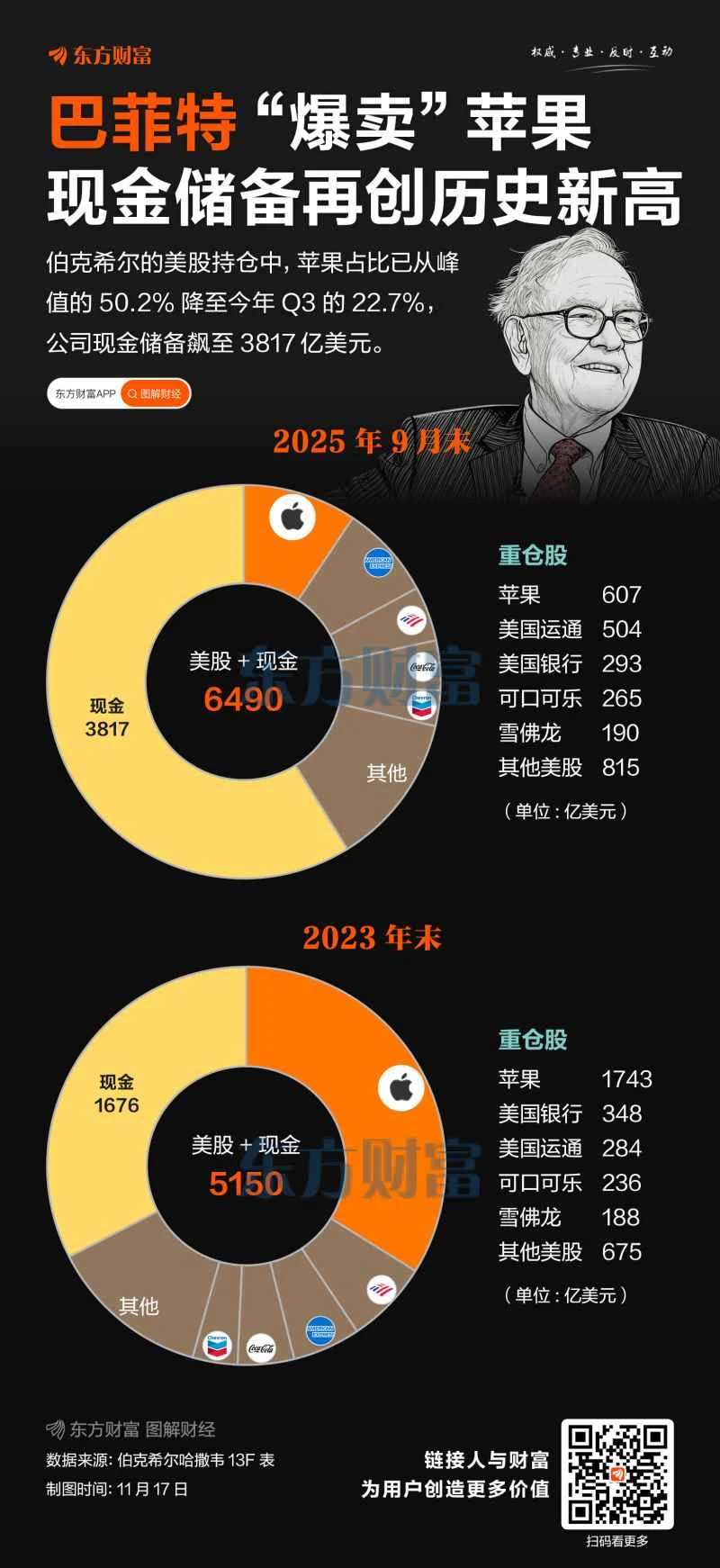

The 95-year-old "Oracle of Omaha" left behind not only an astonishing record of achievements—Berkshire Hathaway has generated a total return of approximately 6,100,000% for its shareholders since Buffett took the helm in 1965, nor just a series of investment philosophies that are remembered by the world, but also a record $380 billion in cash on Berkshire Hathaway's books.

In artificial intelligence With the AI craze sweeping Wall Street and driving stock prices ever higher, how Berkshire Hathaway, led by Abel, will handle this "huge sum" is undoubtedly one of the most pressing questions for investors.

According to Alex Morris, author of "Buffett and Munger Unscripted" and founder of investment research service TSOH, Abel's biggest obstacle will be "finding a smart way to allocate" Berkshire's large and growing cash reserves.

He believes that Abel can use Berkshire's cash reserves to buy back shares, acquire other businesses, or pay dividends to shareholders.

However, Buffett seems to have found these approaches ineffective in recent years. Berkshire Hathaway has not repurchased any shares in the past five quarters, has only paid a dividend once under Buffett's leadership in 1967, and has made almost no major acquisitions in the past 15 years.

Morris stated that as a business icon and legendary investor, Buffett received a greater degree of "leniency" from Wall Street and Berkshire Hathaway shareholders when accumulating cash than Abel might have.

“Finding a solution here is challenging,” he continued, suggesting that Abel could consider a “one-off special dividend.”

In a media interview, Glenview Trust Chief Investment Officer Bill Stone stated, "Berkshire is now so large that you have to find bigger opportunities to make a difference. If Berkshire doesn't use this money for investment, it will soon face pressure to start paying dividends."

Jonathan Boyar, president of research firm Boyar Research, said, "As a shareholder, I think they hold too much cash. Now that Buffett has retired, and he is the greatest stock picker of all time, I hope they will reduce their focus on stock picking and start paying dividends."

Abel's reforms

Warren Buffett and his longtime business partner, the late Charlie Munger, are known for their decentralized management style, which allows Berkshire Hathaway's numerous subsidiaries to operate independently.

These companies cover a wide range of industries, from railroads and energy to insurance. The group has interests in both the retail and automotive industries, with subsidiaries including well-known companies such as GEICO (auto insurance ) and See's Candies. Additionally, the group holds shares in Apple. The company also recently invested in Alphabet, Google's parent company.

Analysts expect that Abel, a veteran with 25 years of experience at Berkshire Hathaway and extensive experience in energy and industrial operations, will make full use of his background during his tenure at the helm.

"Under his leadership, this is likely to become an important business segment for the company and investors," said Cathy Seifert, an analyst at CFRA Research. "Given the industrial and energy-related demands that artificial intelligence is creating, I think this could be an interesting business to watch within the Berkshire Hathaway framework."

In addition, Abel may take a more direct approach to managing Berkshire Hathaway's various businesses.

Boyar said, "There are probably a lot of redundancies that can be cut. Some departments can be merged. They can improve profitability in many ways."

Stone agreed, saying, "Could Munger and Buffett be excellent managers? They probably could, but they chose not to. They prefer to spend their time looking for opportunities. Perhaps there are some real opportunities to introduce professional management skills and expertise... I think we've seen that, and I think Greg certainly possesses those abilities."

Although Buffett's retirement marks the end of an era, it does not necessarily mean the end of his influence.

"Over the past sixty years, he has not only shaped Berkshire Hathaway's business philosophy but also influenced the way many investors think," said Lisa Schreiber, deputy portfolio manager at Gradient Investments, in an interview. "What he said fifty years ago still has great significance today."

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)