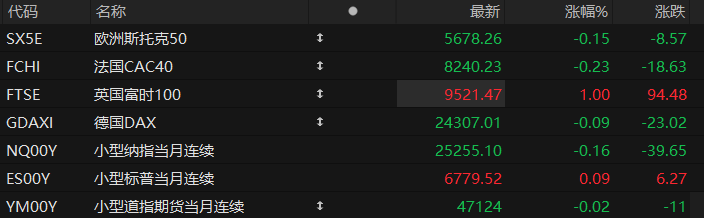

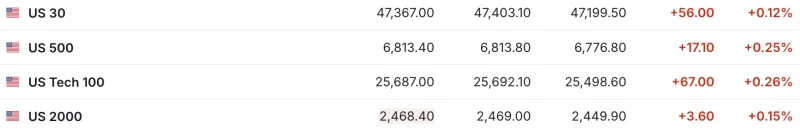

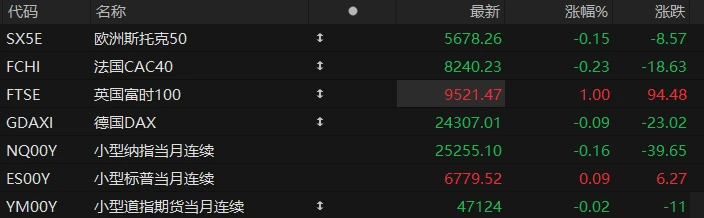

U.S. stock index futures were mixed in pre-market trading on Wednesday, while most major European indices declined. As of press time, the Nasdaq... S&P 500 futures fell 0.16%, S&P 500 futures rose 0.09%, and Dow Jones futures fell 0.02%.

In terms of individual stocks, popular Chinese concept stocks generally fell in pre-market trading, with NetEase among them. Bilibili fell more than 2%. Pony.ai Hesai Kingsoft Cloud TSMC fell more than 1%. Tencent Music Baidu Pinduoduo fell nearly 1%. JD.com It fell by about 0.5%.

The US dollar index broke through 99 for the first time since October 15; the yield on 10-year US Treasury bonds remained unchanged at 3.96%; spot gold fell more than 2% to $4,039 per ounce; spot silver fell below $48 per ounce, a drop of 1.3%; and Bitcoin fell below $107,000 per coin, a drop of 1.22% on the day.

Gold and silver prices both plummeted in the previous trading day due to profit-taking, a technical correction, and signs of easing geopolitical tensions. Spot gold prices plunged as much as 6.3%, marking their biggest intraday drop in over a decade. Currently, spot gold continues its downward trend. Standard Chartered Bank... Suki Cooper, head of commodities research, said the main reason was technical selling, as gold prices had been in overbought territory since early September. The bank also expects gold prices to resume their upward trend next year.

This week, corporate earnings improved market sentiment, but uncertainty surrounding the trade outlook and concerns stemming from the US government shutdown have not been fully dispelled. Trump has injected new uncertainty into trade negotiations. Meanwhile, the current US government shutdown is poised to become the second longest in history, leading to delays in the release of official data, including September's inflation figures originally scheduled for Friday.

Investors are currently focusing on Tesla. The upcoming earnings reports will kick off a period of key financial reporting for the "Big Seven" tech giants. Investors will be watching closely for updates from these companies regarding the expiration of the federal electric vehicle tax credit and the rollout of their self-driving taxis.

Hot News

The current US government shutdown has broken the record for the second longest in history.

As Wednesday morning light bathed Wall Street, the current deadlock in the U.S. federal government shutdown officially entered its 22nd day .

This figure means that this shutdown has surpassed the 21-day shutdown of 1995-1996, becoming the second longest shutdown in US government history, second only to the 35-day shutdown during Trump's first term. Furthermore, considering that Trump will begin his trip to Asia this weekend, the funding impasse could potentially continue throughout October and reach a new historical high.

The budget battle between the two major U.S. political parties is increasingly impacting the economy. Economists have estimated that each week of government shutdown reduces annual economic output growth by 0.1-0.2 percentage points. These fluctuations in macroeconomic figures are becoming tangible results.

By Friday, federal civilian employees who received only partial pay earlier this month will face their first-ever suspension of full pay. The White House has also warned that even with unconventional accounting methods, it may be impossible to pay U.S. military personnel on time, and next month's federal food aid funding is also at risk.

Samsung unveils Galaxy XR multimodal AI The headset's price is only Apple's. Vision Pro half

On Wednesday morning Beijing time, Samsung Electronics officially launched a mixed reality system designed to "unleash the full potential of multimodal AI ". The device is the Galaxy XR. Powered by Google's artificial intelligence. With content ecosystem and Qualcomm With its powerful computing chip, this new headset will challenge Apple's Vision Pro.

This is also the first headset to feature the Android XR platform—XR is a platform Google developed specifically for smart glasses and headsets. The device is powered by the Qualcomm Snapdragon XR2+ second-generation headset chip, offering 20% better CPU performance and 15% better GPU performance than its predecessor.

Samsung claims the Galaxy XR can achieve almost all the features of Apple's Vision Pro: Samsung's headset uses a Micro OLED... The display boasts 29 megapixels (6 megapixels more than Apple's Vision Pro), a resolution of 3552×3840, and covers 96% of the DCI-P3 color gamut—4% higher than the Vision Pro. However, in terms of refresh rate, the Galaxy XR supports a maximum of 90Hz, while the Vision Pro reaches up to 120Hz. As Samsung pioneers " space computing "... "A ambitious product for the market, the Galaxy XR is priced at $1,799 (approximately RMB 12,800) . While the price is clearly not cheap, it still offers good value for money compared to Apple's competing product at $3,499. This product has already launched in the US and South Korea and will be available in more countries in the future."

Shahram Izadi, head of Google XR, said that the partners set the price to "make it affordable for as many people as possible."

Junior Wall Street bankers tremble as OpenAI's secret project to venture into investment banking.

According to industry sources, OpenAI is conducting a secret project called "Mercury" to help its AI models learn to build financial models to replace junior bankers in performing some of the heavy lifting.

It is reported that OpenAI's project has attracted more than 100 former investment bankers, including many from JPMorgan Chase. Morgan Stanley and Goldman Sachs A former employee of the group.

Industry insiders revealed that former investment bankers involved in Project Mercury were paid $150 per hour for writing prompts and building financial models for a range of deal types, including restructurings and IPOs. OpenAI also allowed these contractors to use its developing artificial intelligence in advance.

An OpenAI representative stated that the company is collaborating with a range of experts to improve and evaluate the model's capabilities across various domains. The recruitment, management, and compensation of these experts are handled by a third-party vendor.

Could the "gold price killer" be a conference? This could rewrite US economic expectations.

On Tuesday, December gold futures on the New York Mercantile Exchange fell 5.7%, the largest single-day percentage drop since June 20, 2013, according to an analysis of FactSet data by Dow Jones Market Data. One economist attributed this to last week's International Monetary Fund (IMF) meeting.

Robin Brook , Senior Fellow at the Brookings Institution In his Substack column, Robin Brooks attempts to explain the flow of funds driving gold price fluctuations. He concludes that last week's annual World Bank and IMF meetings in Washington, D.C., likely led most delegates to raise their expectations for the U.S. economic growth cycle, a change that removes one of the core supports for the recent gold investment logic.

Brooks analyzed the reasons commonly cited by the market for the rise in gold prices, such as geopolitical uncertainty, global debt burden and concerns about the resulting devaluation of fiat currencies, and the diversification of central bank assets. However, he commented that "most of these are old news and not the driving factors for the current gold price fluctuations."

Brooks believes that the main driver of recent gold prices is the state of the US economy —whether the US economy will fall into recession and how this prospect will affect the Federal Reserve's monetary policy.

US Stocks Focus

Earnings Countdown: Tesla's Slowing Growth Relies on AI Vision to Support Stock Price

Among the major tech giants listed on the US stock market, Tesla stands out, primarily due to negative factors. The most significant of these is that despite its soaring stock price, its profit growth has been noticeably weak. The electric vehicle manufacturer, led by Elon Musk, will release its third-quarter earnings report after the market closes on Wednesday, and market data indicates that Q3 profits are expected to decline by 25% year-over-year.

This phenomenon is not new; it has been observed for several consecutive years. However, it's worth noting that Tesla... Despite the earnings decline, the stock price has more than doubled in the past 12 months. This is thanks to Musk's successful shift of investor attention away from electric vehicle sales and towards his vision for an artificial intelligence company—focused on self-driving cars and humanoid robots. .

Daniel Newman, CEO of Futurum Group, a technology research and consulting firm, said: " Tesla 's core narrative has never been about the current quarter's performance, but rather the market's longer-term expectations for its ability to continue innovating and transforming into the future."

This mindset of downplaying current performance and pinning hopes on the future has pushed Tesla 's market capitalization to astonishing heights. The stock's forward price-to-earnings ratio for the next 12 months is a staggering 195, far exceeding its April figure of less than 80. It is the fourth most valued stock in the S&P 500, second only to Warner Bros. The company, Palantir Technologies and Boeing company.

Explosive surge! US retail investors once again "short squeeze" Beyond Meat, which has jumped 1300% in just 4 days!

Cultivated meat, once shunned by Wall Street Beyond Meat is making a comeback in an extreme way. Its stock price has exploded in a textbook short squeeze, driven by retail investors in a frenzy reminiscent of past "meme stock" frenzies.

Beyond Meat shares doubled in pre-market trading on Wednesday, hitting as high as $7.33, after previously trading at just $0.524. This brought its cumulative gains to nearly 1,300% in just four trading days. Nevertheless, the share price is still down about 97% from its all-time high in 2019.

The latest catalyst for this frenzy came from a company announcement on Tuesday. Beyond Meat announced it will expand its product offerings at Walmart. The supermarket's sales network covers more than 2,000 stores. This news further ignited already intense market sentiment, pushing the stock price to break through again.

However, behind this astonishing surge lies the rally of retail investors on social media platforms and their precise targeting of the company's extremely high short positions. Meanwhile, an undeniable factor is that Beyond Meat has just completed a debt swap that will massively dilute existing shareholder equity, creating significant risks for this rally.

Baidu is accelerating its global expansion! It will launch Robotaxi testing in Switzerland by the end of the year.

Chinese internet giant Baidu, in partnership with PostBus, a subsidiary of Swiss Post, will launch autonomous driving services in Switzerland by the end of this year. The two companies are conducting road tests of robotaxis and plan to launch the world's first steering wheel-less robotaxi service to the public as early as 2027.

According to a statement released by Baidu on Wednesday, this collaboration will facilitate the rollout of Baidu Apollo Go's driverless taxi service in the cantons of St. Gallen, Appenzell (outer and inner Appenzell) in eastern Switzerland. The planned testing launch in December represents Baidu's most substantial step to date in pushing its driverless taxis onto European public roads.

After the initial safety driver-assisted testing phase, the project will enter the fully driverless testing phase by the end of 2026, and plans to start regular commercial operation no later than the first quarter of 2027.

The vehicles deployed will be Baidu's sixth-generation mass-produced autonomous vehicle, the RT6. This model is equipped with comfort features such as a voice control system, adjustable reclining seats, and massage functions. Baidu stated that once the service is fully operational, the steering wheel will be completely removed, making it the world's first steering wheel-less Robotaxi service to operate on public roads.

(Article source: Hafu Securities) )