JPMorgan Chase and Bank of America Strategists now expect the Federal Reserve to announce at its policy meeting next week that it will stop shrinking its approximately $6.6 trillion balance sheet, thus ending the process aimed at removing liquidity from financial markets.

Both of these Wall Street giants have further advanced their expectations for the Federal Reserve to end quantitative easing (QT), i.e., reducing their holdings of Treasury bonds and mortgage-backed securities. The window for forecasting the Fed's balance sheet reduction process was based on the recent rise in borrowing costs in the dollar funding market. Previously, they generally expected the Fed's balance sheet reduction process to end in December or early next year.

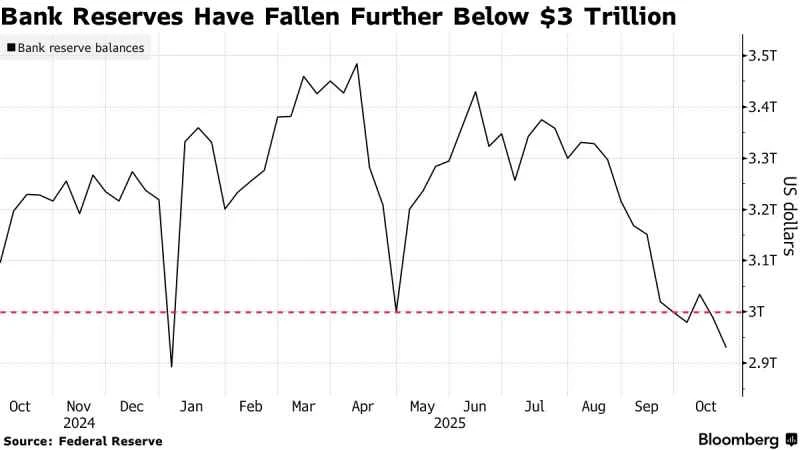

The key factor in the Federal Reserve's decision on whether to continue shrinking its balance sheet—the reserves in the U.S. banking system—has now fallen below the $3 trillion mark for the second consecutive week, just as the Fed is about to finalize its balance sheet adjustment path.

Data released by the Federal Reserve on Thursday showed that, in the week ending October 22, banks... Reserves decreased by approximately $59 billion to $2.93 trillion, the lowest level since the week of January 1.

Currently, the market widely expects Federal Reserve officials to discuss the future direction of the balance sheet reduction process at their policy meeting in Washington next week.

While industry insiders widely expect the Federal Reserve to cut interest rates by another 25 basis points this month, to the 3.75%-4% range, Wall Street has remained skeptical about when policymakers will end the quantitative tightening process. Strategists at institutions such as TD Securities and Wrightson ICAP had previously pushed forward the end of balance sheet reduction to October, while Barclays... Banks and Goldman Sachs The group's analysts, however, believe the termination will be later.

Federal Reserve Chairman Jerome Powell stated in a speech earlier this month that balance sheet reduction will cease when bank reserves are slightly above a level deemed "adequate" by policymakers—the minimum requirement to prevent market turmoil. He hinted that the Fed believes this level is within reach, saying the central bank may approach this point "in the coming months."

U.S. money market rates have been rising recently. While more funds have begun flowing into the short end this week as government-sponsored enterprises deposit their monthly principal and interest payments via repurchase agreements, then transfer them to holders of mortgage-backed securities around the 25th of each month, strategists believe that the continued rise in repurchase rates and volatility still indicates that reserves are no longer plentiful and the financial system is approaching a shortage.

This liquidity decline comes at a time when the U.S. Treasury accelerated its issuance of Treasury bonds to rebuild cash reserves after raising the debt ceiling in July. This has led to a withdrawal of liquidity from other liabilities on the Federal Reserve's balance sheet, including overnight reverse repurchase facilities and bank reserves.

Bank of America analysts Mark Cabana and Katie Craig noted in a report on Thursday, "Current or higher levels of money market rates should signal to the Federal Reserve that reserves are no longer plentiful." They stated that rising repurchase rates and increasing funding pressures indicate that the system is approaching a state of reserve shortage.

(Article source: CLS)