Amazon The company in artificial intelligence Significant progress has been made in the field’s major developments, with its supercomputer, named Rainier, officially going into operation. The computer is powered by nearly 500,000 Trainium2 chips.

The new Rainier system marks a significant turning point for Amazon Web Services, enabling the company to better meet the growing demand for artificial intelligence training and inference. Analysts predict that this growth in demand will generate billions of dollars in revenue for the company by 2026.

Bank of America Securities The company's analyst, Justin Post, maintained a "buy" rating on Amazon and predicted that its stock price would reach $272.

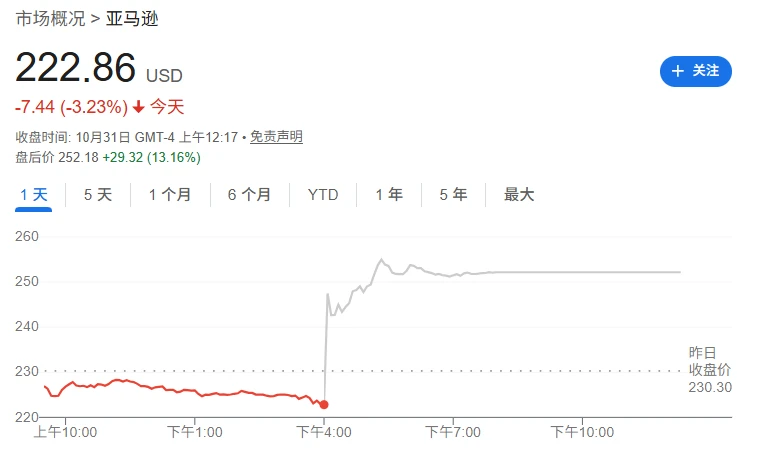

As of the close of trading on Thursday (October 30), Amazon's stock price closed at $222.86 per share. However, after the close of trading, thanks to Amazon's strong earnings report, its stock price rose by more than 13%.

According to the Post, Amazon's Rainier system (one of the world's largest AI training computers) is now operational. The system consists of nearly 500,000 Trainium 2 chips deployed in multiple US data centers . It consists of tens of thousands of hyperservers connected via NeuronLink to minimize latency.

With the help of the Rainier system, Amazon's AI partner Anthropic will have more than five times the computing power of its predecessors. The latter's Claude model is expected to run on more than 1 million Trainium 2 chips by the end of 2025.

The analyst also pointed out that although the release was about a month later than expected, it confirms that Amazon has begun a large-scale capacity increase for AI workloads.

This is expected to boost AWS revenue.

In addition, Justin Post added that the new Rainier data center capacity will significantly enhance the capabilities of Amazon Web Services (AWS) by 2026.

Post predicts that AWS revenue will grow by 19% year-over-year in 2026, slightly higher than the 18% in 2025, primarily driven by the increasing demand for Anthropic AI. He estimates that AWS could generate $6 billion in incremental revenue in 2026, potentially boosting the overall growth rate by 4 percentage points.

The analyst also stated that Amazon's investment in its own technology development (including the Trainium chip and the Nova model) is a crucial strategic move aimed at enabling AWS to stand out in the highly competitive artificial intelligence market.

AWS CEO Matt Garman has stated that these chips outperform general-purpose alternatives. The Post points out that Amazon's internal R&D approach reduces training and inference costs and improves AWS's profit margins.

(Article source: CLS)