The US dollar has finally found a chance to breathe...

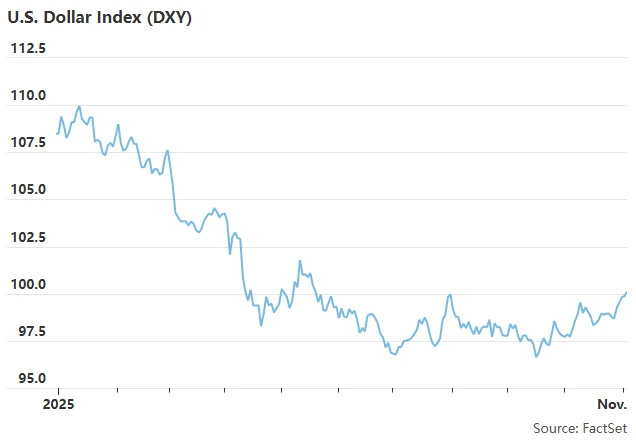

Market data shows that after a historic slump at the start of 2025—marking its worst first half of the year since at least the early 1970s—the ICE Dollar Index has recently embarked on a sustained rebound. According to Dow Jones Markets data, the ICE Dollar Index reached a high of 100.25 on Tuesday, not only breaking strongly above the 100 mark but also reaching its highest point since early August.

Generally speaking, lower US interest rates lead to a weaker dollar, and many Wall Street institutions had previously expected that a rate cut by the Federal Reserve would further depreciate the dollar. However, the foreign exchange market performance over the past few months has clearly not followed this pattern.

Because traders had already priced in a September rate cut by the Federal Reserve—which Powell described as "risk management"—market expectations for an aggressive easing cycle were dashed. Even after the Fed cut rates again by 25 basis points on October 29, the dollar index continued to climb last month and into early November.

It's worth noting that this current rebound marks the second time the US dollar index has attempted to recover the 100 mark in the second half of this year. The last attempt occurred at the end of July, followed by a sharp decline due to significantly weaker-than-expected non-farm payroll data on August 1st, after which the dollar index experienced a second bottoming out.

So , what will be different about this time's "breaking 100" offensive of the US dollar index? What are the driving factors behind the recent strengthening of the US dollar index? Can the dollar bulls continue their momentum and achieve even greater gains? Let's take a closer look:

Why has the US dollar recently staged a rebound?

Currently, many Wall Street strategists have listed several reasons behind the recent rebound of the US dollar: the "cash crunch" in the US money market and concerns about bubbles in risky assets have continued to stimulate the traditional safe-haven demand for the dollar; the Federal Reserve Chairman's rejection of expectations for a December rate cut has silenced dollar bears; and non-US currencies have also recently faced negative factors in their respective economic and policy areas, etc.

As reported by Cailian Press on several occasions recently, the "cash crunch" in the US money market has continued to worsen during the US government shutdown. Following volatile end-of-month trading, the Secured Overnight Financing Rate (SOFR) surged 18 basis points at the close last Friday. This was the largest single-day increase outside of the Fed's rate hike cycle since March 2020. This rate is the overnight borrowing rate for short-term cash primarily secured by Treasury bonds, reflecting the financing costs in the overnight repo market.

Although the SOFR fell on Monday after month-end pressures eased, it remains above the Federal Reserve's key policy benchmark rates, including the federal funds rate. Other short-term overnight repo rates also continue to be higher than the Fed's policy tool rates.

Meanwhile, the valuation bubble in global risk assets has become increasingly worrying recently. This is fueled by the high-profile short-selling of Nvidia by Jerry Burry, the inspiration for the "Big Short." Palantir and Goldman Sachs Global stock markets experienced a sell-off on Tuesday as CEO David Solomon and other corporate executives expressed concerns about U.S. stock valuations, with Bitcoin falling below $100,000 for the first time in months. Given the recent poor performance of safe-haven assets such as gold and U.S. Treasury bonds, the U.S. dollar has undoubtedly become the only safe haven for many.

" I think this is a classic case of safe-haven demand ," said Michael Brown, senior research strategist at Pepperstone, noting that both the dollar and the yen are strengthening.

David Morrison, senior market analyst at financial services firm Trade Nation in London, noted that the US dollar had a "disastrous start" in 2025, with the decline continuing until mid-September, but by then "there may be no one in the market willing to short the dollar anymore."

He explained that the dollar had been "oversold," but has now regained its "cleanest shirt in the laundry room" shine.

When discussing currency trends, Standard Chartered Bank Steve Englander, global head of foreign exchange research, emphasized that the situation in other parts of the world is equally crucial. The weakness of the dollar's main competitors is a key factor driving the recent strong rebound in the dollar.

“Europe is in a bad position,” Trade Nation analyst Morrison noted in a telephone interview. “The Eurozone as a whole is overly reliant on Germany, where the regulatory environment is unfavorable. France is struggling, and Italy is the only bright spot—although its advantage is not significant.”

Meanwhile, the British Chancellor of the Exchequer hinted at "difficult choices" in next month's budget, causing the pound to fall on Tuesday. Japan's new Prime Minister Sanae Takaichi's support for further fiscal stimulus is also pushing the yen weaker.

Of course, the Federal Reserve's actions remain a key driver of the dollar's performance. Last Wednesday, Fed Chairman Powell dismissed market expectations for another rate cut in December, stating that it was not a "certainty." The CME Group's FedWatch Tool showed that the probability of a December rate cut subsequently fell from 90.5% a week earlier to 70.1%.

Mark Chandler, chief market strategist and managing director at Bannockburn Capital Markets, said the dollar appears to have benefited from "a shift in the Fed's hawkish stance and a deterioration in the economic situation in Europe and Japan." He added, "I think the dollar still has room to rise further. More importantly, this is happening during a government shutdown."

Chandler currently expects the dollar index to rise to 101.50 by the end of this month and even reach 105 by the end of the year, but does not believe it will return to the peak levels of January or February.

Trade Nation's Morrison believes the dollar index is "currently in a very interesting position." He predicts the dollar is likely to bottom out again this year. However, if the dollar index can remain above 100 for several consecutive weeks, it could indicate a dollar rebound. If this happens, Morrison believes the dollar could very well recover to its January highs (around 110) sometime next year.

A deeper look: Is the Trump administration's dollar policy quietly changing?

Of course, after reviewing some of the common fundamental factors behind the recent dollar rebound, investors may also need to pay attention to a potential change: the Trump administration's dollar policy.

In fact, the reason why the US dollar fell so sharply in the first half of this year was largely due to the belief among many industry insiders that US President Trump's tariff policies damaged the "brand" image of the United States. Furthermore, there were concerns that he might further depress the dollar to correct trade imbalances, leading many investors to prefer using gold and Bitcoin to hedge against the risk of dollar depreciation.

However, last week, industry insiders revealed that Trump administration officials were discussing how to encourage other countries to adopt the dollar as their primary currency in response to the current global trend that is weakening the dollar's global dominance.

According to reports, Johns Hopkins University professor Steve Hank, a leading expert on dollarization, stated in a recent interview that he met with government officials, including those from the Treasury Department and the White House, this summer to discuss how the government would implement the aforementioned policy. Hank said, "They (government officials) take this policy very seriously, but it's still in progress and no final decision has been made."

Hank has spent much of his career advising on dollarization, maintaining regular contact with government officials. The dollarization issue has surfaced as the U.S. government intervened last month to quell a market crisis in Argentina. Some policymakers and economists believe the Latin American economy is an ideal candidate for dollarization due to the Argentine peso's persistent crisis of confidence—although both the U.S. and Argentina have stated they are not actively considering the matter.

Hank revealed that a person he described as a "politician" with ties to the White House expressed concerns at a meeting in late August about emerging markets reducing cross-border dollar transactions.

"(This politician) made me realize something I already knew: there's a group within the government that's very interested in strengthening the dollar's international status," he added, noting that the focus on dollarization and the government's push for wider use of dollar-backed stablecoins "fall into the same category." "The higher-ups are demanding a thorough review of all related issues, and that's where I came in."

White House spokesman Kush Desai later confirmed that government officials had met with Hank, but emphasized that the government had not yet made any formal decision on whether to encourage dollarization .

He said, “President Trump has repeatedly reiterated his commitment to maintaining the strength and power of the dollar. As with many other important issues in other countries, this administration regularly seeks the advice of outside experts on this presidential priority. However, these discussions and hearings should not be taken as an official policy stance or a reflection of the administration’s decision-making process.”

Regardless, a more stable currency value may be a necessary prerequisite if the US government attempts to promote the wider global use of the dollar. Sharp depreciation like that seen in the first half of this year will undoubtedly only accelerate the global process of "de-dollarization" and even the embrace of gold.

(Article source: CLS)