Image source: Photo by Wang Jiaqi, NBD reporter.

SoftBank Group's high-stakes AI gamble has triggered market turmoil.

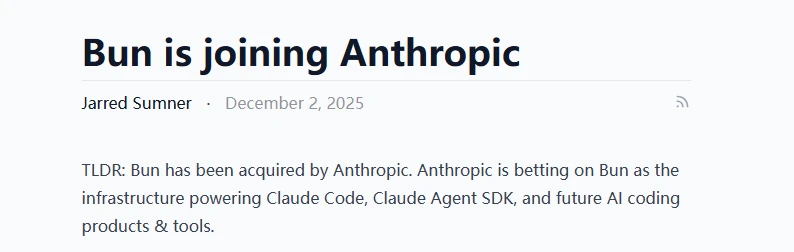

On November 11, SoftBank Group announced in its latest financial report that it had sold off all of its holdings in Nvidia. He cashed out $5.83 billion from the stock and used the money to make additional investments in OpenAI.

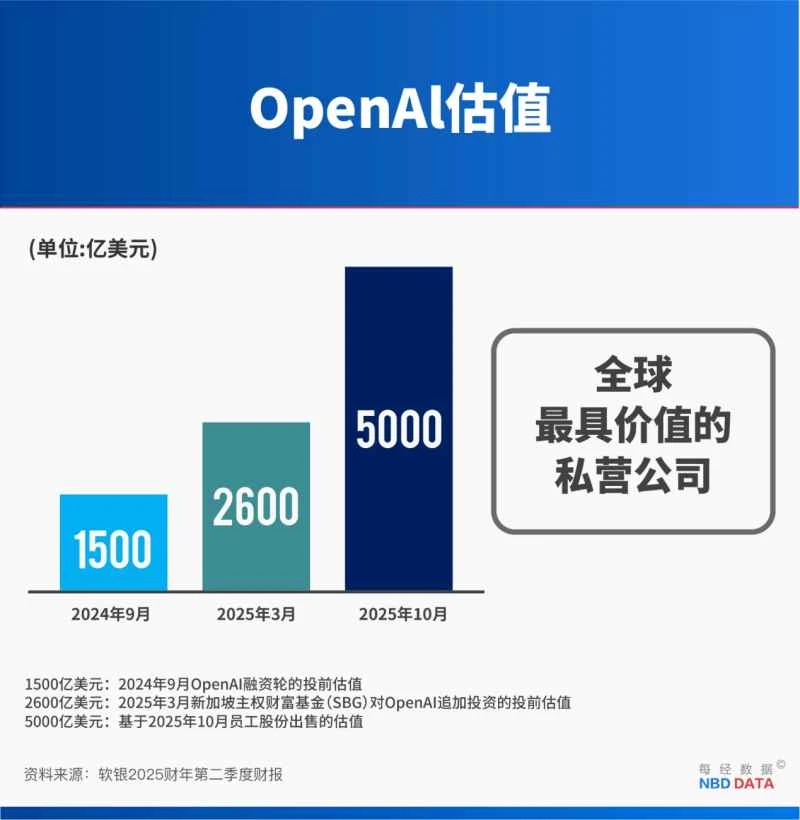

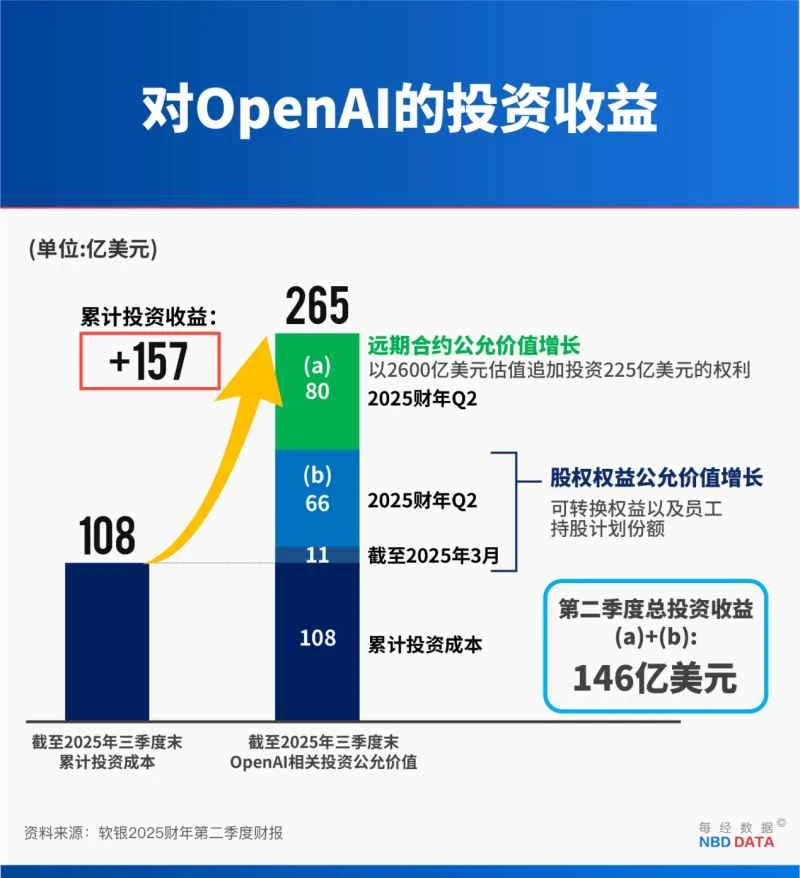

In the second fiscal quarter alone, the group’s net profit reached $16.6 billion, of which $14.6 billion came from the increase in OpenAI’s valuation from $260 billion to $500 billion.

But behind the impressive figures lies a hidden truth: of the $8 billion in returns on investment in OpenAI, SoftBank has not invested any real money, but has included it in the profits based solely on a promise.

Analysts point out that there may be a gap of up to $54.5 billion between SoftBank's total committed investment and its actual available funds, indicating a risk of over-commitment.

From November 12 to 14, SoftBank's stock price fell for three consecutive days, with its market value evaporating by a total of $26.9 billion.

SoftBank's market value evaporated by $26.9 billion in three days as it sold off its Nvidia shares to invest in OpenAI.

SoftBank Group sold all of its 32.1 million shares of Nvidia stock in October, when Nvidia's stock price was at an all-time high.

Some analysts believe this move indicates that Masayoshi Son may have foreseen that the AI frenzy that propelled Nvidia to a $5 trillion market capitalization is cooling down.

However, SoftBank CFO Yoshimitsu Goto emphasized that this move was not aimed at Nvidia's fundamentals, but rather a strategic reallocation of resources to raise funds for the group's larger AI investments. He stated, "This year we have a very large investment in OpenAI—more than $30 billion—and for that we need to divest from our existing portfolio."

This is not the first time SoftBank has sold off its entire stake in Nvidia . Its Vision Fund invested approximately $4 billion in Nvidia in 2017, but sold off its entire stake in early 2019, missing out on more than $100 billion in potential profits.

In addition, SoftBank sold a portion of its T-Mobile stake, worth approximately $9.2 billion. These funds will be directly used for investments in OpenAI and the $500 billion Stargate project, among others.

In the three trading days following the release of its Q2 FY2025 financial report, SoftBank Group's stock price fell by a cumulative 12.8%, wiping out 4.16 trillion yen (approximately US$26.9 billion) in market capitalization. Since November, the company's stock price has fallen by nearly 27%.

The red box shows SoftBank's stock price trend since November.

$8 billion in profits confirmed before any investment was made.

In the second fiscal quarter, SoftBank Group's net profit reached 2.5 trillion yen (approximately US$16.6 billion), more than doubling year-on-year. The valuation increase of OpenAI alone brought SoftBank an investment gain of approximately US$14.6 billion.

Yoshimitsu Goto stated frankly at the earnings conference that OpenAI's latest valuation has reached $500 billion based on fair value, which is a key support for SoftBank's profits.

In terms of profit composition, of the $14.6 billion, $8 billion did not come from the added value generated by SoftBank's actual investments, but rather from the company's clever accounting treatment of "forward contracts".

Specifically, according to the agreement, SoftBank committed to investing an additional $22.5 billion in OpenAI in December of this year, at a valuation of $260 billion. This means that as of September 30th, the end of the second-quarter earnings report, this funding had not yet been paid, but SoftBank had already included the expected $8 billion in potential gains from this investment in its profits.

This kind of "financial magic," where the valuation of an investment target increases and is included in current profits, is essentially unrealized paper profits. It does not bring any actual cash inflow to the company, but it "beautifies" the financial statements.

David Gibson, an analyst at MST Financial, said that this "gain" could evaporate quickly if OpenAI's valuation fluctuates or declines.

A recurring game among AI companies Boost valuation

The partnership between SoftBank and OpenAI highlights a common phenomenon in current AI investment:

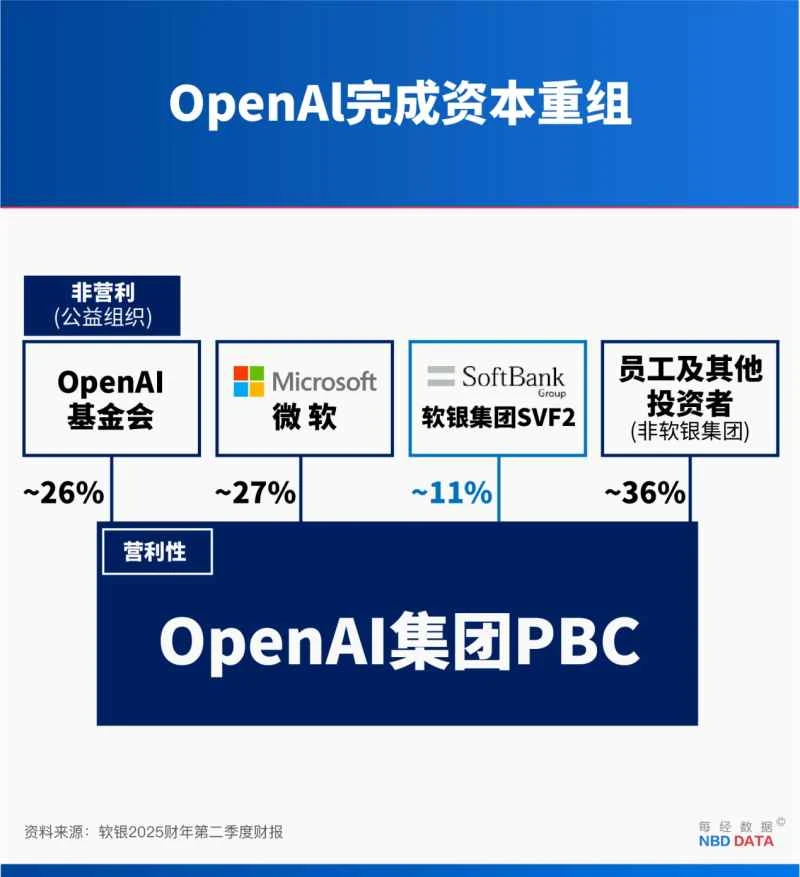

Large technology companies and investment institutions are forming deep partnerships with AI startups through complex agreements, thereby supporting the latter's valuations.

For example, Microsoft While investing approximately $13 billion in OpenAI, it designated its own Azure as OpenAI's exclusive cloud provider.

For example, Nvidia agreed this year to invest up to $100 billion in OpenAI to jointly build large data centers . OpenAI has pledged to purchase millions of Nvidia GPUs to fill these racks.

Let's look at the oracle bone script again. It is both an early investor in OpenAI and signed an agreement this year to provide OpenAI with $300 billion worth of cloud services over the next five years.

Nobel laureate economist Paul Krugman likened this phenomenon to a "self-eating ouroboros": " What appears to be revenue from sales is actually just the same money circulating among different companies. "

Paulo Carvo, a senior fellow at Harvard University's Kennedy School, said this cyclical game is not without precedent in the dot-com bubble of the late 20th century: "Companies buy each other's services to create the illusion of growth, resulting in impressive revenue figures but no real cash flow." Carvo added, "The difference this time is that AI companies do have solid technology, but they are burning through cash faster than they are monetizing it."

" One of the core ideas in Silicon Valley that get people to invest real money is 'pretend to succeed until you actually succeed,'" said Gil Luria, an analyst at DA Davidson.

SoftBank's funding gap may reach as high as $54.5 billion.

This week, SoftBank also announced a 1-for-4 stock split plan, which will officially take effect on January 1, 2026.

The company stated that, given the recent sharp fluctuations in stock price, this move aims to lower the price of a single stock, thereby reducing the investment threshold for individual investors, attracting more investors, and expanding the shareholder base.

Looking back, every SoftBank stock split since the beginning of the 21st century has been accompanied by significant volatility in global markets.

June 2000 stock split (1:3): The dot-com bubble burst.

January 2006 stock split (1:3): The U.S. housing bubble burst.

June 2019 stock split (1:2): The outbreak of the pandemic in early 2020 triggered a global stock market crash.

However, these major crises and SoftBank's stock split are not directly causally related; they are more of a coincidence in timing.

Compared to the so-called "historical curse," analysts are more concerned about SoftBank's future financial risks.

David Gibson warned that SoftBank has publicly committed a total of $113 billion in investments, but its current available funds (including cash, debt, and some saleable shares) are only about $58.5 billion, meaning a funding gap of $54.5 billion .

He further analyzed that, in order to fill the gap, SoftBank may need to use funds from its Vision Fund, or even be forced to sell its stakes in core strategic assets such as Japanese telecom operator SoftBank Corporation or British chip design company Arm. He emphasized that these potential asset disposal processes are "fraught with execution risks," and any mishandling could impact the foundation of the group.

The bond market appears to have sensed the danger, with SoftBank's recent bond issuance yielding over 8%, indicating that bond investors are demanding a higher risk premium. David Gibson stated, "But the stock market seems to be ignoring this potential risk that is not fully covered by funding."

(Source: Daily Economic News)