According to media reports, following Michael Burry, the real-life inspiration for the "Big Short," Bridgewater, SoftBank, and UBS, another billionaire, Peter Thiel, has made a move, liquidating his entire stake in Nvidia. .

A recent report by Thiel Macro, Peter Thiel's hedge fund, revealed that it has sold off all of its Nvidia shares for the third quarter of 2025.

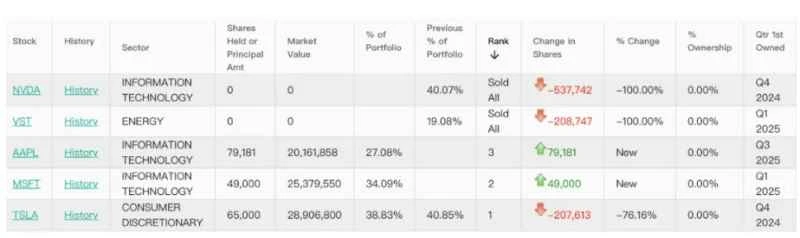

Peter Thiel's hedge fund, Thiel Macro, recently disclosed its Q3 2025 holdings report (13F), revealing that as of the end of September, the fund had sold all 537,700 shares of Nvidia stock, which originally accounted for approximately 40% of its total stock holdings. As of the end of September, the firm's stock holdings had decreased from $212 million at the end of June to approximately $74 million.

Peter Thiel, hailed as the "godfather of venture capital" in Silicon Valley, is the co-founder of PayPal and a big data expert. He is the co-founder and early investor of the company Palantir, and a founding partner of Founders Fund.

Despite these accolades, Peter Thiel's sale of his entire stake in Nvidia may have raised concerns among some investors. However, historically, after he sold off his Facebook (now Meta) shares in 2012, the company's stock performed exceptionally well. Furthermore, in the third quarter of this year, he reallocated some of his funds to Microsoft. And Apple Neither of the two tech companies has completely abandoned the AI field.

Peter Thiel, one of the most influential tech investors, has further fueled market concerns about a bubble in AI stocks with this move. Moreover, the collective sell-off or bearish stance of several top investment institutions on Nvidia raises the question: has the AI rally peaked?

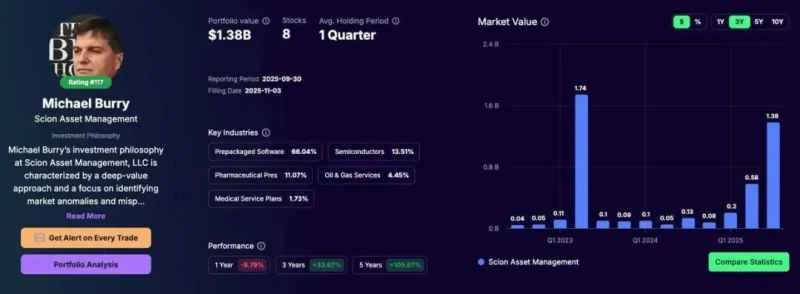

Earlier this month, prominent Wall Street short seller Michael Burry disclosed a large short position in Nvidia . According to the third-quarter holdings report disclosed by Scion Asset Management, a hedge fund under Michael Burry, the fund held 5 million Palantir put options worth approximately $912 million and 1 million Nvidia put options worth approximately $187 million (accounting for 80% of its total assets).

Image source: Gainify, a stock analysis platform

A week before Thiel disclosed his complete divestment of Nvidia shares, SoftBank released its latest financial report, which showed that the company sold all of its Nvidia shares in October of this year, cashing out $5.8 billion.

Several asset management giants simultaneously reduced or completely sold off their Nvidia holdings in the third quarter of this year.

Among them, Bridgewater Associates, one of the world's largest hedge funds, reduced its holdings of Nvidia shares by nearly 4.72 million shares in the third quarter. As of the end of the third quarter, Bridgewater held 2.51 million Nvidia shares, a 65.3% decrease from the 7.23 million shares held at the end of the second quarter. Furthermore, Bridgewater also reduced its holdings in Google, Microsoft , Meta, and Amazon. Bridgewater significantly reduced its holdings in several major U.S. tech stocks during the third quarter. This move indicates that Bridgewater is becoming more cautious about the future performance of high-priced tech stocks such as Nvidia.

SoftBank's latest financial report shows that the company sold all of its Nvidia shares in October this year, cashing out $5.8 billion.

In addition, Barclays Bank of America UBS Group Bank of Montreal HSBC Holdings Citigroup Well-known institutions such as [list of institutions] reduced their holdings in Nvidia to varying degrees during the third quarter.

As of the US stock market close on November 17, Nvidia's stock price was $186.6, down 1.88% from the previous trading day. The company's market capitalization was $4.53 trillion. It's worth noting that compared to its recent high on October 29 (when the stock price was $212.19), Nvidia's market capitalization has evaporated by $621.8 billion in just 14 trading days, equivalent to approximately 4.42 trillion yuan.

A Bank of America survey of global fund managers in October showed that, with the development of artificial intelligence... The continued strong rise of AI concept stocks this year has raised global fund managers’ concerns about an AI bubble to an unprecedented level, with 54% of respondents believing that artificial intelligence concept stocks have entered bubble territory.

Despite the fact that many institutions have chosen to reduce their holdings, there are still differing opinions on Nvidia's future trajectory.

Wen Yandao, Managing Director and Head of Asia Thematic Investments at Neuberger Berman, stated that current valuations and capital expenditures in the AI sector are based on solid financial performance and remain rational overall. While increased capital concentration and interdependence among giants pose potential risks, market demand, production capacity, financing, and project execution are currently well-matched.

Invesco Brian Levitt, chief global market strategist, stated that while the current market does exhibit some bubble-like characteristics, overall, it has not yet entered a typical bubble state. He also emphasized that today's market is significantly different from the dot-com bubble of the late 1990s.

(Source: Daily Economic News)