Nvidia The company will release its earnings report after the market closes on November 19th, Eastern Time. It projects revenue of $54.98 billion for the third quarter of fiscal year 2026, a 56.73% increase year-over-year; and earnings per share of $1.20, a 53.85% increase year-over-year. (The above data uses US-GAAP accounting standards.)

I. Brief Review of Q2 Financial Report

Nvidia reported revenue of $46.743 billion for the second fiscal quarter of 2026, a 56% year-over-year increase, slightly exceeding market expectations of $46.23 billion. Of this, data center revenue accounted for the majority of the revenue in the second fiscal quarter. Revenue was $41.1 billion, slightly below market expectations of $41.29 billion.

II. Q3 Earnings Preview

(I) Data Center Business: Blackwell's Massive Production and Network Business Catching Up

As Nvidia 's core business, the data center business is expected to continue its explosive growth this quarter.

AI chip Strong demand: The market expects data center revenue to reach $48 billion this quarter. Blackwell series (especially the GB300 NVL platform) has become the main driver, contributing over 90% of revenue according to BOCOM International's estimates. Looking at the customer structure, Microsoft... Amazon The four giants—Google, Metacritic, and Tesla—still hold the core market share, but Tesla... Oracle bone script OpenAI and even Apple, which recently entered the market. It is becoming an important contributor to incremental growth.

Supply chain breakthroughs are key: Over the past 3-4 months, Nvidia's supply chain has demonstrated strong execution in increasing Blackwell rack shipments. (JPMorgan Chase) UBS noted that production of related products in FY26Q3 increased by approximately 50% quarter-on-quarter to 10,000 units, and Q4 is expected to maintain a similar growth rate, bringing total shipments for fiscal year 2026 to 28,000-30,000 units. UBS also cited better-than-expected GPU production and TSMC's performance as reasons for this. CoWoS's improved packaging capacity has led to an upward revision of its chip shipment forecast.

Networking business becomes the second engine: The networking business, which surged 98% year-on-year last quarter (revenue of $7.3 billion), will continue its strong growth. According to Nvidia's previous earnings call, the annualized revenue of its core product Spectrum-X has exceeded $10 billion. With the large-scale deployment of new customers such as Google Cloud and Meta, its synergy with AI chips will be further amplified, becoming a powerful growth driver.

(II) Games Business: Traditional strengths are expected to reach new historical highs.

Under the spotlight of AI, NVIDIA's traditional strength – gaming graphics cards – also performed strongly. With the launch and mass production of the new 50-series graphics cards, the gaming business is expected to continue its growth momentum. In the last quarter (FY26Q2), gaming revenue reached $4.29 billion, a significant year-over-year increase of 49% and a quarter-over-quarter increase of 14%. This quarter, driven by the mass production of advanced manufacturing processes and improvements in the supply chain, gaming revenue is expected to continue rising, setting new historical highs. This demonstrates that NVIDIA maintains strong product competitiveness in the consumer market as well.

(iii) Other businesses: automobiles and robots Becoming a new highlight of growth

While relatively small in scale, the professional visualization, automotive, and robotics businesses have demonstrated significant growth potential. These businesses generated a combined revenue of $1.19 billion last quarter, with the automotive and robotics business growing at nearly 70%, even surpassing the growth rate of the data center business. This growth is driven by the development of autonomous vehicles and humanoid robots. With the rapid development of the industry, these emerging businesses are expected to become important growth drivers for Nvidia in the future.

(iv) Gross profit margin is expected to remain high.

Currently, the positive drivers for gross margin improvement are significant: economies of scale from large-scale shipments of the Blackwell platform, improved supply chain capacity (especially TSMC's CoWoS packaging), and the clearing of unfavorable projects, all supporting a return of gross margin to the historical range of 75%-77% guided by management. However, cost pressures are also emerging, primarily not from HBM4 memory with prices locked in through long-term agreements, but from LPDDR procurement which may face market price fluctuations. Market consensus suggests that Nvidia is likely to achieve its gross margin target of approximately 75% by the end of the fiscal year, leveraging its pricing power and supply chain management capabilities.

III. Core Controversies and Risks

(a) Market share in China: Structural decline has become a trend

According to the latest data from Bernstein, Nvidia's share of the AI chip market in China has fallen from 66% in 2024 to 54% in 2025, and may decline further in the future. This is partly due to US export restrictions preventing it from supplying the most advanced products to the Chinese market (such as solutions for handling B30 inventory); and partly due to the impact of restrictions on Huawei, Cambricon, and Hygon . Domestic manufacturers are iterating their products at an astonishing pace (Huawei has already announced a roadmap for its Ascend series up to 2028). Bernstein predicts that the localization rate of China's AI chip market will surge from 17% in 2023 to 55% in 2027. Although Citi believes that demand from other global markets can temporarily offset this loss, in the long run, the loss of the world's most important growth market will limit its growth ceiling.

(II) The AI Bubble Theory: Financial Reports as a "Litmus Test"

Despite discussions about a "rational bubble" in the market and some reductions in holdings by top investors such as Bridgewater Associates and SoftBank, mainstream institutional views are generally positive. Wedbush emphasizes that this earnings report and guidance will be key to refuting the "AI bubble theory."

(III) Supply chain and infrastructure bottlenecks: the core constraint on growth

UBS noted that the focus of the conference call following the earnings release was clearly "how fast can all AI infrastructure be installed?" Citigroup also pointed out that due to limited capacity for advanced packaging (CoWoS), the supply of AI chips will continue to fall short of demand until 2026. JPMorgan Chase cautioned that power constraints (with power supply challenges facing planned computing power capacity of approximately 120 gigawatts over the next five years) and rising component costs are the potential risks that investors are most concerned about.

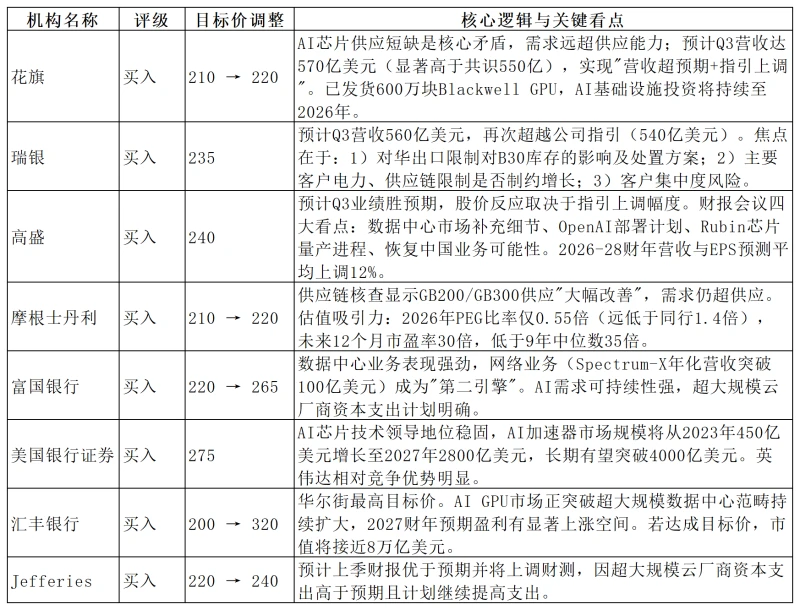

IV. Institutional Views

V. Option Signals

Observing option signals, the increase in put/call options has led to a decline in option trading volume.

Observe the daily fluctuations in earnings reflected by option signals; the expected fluctuation range after the earnings report is ±7.08%.

VI. Conclusion

Nvidia's Q3 FY2026 earnings report is expected to continue its strong growth momentum, with both revenue and earnings per share projected to increase by over 50% year-over-year. The data center business remains the core engine, driven primarily by the large-scale rollout of Blackwell chips and synergies in the networking business, while supply chain breakthroughs support a surge in shipments. However, risks and controversies coexist: market share in China continues to shrink due to geopolitical factors, concerns about an AI bubble persist, and supply chain bottlenecks and power infrastructure limitations remain key constraints on long-term growth. Whether this earnings report can dispel market concerns with better-than-expected figures and shift the focus from "bubble debates" to "demand sustainability" has become the core focus for global investors.

(Article source: Hafu Securities) )