Global markets have had a strong start to 2026. However, investors may face their first real test of the year this Friday – the U.S. Department of Labor will release December employment data at 9:30 PM Beijing time tonight. On the same day, the U.S. Supreme Court will also issue its final ruling on the legality of most of President Trump's tariffs.

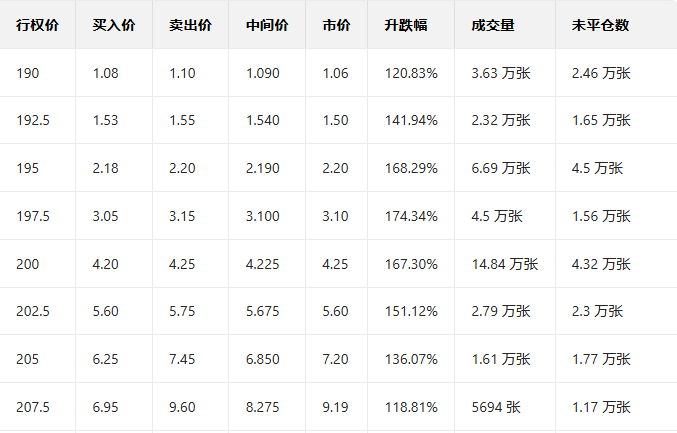

Options market traders are bracing for what could be the most volatile trading day of the year so far – the S&P 500 is expected to see significant swings. According to Steve Sosnick, chief market strategist at Interactive Brokers, the S&P 500 is projected to fluctuate by at least 0.9% on Friday, based on pricing estimates for at-the-money contracts expiring there.

Sosnick also questioned whether investors had been cautious enough. In a commentary, he stated, "A relatively calm market means there's still a possibility of unexpected events."

Non-farm payrolls preview: The most "reliable" US employment data in more than two months is coming?

Tonight's non-farm payroll report is attracting significant attention, partly because many industry insiders believe it may be the first relatively reliable employment data released by the US government since the longest shutdown in history last October. This underscores the report's importance —tonight's data will either solidify market expectations that the Federal Reserve will keep interest rates unchanged this month, or strengthen market perceptions that the Fed may cut rates for the fourth consecutive time…

John Briggs, head of U.S. interest rate strategy for North America at Natixis, said that the December jobs data "will be the first clean U.S. economic report we've received in a long time."

Zachary Griffiths, Head of Investment Grade and Macro Strategy at CreditSights, noted, "We expect market volatility to rise as this data begins to be released more regularly. The market has been in a very calm period until the end of 2025."

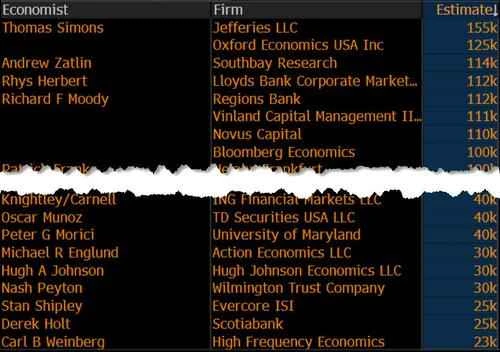

Looking at the data itself, market participants generally expect the December non-farm payrolls figure to be similar to the previous value of 64,000. However, the median forecasts given by different media outlets vary slightly . Reuters, which is most frequently cited, predicts that non-farm payrolls will increase by 60,000 tonight, while the median forecast from the Bloomberg survey is 70,000; the Wall Street Journal predicts 74,000.

Among major Wall Street investment banks, the lowest forecast for tonight's non-farm payroll data comes from High Frequency Economics, predicting 23,000, while the highest is Jefferies' forecast of 155,000. It's worth noting that no institution is currently predicting a negative non-farm payroll figure tonight.

Regarding another key indicator closely watched by investors on "non-farm payroll night"—the unemployment rate—the industry generally expects the December unemployment rate to fall to 4.5% from 4.6% in the previous month. The Federal Open Market Committee (FOMC) projected at its December policy meeting that the U.S. unemployment rate would reach 4.4% by the end of this year and then fall to 4.2% in 2027.

Regarding tonight's non-farm payroll data, Goldman Sachs, in its latest forward-looking report, predicts that non-farm payrolls will increase by 70,000 in December, consistent with the consensus forecast in a Bloomberg survey.

Goldman Sachs believes the positive signals for the December jobs data include moderate private sector job growth as indicated by big data metrics, and seasonal factors also supporting overall job growth in December. Negative factors include Goldman Sachs' forecast of a 5,000-person decrease in government employment—including a 5,000-person decrease in federal government employment while state and local government employment remains unchanged; and a slowdown in construction job growth following a significant increase in November and the impact of unusually severe weather at the start of the survey.

Goldman Sachs also predicts that the unemployment rate will decline slightly to 4.5% in December from 4.6% in November. The bank notes that the November unemployment rate was 4.56% before rounding, so rounding down to 4.5% in December should not be difficult. The number of people continuing to claim unemployment benefits has declined slightly in recent weeks; furthermore, federal employees who previously caused the sharp rise in the overall unemployment rate in November (and who may also be the main reason for the surge in temporary layoffs) have returned to work.

JPMorgan analysts expect the December nonfarm payroll report to be in line with or slightly stronger than recent employment data. They point out that concerns about economic weakness at the end of last summer or in the third quarter have proven unfounded, as strong consumer demand has supported continued GDP growth. However, the lag in hiring growth compared to accelerating consumption makes this expansion unusual by historical standards.

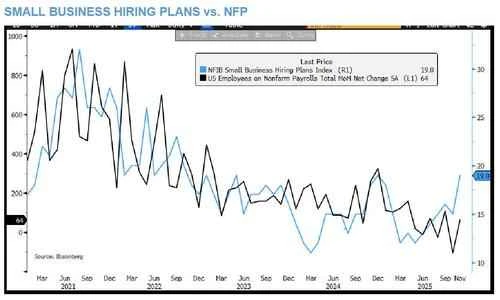

JPMorgan also noted that the NFIB Small Business Survey Index, which typically leads non-farm payroll data by one to two months, has been rising steadily since the summer. While this trend may not yet be fully reflected in the December data, it could indicate a faster hiring pace in the coming months.

Financial markets are on high alert

Due to a cooling labor market, the Federal Reserve cut interest rates in its last three meetings last year—each by 25 basis points. Driven by this, U.S. Treasury bonds rose by more than 6% last year, marking their best performance since 2020.

Investors currently expect that if tonight's non-farm payroll data shows the overall US labor market is stabilizing, this will give the Federal Reserve room to pause interest rate cuts at its January 27-28 meeting. Previously, a report released Wednesday by payroll processing company ADP showed that the US private sector added 41,000 jobs in December, below the consensus range of 48,000-50,000 for economists, but at least returning to positive growth.

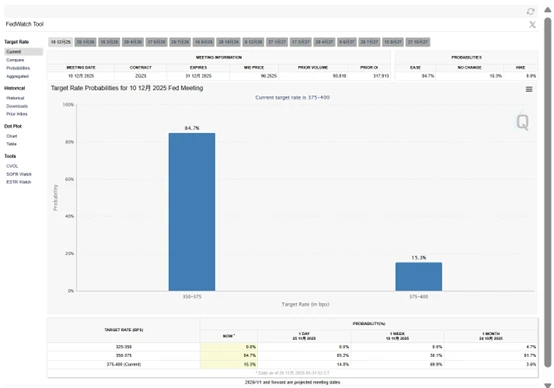

Based on pricing in the interest rate market, investors currently believe there is only about a 10% chance of the Federal Reserve cutting rates this month. They expect the next rate cut to take place in June—the month after Fed Chairman Powell's term ends—and there may be another round of easing in the fourth quarter.

Gregory Faranello, head of U.S. interest rate trading and strategy at AmeriVet Securities, said that if nonfarm payroll data is "very weak," such as job growth being essentially flat, it would "prompt the Fed to act," potentially increasing the probability of a rate cut in January to 50%. He stated that while such an outcome would lead to a decline in yields across all maturities, short-term bonds are expected to perform better, resulting in a steeper yield curve.

Tom Essaye, founder and president of Sevens Report Research, stated that whether the data significantly exceeds or falls short of expectations, it could pose potential risks to investors. He believes that, "As with the previous two jobs reports, a 'golden number' showing robust job growth and a stable unemployment rate would be the best-case scenario for the stock market and the number that would allow this stock market rally to continue."

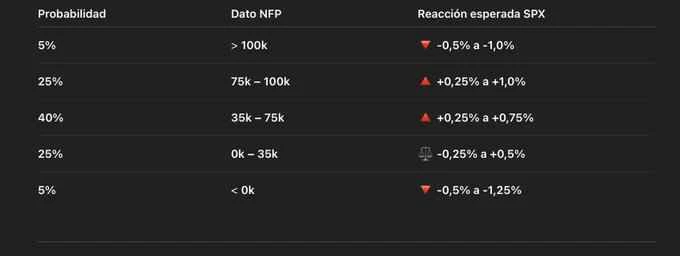

According to analysis by JPMorgan Chase's market intelligence team, the US stock market is expected to react in five different scenarios after tonight's non-farm payroll data release:

① Non-farm payrolls exceed 105,000: The probability of this scenario is 5%, and the S&P 500 index will fall by 0.5%-1% as a result.

② Non-farm payrolls between 75,000 and 100,000: The probability of this scenario is 25%, and the S&P 500 index will rise by 0.25%-1% as a result.

③ Non-farm payrolls between 35,000 and 75,000: The probability of this scenario is 40%, and the S&P 500 index will rise by 0.25%-0.75% as a result.

④ Non-farm payrolls between 0 and 35,000: The probability of this scenario is 25%, and the S&P 500 index is expected to fluctuate between a decrease of 0.25% and an increase of 0.5%.

⑤ Non-farm payrolls are below 0. The probability of this scenario is 5%, and the S&P 500 index will fall by 0.5%-1.25% as a result.

Of course, regarding risk events, tonight's non-farm payrolls report is clearly not just the main event. Many traders, while focusing on macroeconomic data, will also be closely watching the U.S. Supreme Court's ruling on the legality of Trump's tariffs, which may be released as early as Friday morning local time.

“Market sentiment has become more complacent in the past few months due to a lack of economic data,” said Zach Griffiths, head of investment grade and macro strategy at research firm CreditSights. “We may see increased market volatility.” He said the tariff decision is a “huge unknown,” and Friday could see a double blow shaking the $30 trillion U.S. Treasury market. Volatility in that market has been stagnant for a month, with the benchmark 10-year Treasury yield fluctuating in a narrow range of 4.1% to 4.2%.

In a report this week, JPMorgan strategists, including Jay Barry, also pointed out that removing tariffs could "rekindle fiscal concerns, leading to a rise in long-term yields and a steepening of the yield curve." However, they believe that given the U.S. government can reinstate most tariffs through other means, the actual impact "should be quite limited."