JPMorgan Chase Economists now predict that the Federal Reserve will cut interest rates next month (December). This is the second time in a week that the bank has revised its rate cut forecast .

A research team led by Michael Feroli, chief U.S. economist at JPMorgan Chase , said on Wednesday that key Federal Reserve officials—especially New York Fed President John Williams— [are concerned about the situation]. Comments supporting the recent interest rate cuts have prompted them to reconsider .

The Federal Open Market Committee (FOMC), the Federal Reserve's core decision-making body, will meet in Washington on December 9 and 10.

JPMorgan Chase now predicts that the Federal Reserve will cut interest rates by 25 basis points next month and in January next year .

“We are now reassessing our expectations for a final rate cut in January,” Feroli wrote in a report to clients. “While the outcome of the next FOMC meeting remains uncertain, we now believe that the latest round of public statements by Fed officials has increased the likelihood that the committee will decide to cut rates at its meeting in two weeks.”

Data released by the U.S. Bureau of Labor Statistics last Thursday showed that U.S. nonfarm payrolls unexpectedly surged by 119,000 in September, significantly exceeding market expectations of 50,000. The unemployment rate rose to 4.4% from 4.3% in August, a new high since 2021. Furthermore, the combined job gains for July and August were revised downwards by 33,000.

After the September non-farm payrolls data was released, JPMorgan Chase abandoned its prediction of a December rate cut by the Federal Reserve, believing that the next rate cut by the Fed will occur in January next year.

However, comments from Williams , the third-ranking official at the Federal Reserve and president of the New York Fed, changed the situation. Williams stated last Friday that the Fed could still cut interest rates "in the near term" without jeopardizing its inflation target. This statement dramatically increased expectations of a December rate cut.

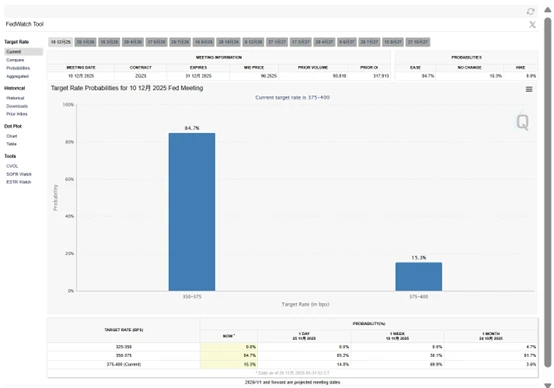

JPMorgan's new view aligns with that of swap traders, who now see an approximately 80% chance of a 25-basis-point rate cut by the Federal Reserve next week. A week ago, this figure was less than 30%, after the September non-farm payroll data was released, but before Williams had made any dovish comments.

Furthermore, according to CME FedWatch data, the market currently expects a 15.3% probability that the Federal Reserve will keep interest rates unchanged in December, while the probability of a 25 basis point rate cut has risen to 84.7%, a significant increase from about 30% a week ago.

Goldman Sachs Earlier this week, the bank also anticipated that the Federal Reserve would implement its third consecutive interest rate cut at its December meeting. The bank believes that slowing inflation and a cooling labor market provide policymakers with room to further ease monetary policy.

(Article source: CLS)