As the "helmsman" of the world's most valuable company, Jensen Huang visited the Consumer Electronics Show in Las Vegas this week. His speech at CES undoubtedly reaffirmed his significant influence within the tech industry—his brief two sentences determined the fate of two major AI-related sectors on the US stock market on Tuesday: the storage sector "burned brighter" due to his remarks, while cooling equipment stocks "fell into an ice age"...

SanDisk A surge of nearly 28% led to a major rally in storage stocks.

Market data shows that SanDisk 's stock price surged 28% on Tuesday, marking its best performance since February, after Jensen Huang emphasized the industry's demand for memory and storage at CES.

The stock has been on a strong upward trend recently—surging over 47% in the first three trading days of 2026 and skyrocketing 1080% since bottoming out on April 22. On Tuesday, its gains further outpaced those of the S&P 500 components, followed by two other storage device manufacturers, Western Digital. And Seagate Technology Both of the latter two also recorded double-digit percentage increases.

In his speech on Tuesday, Jensen Huang emphasized the memory and storage requirements of AI systems, stating, "This is a market that has never existed before, and it is likely to become the world's largest storage market, essentially supporting global artificial intelligence." The amount of RAM.

According to industry analyst Jake Silverman, supply shortages and soaring memory prices are helping to boost storage stocks against the backdrop of growing demand for AI training and inference. He stated that Jensen Huang's comments at CES "show that Nvidia..." Demand for NAND chips from various systems will remain strong.

Global memory prices have been rising sharply in recent weeks. Earlier this week, industry reports indicated that Samsung Electronics and SK Hynix were seeking to increase server DRAM prices by 60% to 70% in the first quarter compared to the fourth quarter of last year.

Bank of America, led by Wamsi Mohan In a report to clients on January 4, the analyst team wrote that SanDisk and other memory and storage companies are seen as “key beneficiaries” driving “AI inference and edge AI” in 2026.

Mohan anticipates that organizations will retain increasingly more data for training, analytics, and compliance purposes, leading to a "parallel surge" in storage demands. He specifically mentioned the use of drones. The technology is increasingly being used in the fields of surveillance, vehicles, and sports technology.

“So far, the focus of AI investment has been on capital expenditure and driving AI model training, which has created the next wave of hardware spending,” Mohan wrote. “Looking ahead to 2026 and beyond, we expect AI inference to dominate.”

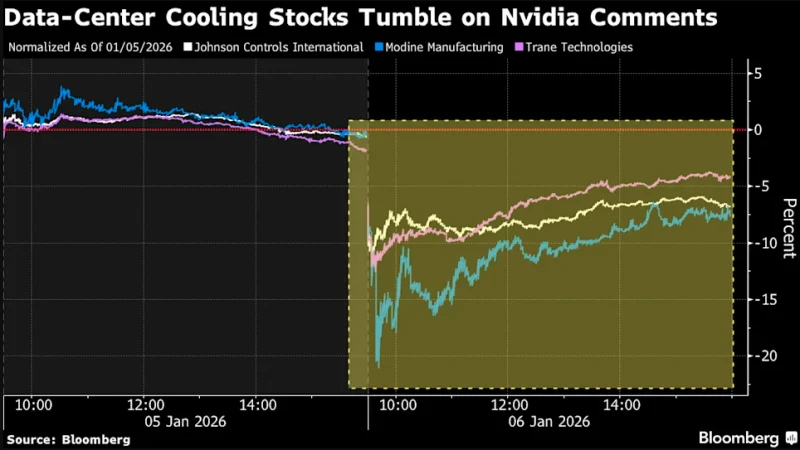

Refrigeration equipment stocks plummeted

While some were "delighted" by Huang's speech, others were "worried"—stocks of refrigeration system manufacturers were generally sold off on Tuesday.

Johnson Controls Tuesday saw a 6.2% drop, marking its worst day since July of last year. Modine Manufacturing Co. recovered some ground after falling as much as 21%, ultimately closing down 7.5%. Trane Technologies fell 2.5%.

The decline in cooling equipment stocks was solely due to Jensen Huang's statement on Tuesday that server racks equipped with the new Rubin chip will be able to be cooled without water chillers. This is one of the core thermal innovations of the Rubin platform, which can significantly reduce data center costs. Cooling costs. According to industry analysts, cooling units are a major component supplied to data centers by companies like Johnson Controls and Trane Technologies. It can be said that Huang's move has struck at the heart of these cooling equipment companies.

In a report to clients, Baird analyst Timothy Wojs noted, "These comments raise questions about the long-term role of chillers in data centers , especially with the increasing prevalence of liquid cooling technology." He added that current liquid cooling technology allows systems to operate at higher temperatures.

While Wojs believes the short-term earnings outlook for refrigeration equipment companies is not significantly risky, he anticipates that "this news will trigger additional concerns about orders, especially in the second half of 2026."

Last year, investors eager to capitalize on the AI boom flocked to buy AI chip manufacturers. Stocks of companies producing rack cooling equipment. Johnson Controls' share price surged 52% in 2025, while Vertiv, which manufactures cooling systems and power equipment, saw its share price rise 43%.

Of course, some industry insiders believe there's no need to be overly pessimistic about the prospects of these cooling equipment stocks. Citigroup analyst Andrew Kaplowitz told clients that investors' sell-off of cooling equipment stocks was "overdone." He pointed out that cooling system manufacturers have partnerships with chip manufacturers and data center operators, and the risk of these companies falling behind as data center technology evolves is manageable.

Kaplowitz stated, "While we acknowledge that the comments about Rubin highlight the rapid evolution of data center thermal management technologies, we do not believe this will catch our customers off guard."

Barclays Analyst Julian Mitchell pointed out that Vertiv holds a "strong position in the liquid cooling field" and may benefit from the technological developments mentioned by Jensen Huang, but its cooling unit business may suffer. The company's stock closed up 0.6% on Tuesday, reversing earlier losses.

"Given Nvidia 's dominant position in the entire AI ecosystem, investors should not underestimate the impact of its rhetoric, despite its seemingly dramatic nature," Mitchell wrote in the report.

(Article source: CLS)