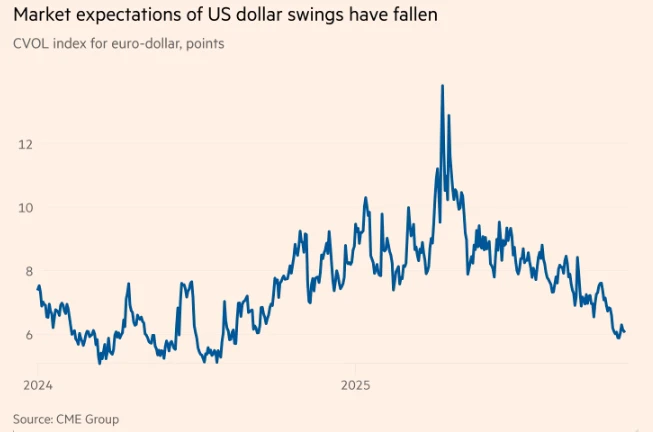

There are signs that the global foreign exchange market has gradually recovered from the "Trump shock" that caused sharp fluctuations at the beginning of the year, with multiple sets of foreign exchange volatility indicators falling to levels seen before last year's US election.

Data from the CME Group shows that the expected volatility index for the US dollar against the euro and the Japanese yen has fallen from its peak after Trump's election last November, and earlier this month it fell to a more than one-year low.

Meanwhile, the ICE Dollar Index, which measures the dollar's performance against a basket of currencies including the pound and the euro, has rebounded significantly from its year-to-date lows, briefly breaking through the 100 mark last week—approaching the level when the dollar began to surge before Trump's election victory last year.

Many industry insiders point out that a series of tariff agreements reached between the United States and its major trading partners have eliminated market volatility, and the US economy has outperformed many in withstanding the impact of the tariff war. Meanwhile, major central banks are nearing the end of their interest rate cut cycles, eliminating another source of market instability.

ING Chris Turner, head of market research at the group, said, "The world is learning to live with Trump. Investors have learned to take headlines with a grain of salt."

Around the time of last year's US presidential election, the US dollar strengthened significantly due to the "Trump rally"—at the time, the market bet that the Republican's trade and tax policies would boost the world's largest economy and its currency. However, with the "Liberation Day" tariffs announced by Trump in April this year triggering violent fluctuations in the foreign exchange market, the dollar's trend reversed sharply—the average daily trading volume of foreign exchange that month reached a record high of nearly $10 trillion.

Concerns about the impact of the trade war on the US domestic economy, as well as questions about the independence of the Federal Reserve, caused the dollar index to plummet in the first half of this year, marking its worst start to the year since the 1970s.

However, the dollar has been climbing steadily since the summer, partly due to the rebound in U.S. stocks—the S&P 500 had repeatedly hit record highs before last week's pullback in large-cap tech stocks. Some large fund managers believe that market concerns about U.S. assets are excessive.

Robert Tipp, Global Head of Bonds at PGIM, pointed out: "Despite much discussion about the end of American exceptionalism, the dollar has maintained its strength for several years from a macro perspective." He believes that this year's dollar decline is a "correction in a bull market," rather than "the beginning of the end of the bull market."

Will the "Trump shock" end and interest rate spreads regain dominance?

Deutsche Bank In a report this week, analyst George Saravelos pointed out that the sharp drop in expected currency volatility indicates that the market believes "the Trump shock is over," based on easing trade tensions and fiscal policy moving into "autopilot" mode.

"What other measures can Trump take to shock the market? We can't figure it out ourselves," Saravelos wrote.

Many analysts point out that the longest government shutdown in U.S. history has resulted in a lack of macroeconomic data, which has also weakened the volatility of the dollar and U.S. Treasury markets. Due to limited comprehensive data on inflation, the labor market, and consumer spending, investors have not yet established large positions. Since the U.S. government shutdown, the Bank of America MOVE Index, which measures volatility in the U.S. Treasury market, has also fallen to a four-year low.

Last month's Federal Reserve decision also provided support for the dollar—although the Fed announced a rate cut, Chairman Powell warned that the next (December) rate cut was not "a foregone conclusion." A slower pace of rate cuts is generally beneficial for the dollar.

Some investment banking experts say this indicates the dollar is returning to being driven by traditional exchange rate determinants, primarily interest rate differentials between countries. Turner of ING Group noted, "The foreign exchange market has returned to more traditional drivers."

Data from the CME Group shows that demand for dollar call options (betting on a stronger dollar) has exceeded that for put options, reaching its highest level since February.

Some fund managers point out that the US dollar is regaining its traditional stabilizer role in their portfolios—due to its tendency to strengthen during periods of global turmoil. Previously, under Trump's April tariff offensive, the dollar plummeted in tandem with risk assets, casting doubt on its safe-haven status.

Rushabh Amin, portfolio manager at Allspring Global Investments, said: “The market performance at the beginning of the year was more of an anomaly than a trend. We believe the US dollar will continue to play a role in diversifying portfolio risk, especially for foreign investors.”

(Article source: CLS)