On Friday local time, South Korean battery giant LG Energy Solutions released its preliminary earnings report for the fourth quarter of fiscal year 2025. Impacted by declining demand in overseas electric vehicle markets, the company's quarterly profit turned into a loss.

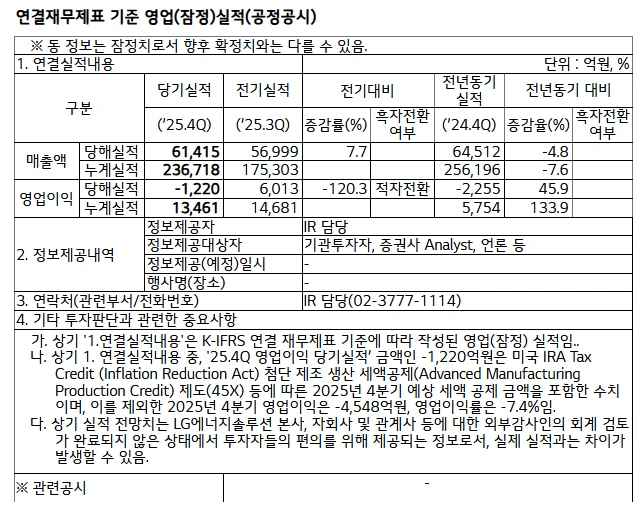

The company reported an operating loss of 122 billion won (approximately 580 million yuan) for the three months ending December 31, significantly lower than analysts' consensus forecast of a profit of 33.1 billion won , compared to an operating profit of 601.3 billion won in the previous quarter. Revenue also declined by nearly 5% year-on-year to 6.1 trillion won .

(Source: Company website)

The disclosure document indicates that without the U.S. government's tax credit for advanced manufacturing, the company's losses for the quarter could have exceeded 450 billion won . The company will release its full financial report later this month.

The decline of the South Korean battery giant was already evident in the capital markets. With the phasing out of electric vehicle subsidies in its main market, the United States, LG Energy's stock price has been falling continuously since November of last year, with a cumulative drop of over 30%.

(LG Energy Solutions daily chart, source: TradingView)

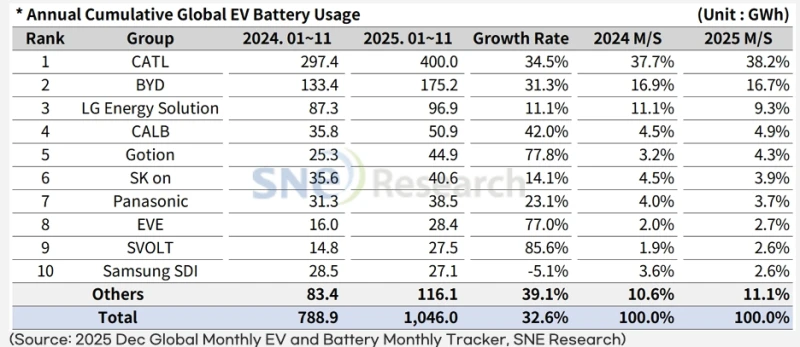

According to a report released this week by South Korean research firm SNE Research, data on global electric vehicle battery installations from January to November 2025 shows that LG Energy ranks third globally with 96.9 GWh.

The report indicates that LG Energy's major customers include Tesla, Chevrolet, Kia, and Volkswagen. Tesla's use of LG batteries declined by 8.2% year-on-year due to slowing sales of Tesla models equipped with LG batteries. On the other hand, sales of the Kia EV3 and electric vehicles based on the Ultium platform expanded, maintaining the company's upward trend in shipments.

(Source: SNE Research)

The sluggishness of the overseas electric vehicle market has also begun to affect LG Energy's future orders.

In December of last year alone, Ford Motor Company announced the cancellation of a 9.6 trillion won battery procurement agreement with LG Energy . Subsequently, Fraunberg Battery Systems of Germany announced its exit from the battery business, also canceling a 3.9 trillion won agreement with LG Energy. To improve operational efficiency, LG Energy also sold the facilities and assets of its Ohio joint venture battery plant to its joint venture partner, Honda Motor Company.

In a research report in early January, NH Investment & Securities of South Korea mentioned that LG Energy might soon announce the suspension of operations at its battery plant in partnership with General Motors in the United States , which could bring an additional cost of 1 trillion won.

Faced with a deteriorating outlook for electric vehicles, LG Energy is accelerating the transformation of its energy storage business.

LG Energy Solutions CEO Kim Dong Myung said this week that the company will accelerate the adjustment of its electric vehicle battery production layout in North America, Europe, and China to increase energy storage system (ESS) capacity . At the same time, the company also plans to prioritize the introduction of artificial intelligence (AI) in product and materials research and development as well as manufacturing, aiming to improve overall production efficiency by at least 30% by 2030.

In his New Year's address, Kim Dong-myung said, "I hope to fully unleash the growth potential of the company's energy storage business. Currently, the demand for ESS is expanding at an unprecedented rate, which will be a key opportunity to determine the success of our portfolio rebalancing."