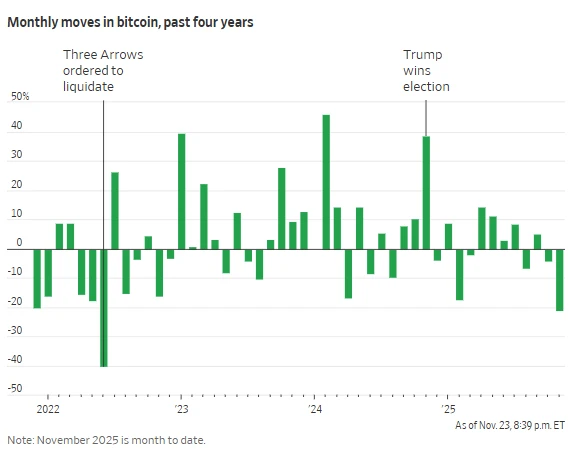

The recent volatility in both the global cryptocurrency market and the US stock market has undoubtedly drawn increasing attention from market participants to the correlation between the two.

As previously reported by Cailian Press, the correlation between Bitcoin and US tech stocks has not been this high in many years —Bitcoin and Nasdaq. The 30-day correlation coefficient of the S&P 100 index reached approximately 0.80 (maximum value 1) in mid-month, the highest level since 2022 and the second highest reading in nearly 10 years.

The continued plunge in Bitcoin over the past few weeks has become a major focus of the global market. Last weekend, the price of Bitcoin briefly approached the $80,000 mark, falling by about 34% from its all-time high of over $120,000 reached in October.

Although cryptocurrencies are known for their volatility, and many Bitcoin enthusiasts remain convinced that Bitcoin can still rebound, so-called "crypto reserve companies" that raise funds by selling stocks to buy cryptocurrencies are currently suffering heavy losses. This trading model, which was popular earlier this year, now seems to be collapsing—for example, Strategy's stock price has fallen by 37% this month.

Some Bitcoin traders have pointed out that as long as cryptocurrency reserve companies continue to struggle, they will find it difficult to purchase cryptocurrencies, which will cause the crypto market to lose key buying power—the large funds that can drive price rallies.

Historically, despite cryptocurrency crashes, the impact on the US stock market or the overall US economy has often been minimal. For example, when Sam Bankman-Fried's FTX (then the world's second-largest cryptocurrency platform) went bankrupt, the stock market was virtually unaffected.

However, the increasing number of cryptocurrency holders and the expanding market size are now enough to raise concerns about broader implications. Many traders say that Bitcoin prices have consistently been a key indicator of the direction of the US stock market.

Last Friday, renowned hedge fund manager Bill Ackman admitted that he had “underestimated” the correlation between Fannie Mae and Freddie Mac stocks (which fell 4.5% and 1.1% respectively that day) and cryptocurrencies —crypto investors faced margin calls, leading to a sell-off of the two lending giants’ stocks (listed on the pink sheets market).

How did Bitcoin shake up the US stock market?

Many traders, busy explaining the reasons for the sharp fluctuations in the two major markets, have pointed the finger at leveraged trading and the impulse to take profits before the end of the year.

In recent years, both Wall Street and ordinary investors have amplified their market bets through financial leverage. (According to US financial...) According to statistics from the industry regulator, brokerage account lending exceeded $1.1 trillion at the end of October, setting a new record. (Morning Star) Data also shows that leveraged equity fund assets surged to over $140 billion this fall, the highest level since records began in the 1990s.

While leverage can indeed amplify the returns of bullish bets during market rallies, it can also rapidly escalate situations during volatile periods, forcing investors to sell their positions to meet margin requirements from lenders . Simultaneously, many stock traders holding highly leveraged instruments often attempt to amplify their bullish Bitcoin trades as well. When Bitcoin prices fall, these traders can suffer substantial losses.

Benn Eifert, managing partner at San Francisco-based investment firm QVR Advisors, pointed out: "There is a group of over-leveraged market participants who are long on both cryptocurrencies and overvalued tech stocks. When their cryptocurrency positions are forced to liquidate, they sell their tech stocks to cash out."

Frank Monkam, Head of Cross-Asset Macro Strategy and Trading at Buffalo Bayou Commodities, also believes that "the cross-asset deleveraging chain reaction is not over yet as cryptocurrencies enter a bear market. The cryptocurrency market is dominated by retail investors, who are the main drivers of the rally since the spring – and their vulnerability is obvious."

In addition, the human tendency to "take profits and run" may also have exacerbated stock market volatility. Investors still enjoy substantial profits in major US markets this year—the S&P 500 has risen 12% year-to-date, and the bond market has seen its best performance since 2020. Meanwhile, Bitcoin, which has plummeted, has completely erased its year-to-date gains this month.

Hedge fund traders often develop a "fear of battle" at the end of the year—fearing that a market reversal at the end of the year will cause huge bonuses to slip through their fingers. If the market weakens at this time of year, they often rush to sell stocks, especially now that they see many cryptocurrency traders having worked themselves to death or even been liquidated...

(Article source: CLS)