There are signs that credit derivatives trading in companies that pay out indemnities in the event of default are surging as investors seek to protect their portfolios from the risk that the AI “boom” may turn into a “cold snap.”

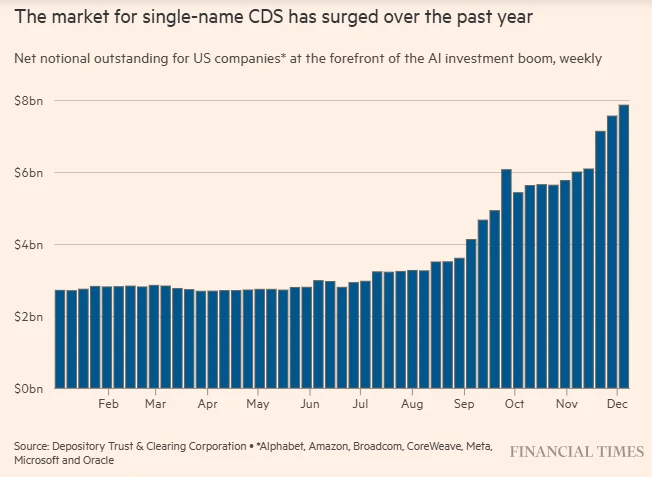

Data from clearing house DTCC shows that since the beginning of September, the volume of credit default swap (CDS) transactions linked to a few U.S. technology companies has climbed by 90%.

The expanding use of this strategy highlights that many investors are optimistic about technology companies' potential in artificial intelligence. There is unease about a series of bond transactions undertaken to finance infrastructure investments that may take years to generate returns.

Oracle last week Hebotong The earnings reports of two tech giants fell short of investors' high expectations, triggering a sell-off in Wall Street tech stocks and prompting investors to accelerate the deployment of default hedging strategies.

Oracle Bone Script becomes the target of concentrated criticism.

As traders scrutinize corporate earnings reports and delve into how competition from AI products from companies like OpenAI, Google, and Anthropic will impact the chip and data center markets. Demand, debt, and equity of technology-related companies have fluctuated dramatically in recent months.

Oracle and cloud computing The increase in credit default swap trading volume was particularly significant for companies like CoreWeave, both of which are securing data center capacity by issuing billions of dollars in bonds. Oracle, in particular, is currently under intense scrutiny after its earnings report last week reignited concerns about its massive capital expenditures.

Market data shows that the yield on Oracle's 5.2% coupon bond maturing in 2035 rose to 5.9% last Friday, currently exceeding the average yield of 5.69% for the highest-rated junk bonds. This is despite Oracle's bond rating still being two notches above speculative grade (junk bonds)...

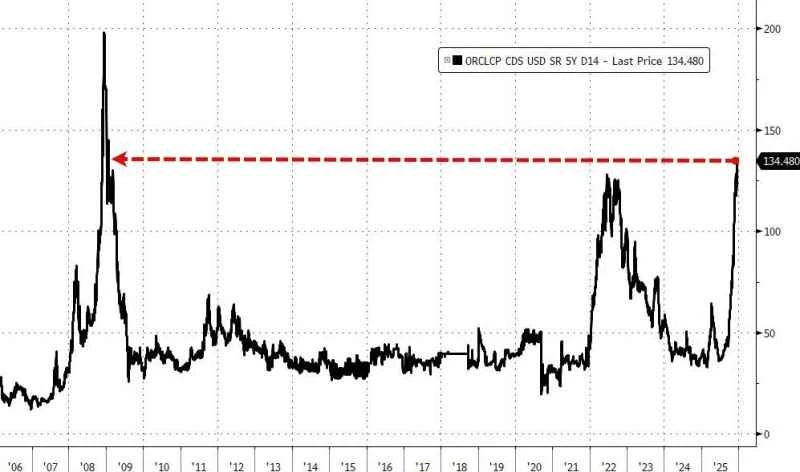

The sell-off of Oracle bonds naturally led to a surge in its CDS spreads. Oracle's five-year CDS rose as much as 14.4 basis points to 151.3 basis points on Friday, marking the second consecutive trading day that it reached its highest level since the 2009 global financial crisis.

In terms of transaction volume, Oracle CDS weekly trading volume has more than tripled since the beginning of this year.

Oracle is one of the largest investors in the US artificial intelligence field, participating in the "Stargate" project with OpenAI and SoftBank Group—a project aiming to rapidly invest $500 billion in building AI infrastructure. As part of this project, approximately 20 banks... The consortium is providing approximately $18 billion in project financing loans to build a data center campus in New Mexico, where Oracle will be a tenant.

The company also issued $18 billion in high-grade bonds in September, making it one of the largest corporate bond issuances in the US this year. Following the new bond issuance, Oracle's total outstanding debt exceeded $100 billion, making it the investment-grade large technology company with the highest debt ratio. The company is burning through cash and still needs to borrow billions of dollars to meet its dividend and capital expenditure commitments.

Last week, Oracle's stock and bond prices both plummeted after third-quarter revenue missed analysts' expectations and second-quarter RPO (Remaining Performance Obligations) surged year-over-year. Its stock price fell further on Friday after the company announced a delay in the construction of at least one data center.

"We don't think Oracle will default in the short term, but its CDS is seriously mispriced (underpriced)," said Benedict Keim, portfolio manager at asset management firm Altana Wealth.

Altana is currently betting on a decline in Oracle's stock price via CDS. The company initiated the trade in early October after an assessment revealed Oracle's rising debt levels and over-reliance on a single customer—ChatGPT developer OpenAI. "It was a golden investment opportunity," a company executive stated.

AI companies' CDS trading volume continues to surge

CDS can be used for default protection, as well as for hedging or betting on bond price fluctuations.

JPMorgan Chase Investment-grade credit strategist Nathaniel Rosenbaum noted, "There has been a significant increase in single-name CDS (CDS) transactions this quarter, particularly among tech giants building hyperscale data centers across the United States."

An executive at a major U.S. credit investment firm agreed with this view, adding, "There has been a significant increase in single-name credit default swap transactions, and investors are increasingly adopting portfolio strategies targeting tech giants, particularly Oracle and Meta."

"How can you protect yourself and establish a hedging mechanism? The most common way is to use a technology stock CDS portfolio strategy," the person added.

It is worth mentioning that at the beginning of the year, there was little or no demand for CDS of highly rated US companies, as US tech giants were mainly relying on huge cash reserves and strong profits to support their AI spending.

The market only began to heat up when these companies started using the debt market to cover their rising costs. This fall, Meta and Amazon... Four companies, including Alphabet and Oracle, have collectively raised $88 billion for artificial intelligence projects. JPMorgan Chase predicts that investment-grade companies could raise $1.5 trillion by 2030.

An investor from a professional asset management company stated, "Market perception has shifted from 'there is almost no credit risk' to 'different companies have different risks,' which necessitates hedging operations."

Wellington portfolio manager Brij Khurana points out that single-name CDSs are experiencing a golden age. He adds, " Banks and private lending firms have significantly increased their exposure to individual companies, creating a pressing need for hedging. Investors are seeking hedging tools for their holdings."

(Article source: CLS)