① Goldman Sachs The group warned that if the technology industry fails to drive explosive growth in demand for AI applications and successfully monetize them, tech giants will face consequences for their data center investments . Large-scale investments may result in total losses. ② The global AI data center infrastructure construction boom continues, with capital expenditure on data centers expected to reach $1.6 trillion by 2030, but the return on investment is worrying.

As the market reacts to the massive investments in artificial intelligence by US tech giants... With growing concerns about infrastructure risks, Goldman Sachs recently warned that if the tech industry fails to drive explosive growth in demand for AI applications and successfully monetize artificial intelligence models, many tech giants' massive investments in data centers could be wiped out.

The return on investment for data centers is worrying.

Driven by the growing demand for computing resources fueled by artificial intelligence (AI) , a global boom in AI data center infrastructure construction continues. Analysis firm Omdia stated last week that capital expenditure on data centers is projected to reach $1.6 trillion by 2030 due to AI, implying an annual growth of 17% from now.

But the question of how much return on investment (ROI) the massive construction of data centers can actually bring is lingering in the minds of more and more people.

"Many investors are struggling to cope with this hype and trying to quantify what all this means," said Jim Schneider, senior equity analyst at Goldman Sachs, in a report.

He outlined four hypothetical scenarios for the possible development of the data center field from now until 2030.

Overall, Goldman Sachs sees two major demand-side risks that data centers may face in the coming years: cooling demand due to difficulties in monetizing AI models, and cooling demand for cloud services.

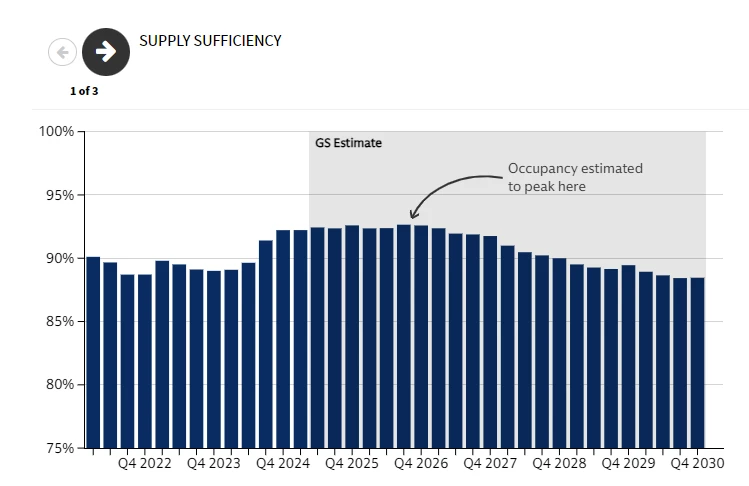

Their basic prediction is that even if the demand for artificial intelligence continues to grow, the occupancy rate of data centers will peak next year, and then gradually decrease in the following years, which means that the tension between supply and demand will gradually ease.

Occupancy, or "supply sufficiency," reflects the utilization rate of data center computing power. Goldman Sachs states that this metric is largely linked to corporate profit margins. If data center occupancy cannot be maintained at a high level in the future, it means that data center operators' large investments may not yield returns.

Basic scenario: Data center demand will approach supply.

According to Goldman Sachs' basic forecast, artificial intelligence will double its share of the overall data center market to 30% within the next two years, thereby eroding the market share of traditional workloads and cloud workloads.

Their base case is that by 2030, overall energy consumption in data centers will increase by 175% compared to 2023 (Goldman Sachs analysts previously predicted an increase of 165%).

Goldman Sachs Research's base case forecast is that the supply-demand balance will narrow significantly over the next 18 months as more data centers come online. Data center occupancy is expected to remain at peak levels until 2026.

Although the outlook beyond 2027 remains uncertain, Goldman Sachs analysts predict that the tight supply of data center resources will ease thereafter, with occupancy rates gradually falling to around 90% by 2028 before stabilizing.

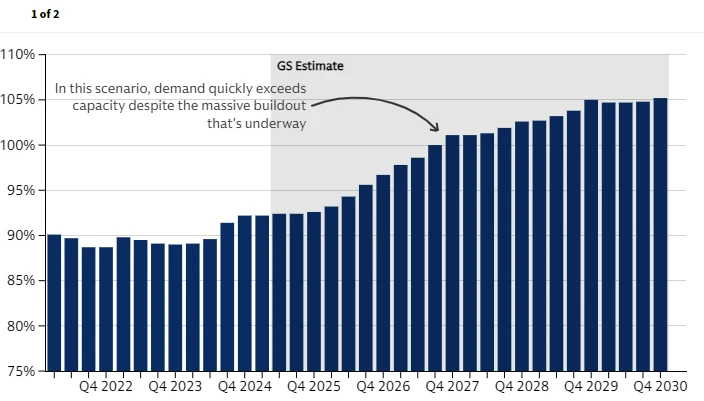

Scenario 2: A surge in demand for AI applications leads to a shortage of data center supply.

In this hypothetical scenario, AI applications—especially AI video—explode in popularity, and since AI video is a data-intensive application, the demand for computing power may increase significantly.

However, the energy consumption of next-generation artificial intelligence chips—graphics processing units (GPUs)—may also exceed expectations. "Despite improvements in energy efficiency, energy demands are still exceeding many people's expectations," Schneider said.

In this scenario, by 2030, data center occupancy rates in peak regions will exceed 100%, 17 percentage points higher than the baseline, indicating a supply shortage.

Scenario 3: Failure to monetize AI leads to a cooling of demand for data centers.

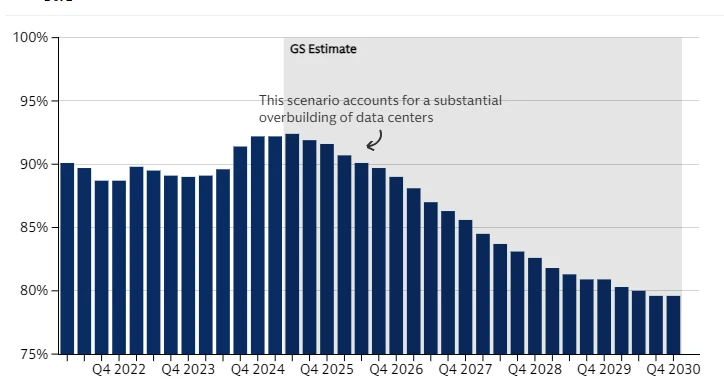

In the third hypothetical scenario, if users are unwilling to pay for AI tools, the monetization plans for AI products will fail, further slowing demand for data centers. This would lead to an oversupply situation, with AI demand declining by 20% between 2025 and 2030, and data center occupancy rates falling by 8 percentage points below the baseline.

This means that there will be an oversupply of data centers, which may force operators to lower rental prices.

"If we see a slowdown in end-user demand for artificial intelligence, then the profit opportunities for artificial intelligence will decrease, and the demand for data centers across the industry may also decline as a result."

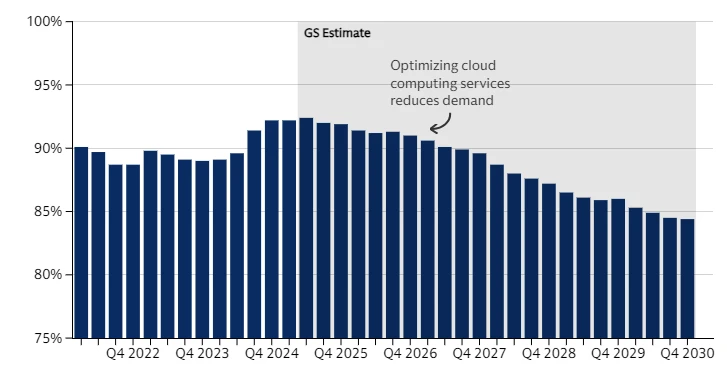

Scenario 4: Cooling demand for cloud services leads to a downturn in data centers.

Despite the significant progress in artificial intelligence, a large portion of data center capacity is still currently used for conventional cloud computing . Services (Currently, cloud services and traditional workloads account for approximately 85% of data center demand).

Therefore, Goldman Sachs' fourth scenario is that if businesses reduce their spending on the aforementioned basic services, data center utilization could fall by 4 percentage points from the baseline, even if demand for artificial intelligence remains stable.

"If economic growth slows and companies decide to use cloud services more rigorously, then the growth rate may decrease," Schneider said. He added that companies are also continuously working to optimize their use of cloud services, which can also reduce demand.

More and more investment giants have sensed the risks.

In the recent US stock market, Oracle... Leading tech giants have already experienced a sell-off in their stock prices due to the risks of building massive data centers, and some investment giants have also begun to express their concerns.

French asset management giant AXA recently stated that it is "being more cautious about building artificial intelligence" when providing financing for the data center industry, as people are increasingly aware of the potential risks involved.

Managers of Norway’s $2 trillion sovereign wealth fund recently stated that they are cautious about directly investing in data centers due to the high volatility of the artificial intelligence industry.

(Article source: CLS)