A major turning point in Wall Street's recent headlines took a dramatic turn on Monday. Former Federal Reserve Governor Kevin Walsh replaced Kevin Hassett as the frontrunner for the next Fed chair. For President Trump, with the re-election of regional Fed presidents bringing his attempts to exert influence over the central bank to a serious challenge.

Did the dark horse emerge victorious?

Data from the prediction market platform Kalshi shows that former Federal Reserve Governor Warsh's nomination probability has risen to 47%, compared to 39% on Sunday and only 11% on December 3. Meanwhile, White House National Economic Council Director Hassett's nomination probability has fallen to 41%, a significant drop from 51% on Sunday and 81% on December 3.

The report points out that Hassett's candidacy is facing opposition from Trump's close associates, a development that appears to be a key reason for Walsh's surge in approval ratings. This opposition stems from concerns about Hassett's close relationship with Trump.

Last Wednesday, US President Trump met with Walsh at the White House, explicitly asking whether Walsh would support interest rate cuts and whether he could gain Trump's trust. "I'm not asking him to do exactly what we say, but... I have unique insights that he should listen to," Trump said, noting that he expects interest rates to fall to 1% within a year, or even lower.

This report surprised Wall Street. Previously, the market had almost unanimously favored Hassett, and this news caused Walsh's nomination chances to rise from rock bottom.

However, rumors had long circulated within Wall Street's financial circles that Hassett was not their ideal candidate for Federal Reserve Chair. Media reports, citing sources familiar with the matter, indicated that the largest bank in the United States... JPMorgan Chase At a private summit for the asset management industry on the 11th, CEO Jamie Dimon expressed his support for Warsh and predicted that Hassett is more likely to cater to Trump's demands and push for further interest rate cuts. Furthermore, bond investors expressed their concerns about Hassett to the U.S. Treasury Department in November, fearing that Hassett would implement aggressive interest rate cuts to appease Trump.

According to Trump's previous plan, he will nominate a new Federal Reserve Chairman in early 2026, while the current Chairman Powell's term will expire in May of the same year.

It's worth noting that Hassett deliberately distanced himself from Trump in his latest statement. When asked whether Trump's opinions carried the same weight as those of the Federal Open Market Committee voting members, Hassett responded, "No, his opinions have no weight." He explained, "They only have significance when they are reasonable and supported by data. Even if you propose to the committee, 'The president's point is very valid, what do you all think?', if the committee members disagree, they will still cast different votes."

Earlier last week, when asked a similar question, Hassett responded, "If inflation rises from 2.5% to 4%, then we can't cut rates." Following this, reports emerged of Trump meeting with Warsh.

Boris Schlossberg, a macro strategist at BK Asset Management, told CBN reporters that he had noticed Hassett's series of remarks, and that such independent statements were clearly unacceptable to Trump. "The US president now needs a 'compliant' Fed chair; he's clearly had enough of Powell, which is why Hassett's popularity is declining."

Trump's dilemma

For US President Trump, the grim situation in the midterm elections has heightened the urgency to reform the Federal Reserve.

In a media interview last week, he said he was unsure whether the Republican Party could retain control of the House of Representatives in next year's midterm elections because some of its economic policies had not yet fully taken effect. "I can't give an answer. I don't know when the benefits of these policies will fully materialize."

Trump claimed that his economic policies, including imposing tariffs on a wide range of imported goods, were creating jobs, boosting the stock market, and attracting more investment to the United States.

However, while he promised to curb inflation during last year's campaign, in recent weeks he has wavered between several statements: sometimes dismissing the high cost of living as a hoax, sometimes blaming former President Biden, while simultaneously promising that his economic policies will benefit the American people next year. "I think by the time we have to talk about the election in a few months, prices should be in a good position."

Schlossberg told CBN reporters that Trump's goals are becoming increasingly difficult to achieve. Due to the unresolved legal dispute with Federal Reserve Governor Cook, even with the addition of his "close confidant" Milan within the Fed, he is still unable to control the Fed Board and exert significant influence.

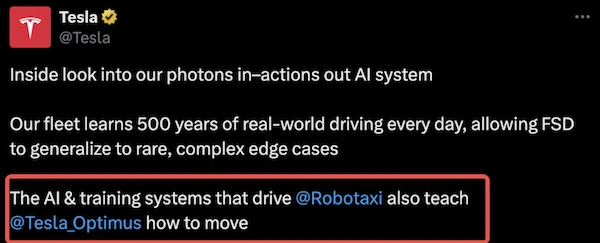

It's worth noting that the Federal Reserve just announced last week that the Board of Governors had unanimously approved extending the terms of all regional Federal Reserve Bank presidents for another five years. This process is normally a routine administrative matter, but it has attracted significant attention this year due to pressure from Trump to lower interest rates. First Financial Daily previously reported that two hawkish regional Federal Reserve presidents may be rotated into the Federal Open Market Committee (FOMC) next year and gain voting rights.

Schrosberg analyzed that Trump's attempts to intervene in the Federal Reserve this year have not been successful. He faced significant resistance in his attempt to fire Powell, and concerns about his potential impact on the Fed's independence have intensified. Turning to regional Fed officials might have been a good option, but that path is now largely blocked. Looking at the Fed's December policy meeting, there was significant internal disagreement on interest rate cuts, and data-driven decision-making will continue to be a determining factor in the policy path. The latest economic forecasts indicate that the Fed is likely to adopt a cautious wait-and-see approach, at least until the first quarter of next year.

(Article source: CBN)