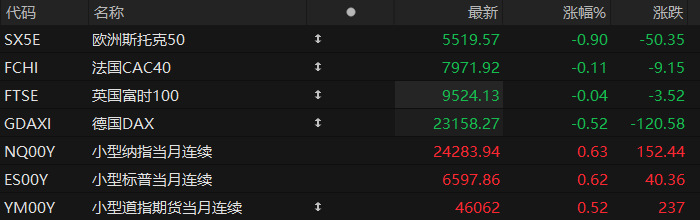

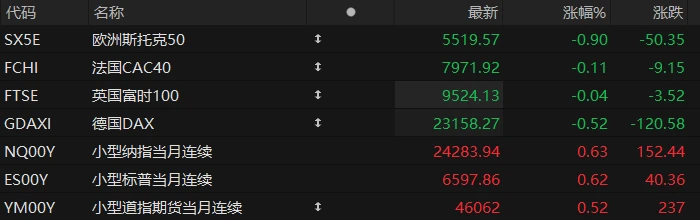

U.S. stock index futures rose across the board in pre-market trading on Friday, while major European indices generally fell. As of press time, the Nasdaq... S&P 500 futures rose 0.63%, S&P 500 futures rose 0.62%, and Dow Jones futures rose 0.52%.

In terms of individual stocks, cryptocurrency stocks fell across the board. ALTS fell more than 6% pre-market, Nabitt fell more than 4% pre-market, and Strategy, Hut8, Bitfarms and ABTC fell more than 2%. Bitcoin once fell below the $82,000 mark during the day.

Bilibili NetEase rose about 1% pre-market and continued to receive positive reviews from institutions after its earnings report; The stock fell nearly 2% in pre-market trading. In terms of news, a report from BOC International indicated that NetEase's total revenue in the third quarter increased by 8% year-on-year, with online games... Revenue grew by 13% year-on-year, both figures falling short of market expectations.

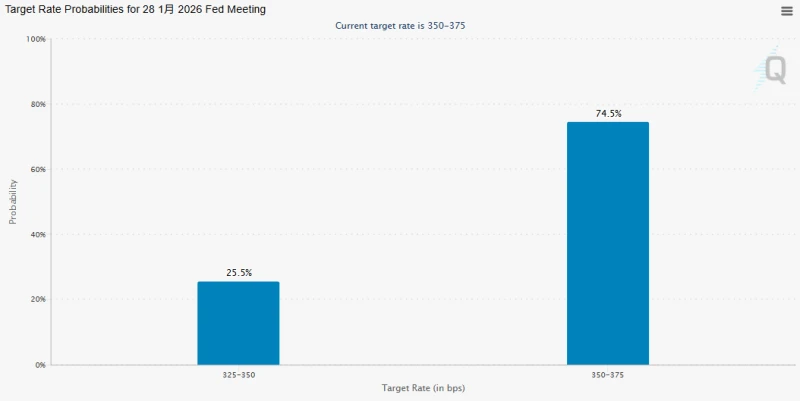

On Friday local time, Williams In his prepared speech in Santiago, Chile, he noted that downside risks to employment have increased, while upside risks to inflation have eased. He believes monetary policy is currently in a state of moderate tightening, but the degree of restriction is lower than before recent actions.

Following Williams' speech, traders' bets on a December rate cut intensified. Overnight index swap (OIS) rates related to the December meeting fell sharply, with the market pricing in approximately 14 basis points of easing, equivalent to a 56% probability of a 25 basis point cut, compared to Thursday's close which only reflected an 8 basis point rate cut expectation. The market reacted positively, with U.S. stock index futures rising briefly, U.S. Treasury bonds increasing, and spot gold climbing nearly $10.

Hot News

Why did US stocks plunge? Wall Street analysts: Five forces at play.

On Thursday, Eastern Time, US stocks experienced a rare opening higher but closing lower – following Nvidia's performance. Driven by strong earnings reports, the S&P 500 opened nearly 2% higher, but then plunged after the release of the non-farm payrolls report, ultimately closing down 1.6%.

This reversal sent the Nasdaq down to its lowest closing level since September 11 and the S&P 500 down to its lowest level since September 10. Meanwhile, market volatility surged, with the VIX index hitting its highest closing level since the end of April.

Earlier this month, investment research firm Yardeni Research had already anticipated a correction in US stocks. Yardeni Research analysts released a report on Thursday stating that this correction has clearly intensified and may be entering the early stages of a broader market correction, particularly for the Nasdaq . Yardeni Research analysts believe there are five main forces behind the sudden bearish market sentiment: artificial intelligence... Concerns about a bubble, the freefall of Bitcoin, worries about the Federal Reserve cutting interest rates, doubts about economic growth, and the prolonged unemployment of Americans.

Analysts also stated that if this correction truly spreads into a full-blown correction, the S&P 500 may struggle to reach its target of 7,000 points by the end of the year, and the decline could extend into early 2026. However, analysts believe that the rapid shift in market sentiment suggests that the slump in US stocks should end soon.

Will gold continue to shine? UBS raises its mid-2023 price target: up to $4,900!

In a recent report released on Thursday, UBS raised its mid-2026 gold price target to $4,500 per ounce from $4,200 to $4,500, citing expectations of a Federal Reserve rate cut, persistent geopolitical risks, fiscal concerns, and strong demand from central banks and ETF investors.

UBS wrote, "We expect gold demand to rise further in 2026, driven by anticipated Fed rate cuts, declining real yields, continued geopolitical uncertainty, and changes in the U.S. domestic policy environment."

The bank also raised its upside target for gold by $200 to $4,900 per ounce, citing a potential surge in political and financial risks, but maintained its downside target at $3,700 per ounce.

UBS analysts stated that a deteriorating US fiscal outlook could support gold purchases by central banks and investors, and they expect demand for exchange-traded funds (ETFs) to remain strong in 2026. On the other hand, they cautioned that a potentially hawkish stance from the Federal Reserve and the risk of central bank gold sales remain major challenges to their overall bullish outlook.

Bitcoin plunged, briefly falling below $82,000 during the day.

On Friday, Bitcoin briefly fell below the $82,000 mark, hitting a low of $81,111, a new low since April 7.

As of press time, Bitcoin had fallen more than 9%, trading at $82,885. It's worth noting that earlier this week, Bitcoin's decline triggered heightened market pessimism, which quickly spread to stock markets across many parts of the world.

Tom Lee, Head of Research at Fundstrat, and Interactive Brokers Chief strategist Steve Sosnick points out that algorithmic traders are currently viewing Bitcoin as a "leading indicator," which has essentially become a substitute reference for the speculative frenzy.

US Stocks Focus

Jensen Huang reportedly complained internally: The market has not fully recognized Nvidia 's excellence.

Following the sharp drop in Nvidia's stock price after the release of its financial report, Asian markets experienced a collective correction on Friday, with well-known high-performing stocks in the "AI industry chain," such as Samsung Electronics, SoftBank Group, Kioxia Holdings, and Tokyo Electron, all suffering significant declines.

Seemingly influenced by stock price fluctuations, at an all-hands meeting held by Nvidia on Thursday, Jensen Huang stated that "market expectations for Nvidia are currently ridiculously high," to the point that the company is in a "no-win" situation where it's difficult to please the market no matter what it does. He also commented on Nvidia's enormous influence on the global market.

Huang said, "If we deliver a terrible quarterly report, even by a tiny margin, the whole world will collapse... You've probably seen some of the memes online that say we're basically supporting the entire planet, and that's not an exaggeration."

At the same time, Huang Renxun also complained: "If we deliver poor performance, it will be solid proof of the AI bubble; if we deliver outstanding performance, it will be that we are fueling the AI bubble."

The head of the world's most valuable publicly traded company also reassured employees at the meeting, saying he was pleased with the company's performance and proud of the employees, but that Nvidia's enormous influence was making it harder to meet external expectations.

Crazy rush! Oracle amidst AI bubble debate CDS becomes the ultimate "doomsday insurance" "

For many market participants, Oracle is playing the role of a "canary in the coal mine" in this AI boom—this once conservative database giant has now borrowed tens of billions of dollars, not only closely linking its own fate with the artificial intelligence boom, but also rapidly becoming a barometer for measuring AI risks in the credit market and even the global stock market.

In recent months, traders have been flocking to buy Oracle 's credit default swap (CDS) contracts. This is due to the company's massive investment in artificial intelligence , its central role in intricate trading networks, and its lower credit rating compared to Microsoft. Along with peers like Google's parent company Alphabet, these factors have made CDS contracts the preferred tool for market hedging and even shorting the AI craze.

According to the Intercontinental Exchange According to statistics from ICE Data Services, the cost of protecting Oracle’s debt from default over the next five years has tripled in recent months – on Wednesday, Oracle’s 5-year CDS spread reached 111 basis points, which is equivalent to paying about $111,000 per year for every $10 million of principal protected.

Barclays bank Credit strategist Jigar Patel points out that as AI skeptics flood the market, Oracle CDS trading volume surged to approximately $5 billion in the seven weeks ending November 14, far exceeding the $200 million recorded in the same period last year.

Acknowledging Google's lead! An internal memo from Altman reveals OpenAI's narrowing advantage and warns of impending "difficult times."

On November 21, according to tech media outlet The Information, Altman acknowledged in an internal memo last month that Google's latest advancements in artificial intelligence "may bring some temporary economic headwinds to our company," and warned employees that "I expect the external atmosphere to be challenging for some time." He admitted that Google's recently created new AI seems to have surpassed OpenAI in its development approach, adding, "We know there is still some work to be done, but we are catching up quickly."

The report states that this internal statement foreshadows the significance of Google launching Gemini 3 this week. (Software Development ) The researchers stated that the AI model excels in automating website and product design tasks, as well as programming, and programming ability is one of the most important revenue drivers for AI companies like OpenAI.

Even more challenging is the fact that OpenAI's competitors are making breakthroughs on multiple fronts. As previously reported by The Information, Anthropic, founded just four years ago, may surpass OpenAI's revenue this year from selling AI to developers and enterprises. Meanwhile, although ChatGPT still significantly leads Google's Gemini chatbot in both usage and revenue... However, the gap is narrowing.

(Article source: Hafu Securities) )