The current Federal Reserve Chairman Jerome Powell's term will end next May, and Trump's handpicked "confidant" is about to take office, aiming to push for significant interest rate cuts and accomplish the tasks that Powell has long "resisted".

However, according to Capital Economics, the current state of the U.S. economy may prevent the central bank from lowering interest rates as President Trump would like.

In a recently released report, Capital Economics economists stated that recent developments driven by artificial intelligence... The AI-led investment surge is just the beginning of a multi-year boom in capital spending. As a result, GDP is projected to grow at a robust rate of 2.5% in 2026 and 2027, even taking into account factors that a weak labor market will slow consumption.

Capital Economics predicts: "With core inflation remaining above the 2% target for a considerable period, we believe the Fed will only cut rates by 25 basis points in 2026, which will almost immediately lead to a dispute between the new Fed chairman and President Trump. "

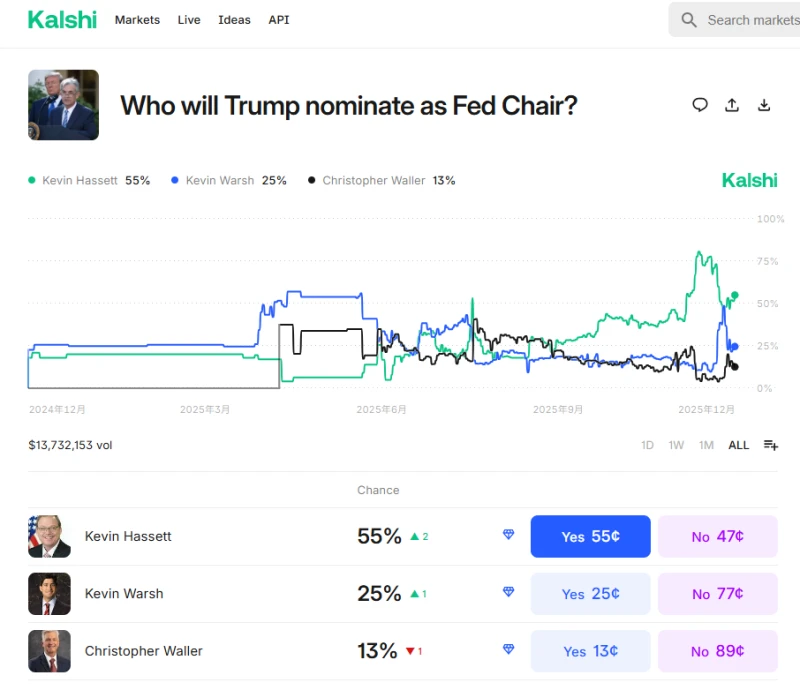

Trump recently stated that he has decided who will succeed Powell, but the announcement may not be made before the end of the year, but rather "within a few weeks." Kevin Hassett, director of the White House National Economic Council, and former Federal Reserve Governor Kevin Warsh are considered the most likely candidates to succeed Powell.

According to the latest data, Hassett still has the highest probability of being nominated by Trump as the Federal Reserve Chair on the US prediction markets Kalshi and Polymarket, both around 55%.

Last Wednesday evening local time, Trump addressed the nation, saying that a new Federal Reserve chairman would be appointed soon and that he was a candidate who endorsed low interest rates.

“I will soon announce our next chairman of the Federal Reserve, someone who firmly believes that interest rates will fall significantly and mortgage payments will fall even further,” he added. Earlier this year, Trump suggested lowering the policy rate to 1%, a level that typically signifies a recession rather than healthy economic growth.

Capital Economics states that while the job market is showing signs of stagnation, the boom in artificial intelligence will keep the economy active and incomes growing. As AI applications expand beyond technology to other sectors such as finance, real estate, and healthcare, corporate investment will grow by 6.5% in 2026 and accelerate to 7.4% in 2027.

Economists say that AI-driven productivity gains should also help offset labor market strain caused by Trump’s immigration crackdown, but his tariffs will keep inflation sticky.

Of course, Trump's "Federal Reserve believers" might heed his orders and push for further rate cuts, but this would require the cooperation of other policymakers. Even if they did, aggressive easing would ultimately backfire.

Capital Economics warns: "Admittedly, appointing a new Fed chair could trigger a larger wave of policy easing, but only if the Trump administration is willing to undermine the independence of the Federal Open Market Committee and its credibility in fighting inflation, which could lead to higher long-term interest rates."

As for Hassett, he appeared to show a rare sign of independence from Trump last week, saying the president’s opinions have “no influence” on the Federal Open Market Committee (FOMC), which sets interest rates.

Of course, not everyone is so optimistic about the economy. Analysts at Citi Research predict that U.S. GDP growth will be around 2% next year, inflation will move toward the Fed's 2% target, and the labor market will continue to soften. This would pave the way for the Fed to cut interest rates by a total of 75 basis points (three times Capital Economics' forecast) to 2.75%-3.0%.

"The risks of a faster rise in unemployment are converging, which could lead the Federal Reserve to cut interest rates more quickly and significantly. We do not expect a rebound in economic growth or labor demand in 2026. Instead, our base case forecast is that employment will remain weak, leading to slower income growth and continued slowdown in consumer spending," the bank said.

(Article source: CLS)