1. Metals surge continues, with spot gold, silver, and LME copper all hitting record highs; 2. US Q3 GDP data exceeds expectations; 3. Novo Nordisk... Oral weight loss drug rises over 8% pre-market Approved to launch in the US market; 4. Another 1 million users in 47 days! Musk's satellite internet Business growth has "taken off".

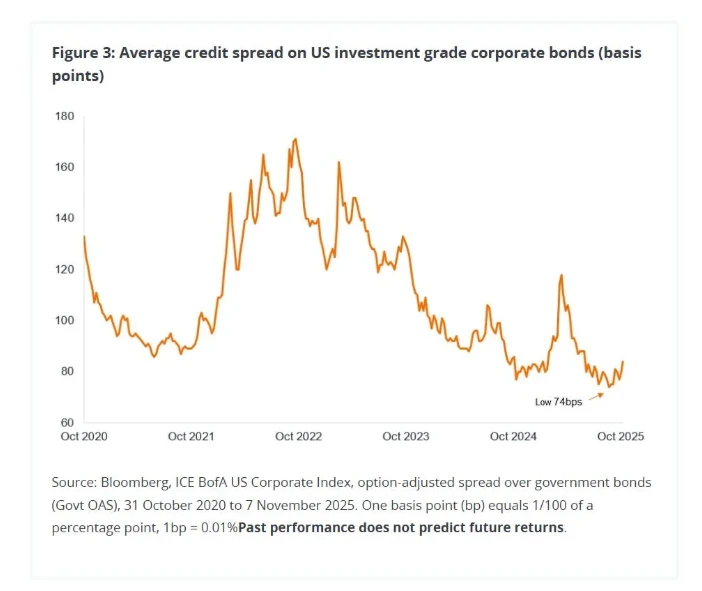

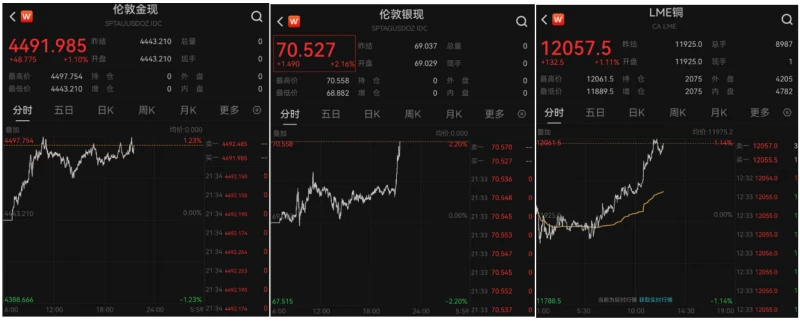

After several days of gains, major U.S. stock futures indexes resumed their consolidation pattern in pre-market trading on Tuesday, hovering around record highs, and weakened slightly after the release of better-than-expected GDP data. Against the backdrop of a continued weakening dollar, spot gold, silver, and LME copper all hit new record highs in the past few hours .

As of press time, Nasdaq S&P 500 futures (2603 contract) fell 0.27%, S&P 500 futures fell 0.16%, and Dow Jones futures fell 0.16%. After rising for three consecutive trading days, the S&P 500 index has once again reached the 6900 mark, just 23 points away from setting a new record closing high.

(S&P 500 daily chart, source: TradingView)

In the past few hours, spot gold, silver, and LME copper have all hit record highs . Spot gold is approaching $4,500 per ounce, spot silver has broken through $70 per ounce, and LME copper has surpassed $12,000 per ton for the first time in history.

Besides the frequently mentioned geopolitical risks, supply and demand dynamics, and speculative factors, the continued weakening of the US dollar is also a backdrop to rising commodity prices. Data shows that the US dollar index continued to fall on Tuesday, down more than 9% year-to-date, approaching its largest annual decline since 2017. Given that the Federal Reserve's interest rate cuts are significantly slower than its peers, the options market generally prices for the dollar to continue falling next year.

On Tuesday pre-market, the market also received the last wave of belated US economic data before the Christmas holiday.

Specifically, the annualized quarterly rate of US GDP growth in the third quarter reached 4.3%, significantly higher than the expected 3.3% ; real personal consumption expenditure increased by 3.5% quarter-on-quarter in the third quarter, better than the expected 2.7%; and the core PCE price index rose by 2.9% year-on-year in the third quarter, in line with expectations.

Starting Wednesday, European and American markets will enter the Christmas period. Specifically, the US stock market will close three hours early on Wednesday, be closed all day Thursday, and resume trading on Friday.

Other market news

Novo Nordisk 's oral weight-loss drug approved for the US market

Danish pharmaceutical giant Novo Nordisk shares rose more than 8% in pre-market trading on Tuesday. The company announced after the market closed yesterday that the tablet version of its GLP-1 weight-loss drug Wegovy had received FDA approval in the United States, with plans to begin sales of the new tablet in early January. This is reportedly the first GLP-1 oral weight-loss tablet approved by the FDA.

Tesla European sales fell by nearly 12% in November.

Data from the European Automobile Manufacturers Association (ACEA) shows that Tesla's sales in the EU, EFTA, and UK fell 11.8% year-on-year to 22,801 units in November. Tesla 's market share in Europe also declined to 2.1% in November from 2.5% a year ago, but recovered from a dismal 0.6% in October.

Starlink surpasses 9 million active users worldwide.

On Tuesday morning Beijing time, Elon Musk's satellite internet business, Starlink, announced that its global active user base had surpassed 9 million. According to statistics, Starlink's user growth is accelerating; for example, it took 79 and 70 days to reach 7 million and 8 million users respectively, but the latest increase of 1 million users took only 47 days.

Samsung reportedly to have exclusive control over 70% of the DRAM supply for the iPhone 17.

According to media reports, with the development of memory chips Prices rose rapidly, Apple Samsung will increase its sourcing of memory chips for iPhones. This shift is expected to result in Samsung supplying approximately 60% to 70% of the low-power dynamic random-access memory (DRAM) in the iPhone 17, whereas in previous generations, the supply share was more balanced between Samsung and SK Hynix, with Micron participating in the supply with a smaller share.

Trump's warship program continues to stimulate the shipbuilding sector.

Driven by President Trump's announcement on Monday of plans to build new frigates and "Trump-class" battleships, Hanwha Marine, the shipbuilding partner named by the US president, rose 12% in the South Korean market on Tuesday. Meanwhile, Huntington Ingalls Industries, the largest US military shipbuilder also expected to secure orders, rose nearly 2% in pre-market trading on Tuesday after hitting a record high on Monday, up 5%.

Amazon Zoox recalls self-driving cars

The National Highway Traffic Safety Administration (NHTSA) said Tuesday that Amazon’s self-driving car division, Zoox, is recalling 332 vehicles in the United States due to a software bug in its Autopilot (ADS) system. The bug could cause the vehicle to veer into the oncoming lane or stop when an oncoming vehicle is approaching, increasing the risk of a collision.

(Article source: CLS)