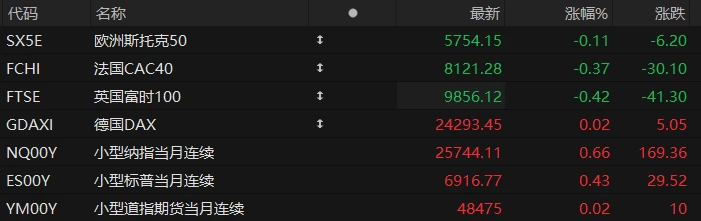

U.S. stock index futures rose across the board in pre-market trading on Monday, while most major European indices fell. As of press time, the Nasdaq... S&P 500 futures rose 0.66%, S&P 500 futures rose 0.43%, and Dow Jones futures rose 0.02%.

In terms of individual stocks, leading tech stocks generally rose, with Oracle among them. Nvidia shares rose nearly 3%. AMD rose nearly 2%, Tesla... Broadcom TSMC The stock rose more than 1%. Nvidia reportedly plans to begin delivering its first batch of H200 AI systems to China by mid-February next year. chip.

Storage concept stocks rose across the board in pre-market trading, with Micron Technology leading the gains. SanDisk Western Digital rose about 4%. Seagate Technology rose 2%. Up 1.8%.

Goldman Sachs on Wall Street A recent report indicates that the global stock market bull run is expected to extend further into 2026, with investment returns no longer limited to US tech stocks as earnings growth continues in various markets.

In its latest global equity investment strategy outlook, Goldman Sachs remains optimistic about the stock market next year, but expects stock index returns to be lower than those in 2025.

A team of strategists led by Peter Oppenheimer predicts that global stock prices will rise by an average of about 13% in 2026, or nearly 15% if dividends are included. This growth is primarily driven by corporate earnings rather than valuation expansion.

The team believes that, given its macroeconomic forecast of continued global economic expansion and its prediction of the Federal Reserve's moderately accommodative policy, "even though stock market valuations are high, the stock market is unlikely to experience a significant decline or bear market unless an economic recession occurs."

Goldman Sachs also believes that investors should continue to hold their portfolios while expanding their investment scope across different regions, focusing more on emerging markets, balancing growth and value investment styles, and diversifying across different sectors to benefit from the spillover effects of technology capital spending and beneficiaries in the field of artificial intelligence .

Hot News

Is the US stock market about to undergo a major reshuffle? AI trading is still in its infancy, but Wall Street is looking for new "winners."

After the recent rollercoaster ride of US tech stocks, the market has begun to realize that while concerns about an AI bubble are not entirely unfounded, market confidence in the future of AI has not been extinguished.

This means the market landscape in the field of artificial intelligence technology may still be evolving. Investors are no longer blindly embracing all "AI concept stocks," but are becoming more cautious and starting to examine which companies are more likely to become the real winners in the AI field in 2026.

Tom Essaye, founder of Sevens Report Research, said he expects the winners and losers among U.S. tech giants to be different next year than this year.

In his report, he wrote, "I think we're going to see some extremely significant divergence. There will be winners and losers within the 'Big Seven' in the next round of this deal." He stated that his favorite stock is Google because of the strong growth prospects of Google's Gemini AI product.

He added, "Companies like Oracle aren't actually in a tight financial situation, but their massive investments in artificial intelligence have drawn attention. I think these kinds of companies may face difficulties."

Gold and silver both hit record highs! Geopolitical tensions boost safe-haven demand, with spot gold surpassing $4,390.

Gold and silver prices hit record highs in early Asian trading on Monday, with spot gold surpassing $4,390 for the first time and spot silver approaching $69, driven by escalating geopolitical tensions that boosted demand for safe-haven assets. Platinum and palladium prices also rose, boosted by safe-haven demand, with spot platinum breaking through the $2,000 mark for the first time since 2008.

According to a Xinhua News Agency report over the weekend, amid concerns about Iran's "expanding ballistic missile production," Israeli Prime Minister Benjamin Netanyahu is preparing to inform US President Donald Trump that Israel may again strike related Iranian facilities. The report states that Trump and Netanyahu are expected to meet later this month at Mar-a-Lago in Florida. Netanyahu may then state that the expansion of Iran's ballistic missile program not only poses a threat to Israel but also jeopardizes regional security and related US interests, necessitating swift military action.

In addition to the sudden change in the situation between Iran and Israel, tensions between the United States and Venezuela are also escalating. These two geopolitical developments have collectively boosted investors' demand for safe-haven assets.

Outperforming the "Big Seven"! Military Industry as Warfare Dramatically Changes Is the stock poised to become a super growth stock?

This year, emerging military companies that have made their mark on the list of stocks with the highest price increases (even if their market capitalization is not yet leading) include: drones. Manufacturer Kratos Defense & Security Solutions, satellite intelligence firm Planet Labs, and data analytics company Palantir Technologies—all of these companies have seen their stock prices at least double this year. AeroVironment and BlackSky Technology have also performed strongly.

James St. Aubin, chief investment officer at Ocean Park Asset Management, said this year marks "a new dawn for defense stocks." Defense stocks have long been defensive, and that still holds true to some extent, but it's undergoing a new shift. This year is an excellent year for investment in U.S. military contractors and their suppliers. The S&P 500, which covers 24 companies... The CSI 1500 Aerospace & Defense sector has risen 41% this year, on track for its biggest gain since 2013. This is more than double the S&P 500's gain and about 16 percentage points higher than the overall gains of the "Big Seven" aerospace and defense stocks.

RBC analyst Ken Herbert points out, "The U.S. Department of Defense is pursuing a clear strategy with the core idea of accelerating the delivery of technology to warfighters, striving to speed up the contract awarding process, and directing more business toward technology-oriented small and medium-sized enterprises."

US Stocks Focus

Apollo Global shifts investment strategy: Maintaining cash reserves to prepare for potential market volatility.

Apollo Global Management , a well-known US asset management company Apollo Global's top management is preparing for potential market turmoil. The company is currently increasing its cash reserves, reducing leverage, and withdrawing from the riskier bond market.

The company’s CEO, Marc Rowan, believes that this defensive strategy will prepare Apollo for more challenging credit and stock markets in the future and enable the company to make larger investments better in any turbulent period.

In response to potentially more volatile financial markets, Apollo has prepared insurance policies for its subsidiaries. Athene increased its liquidity reserves, purchased hundreds of billions of dollars more in Treasury bonds, and reduced its leveraged loan portfolio significantly.

Apollo has publicly stated that Athene is reducing its exposure to secured loan obligations (CLOs) by about half to $20 billion.

In addition, Apollo is working to mitigate risk in areas vulnerable to technological change. Reports last week indicated that Apollo is rapidly reducing its investment in software lending, an area considered potentially challenging due to the risks posed by artificial intelligence.

A leading tech analyst predicts Tesla will achieve " autonomous driving " in 2026. Competition, Apple Breaking through in the AI race!

Just this past weekend, Dan Ives, managing director and renowned technology analyst at Wedbush Securities, released his "Top 5 Optimistic Predictions" for U.S. tech stocks and artificial intelligence (AI) in 2026.

Unsurprisingly, he still believes Tesla has a "bright future." Elon Musk's car company's stock hit a record high last week, but Ives predicts there's still room for further growth. " Tesla... " The robot will be successfully launched in more than 30 cities by 2026. "They're starting to mass-produce driverless taxis, Cybercabs," he wrote. Ives firmly believes Musk's company will win the " driverless car race." He noted that under the base case scenario, Tesla's stock price will rise 26% next year ; while under the bullish scenario, it will rise 68%.

Ives suggests that two tech giants may join forces in 2026 to help lead the next phase of artificial intelligence. He predicts that Apple and Google are about to form a joint venture, which will help the iPhone maker catch up with its competitors in the AI race.

" Apple and Google will formally announce an AI partnership around Project Gemini, which will finally solidify Apple's true AI strategy. This service will eventually roll out across Apple's network and is expected to help Apple achieve a $5 trillion market capitalization by 2026," he wrote.

Uber Partnering with Baidu Launching driverless transportation service in London

Uber shares rose 1.12% pre-market to $80.20. The news comes after Uber announced a partnership with Baidu 's Carrot Express to pilot driverless taxis in the UK, putting it on par with US self-driving car company Waymo.

Uber announced plans to launch a pilot program using Baidu Apollo Go RT6 vehicles in London in the first half of 2026, with full operation expected by the end of 2026. Previously, Waymo had already launched related tests in London in early December, indicating a significant acceleration in the global deployment of driverless ride-hailing services.

Previously, after a massive power outage crippled several self-driving cars, Waymo, Google's self-driving car division, temporarily suspended its autonomous taxi service in San Francisco, causing traffic disruptions in parts of the city.

Micron's strong guidance, coupled with bullish investment bank sentiment, boosted the US semiconductor sector in pre-market trading. The sector rose

The semiconductor sector generally rose in pre-market trading, supported by multiple positive factors. Core driving force Micron Technology 's strong earnings report and optimistic guidance released last week effectively alleviated market concerns about a slowdown in AI hardware demand, driving its stock price up more than 3% in pre-market trading.

Meanwhile, Wall Street investment banks collectively raised their target prices for Broadcom and TSMC , further confirming the long-term potential of AI infrastructure development.

In addition, with companies such as Atlas Cloud AI continuing to increase their investment in Nvidia's Blackwell chips, and with the market's optimistic expectations for a "Santa Claus rally," core chip stocks such as Nvidia and AMD have followed suit, and the sector as a whole has shown a strong recovery momentum.

(Article source: Hafu Securities) )