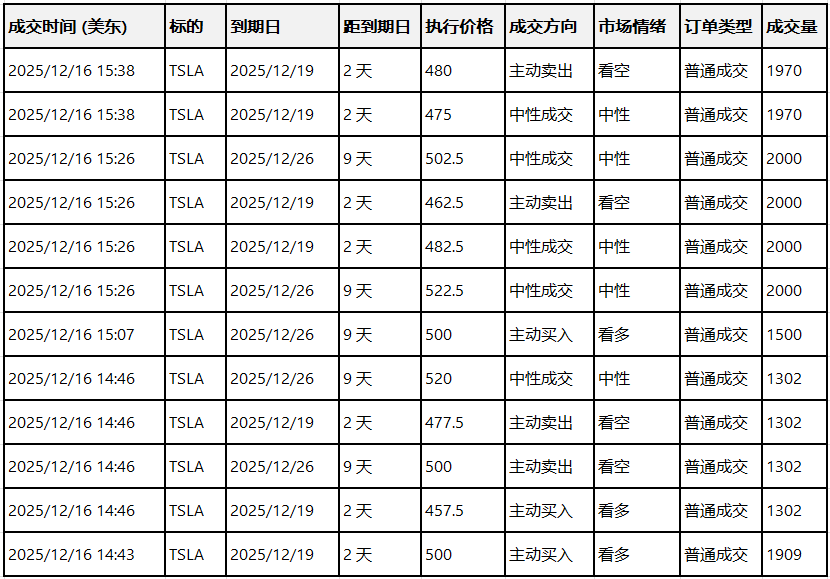

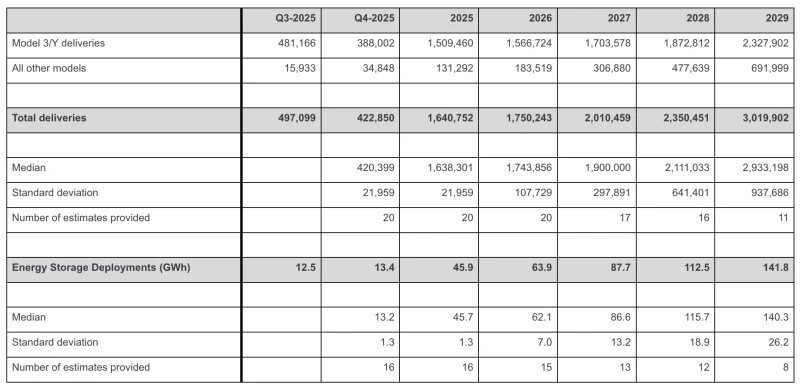

On December 30th local time, Tesla The company unusually released a summary of pessimistic analyst delivery forecasts on its official website. The data shows that its average forecast for fourth-quarter deliveries is 422,850 vehicles, a 15% year-on-year decrease, even more pessimistic than Bloomberg's market consensus of 440,000 vehicles. This includes forecasts from Daiwa and Deutsche Bank . Goldman Sachs Barclays Twenty institutions, including [names of institutions], participated in the forecast.

Based on current projections, Tesla's total deliveries in 2025 will drop to around 1.64 million vehicles, a year-on-year decline of 8%. This would be the second consecutive year of sales contraction for Tesla , following a 1% year-on-year decrease in 2024 with 1.789 million vehicles delivered.

Image source: Tesla official website

It is worth noting that Tesla It explicitly states that it "does not endorse any information, advice, or conclusions from analysts" and only presents the aggregated consensus data objectively.

Typically, Tesla compiles sell-side analysts' predictions for future delivery data, but this information has usually been sent via email by the investor relations team to specific analysts and major investment institutions, and is rarely made public.

Market analysts believe that Tesla's decision to release this relatively low consensus estimate now appears to be an attempt to lower market expectations before the official delivery and production report is released in early January 2026. Gary Black, co-founder of Future Fund Advisors, commented that this move is "highly unusual." He speculates that Tesla's actual deliveries are likely around 420,000 vehicles.

Tesla's fourth-quarter deliveries faced significant downward pressure, primarily due to changes in U.S. federal tax credits and increased global competition.

The $7,500 federal tax credit in the United States expires at the end of September 2024, causing Tesla's third-quarter demand to be released ahead of schedule, reaching 497,000 vehicles, directly depleting the market demand for the fourth quarter. Although Tesla launched the Model 3/Y standard version priced below $40,000 in October to try and revive the market, the effect was minimal.

According to statistics released by the European Automobile Manufacturers Association on December 23, Tesla's new car registrations in Europe in November were 22,801 units, a year-on-year decrease of 11.8%. In the first 11 months of this year, Tesla's new car registrations in Europe decreased by 28% year-on-year.

The association's statistics cover the EU as well as the UK, Iceland, Norway, Switzerland, and Liechtenstein. Within the EU, Tesla's new car registrations fell nearly 34.2% year-on-year in November; in the first 11 months of this year, they fell 38.8% year-on-year, with market share dropping to 1.3%.

At the same time, Chinese automakers are expanding in Asia and traditional automakers are accelerating their deployment of affordable electric vehicles, further encroaching on Tesla's market share.

Tesla's Q3 2025 financial report showed revenue of $28.1 billion, a 12% year-over-year increase and a record high for the same period. However, net profit was $1.373 billion, a 37% year-over-year decrease, with an operating profit margin of only 5.8%, the lowest in nearly five years, compared to over 10% in the same period last year. Furthermore, adjusted net profit was $1.77 billion, a 29% year-over-year decline.

Previously, Tesla CEO Elon Musk had repeatedly emphasized that "Tesla is at its core an AI company," linking it to autonomous driving and robotics. Listed as key to future development, Tesla is currently preparing to expand its Texas Gigafactory again, planning to build a dedicated facility for the mass production of its humanoid robot Optimus, aiming to achieve an annual production capacity of 10 million units. Musk also revealed that the company's Robotaxi fleet is expected to double in size next month.

As of the US stock market close on December 30, Tesla's stock price was $454.43, down 1.13% from the previous trading day, and down slightly by 0.07% in after-hours trading.

(Article source: Jiemian News)