I. Overview of US Stock Index Options

Trading volume in the US stock index options market is currently declining, while the put/call ratio has risen slightly, indicating a decrease in market risk appetite.

The volume distribution of S&P 500 index options expiring today shows a divergence between call and put order distributions, with put orders peaking at 6670 points and call orders peaking at 6770 points.

Nasdaq contracts expiring today 100 Index Options Trading Volume Distribution: Call single peak at 25600, Put single peak at 25000 points.

II. US Stock Options Trading Volume Ranking

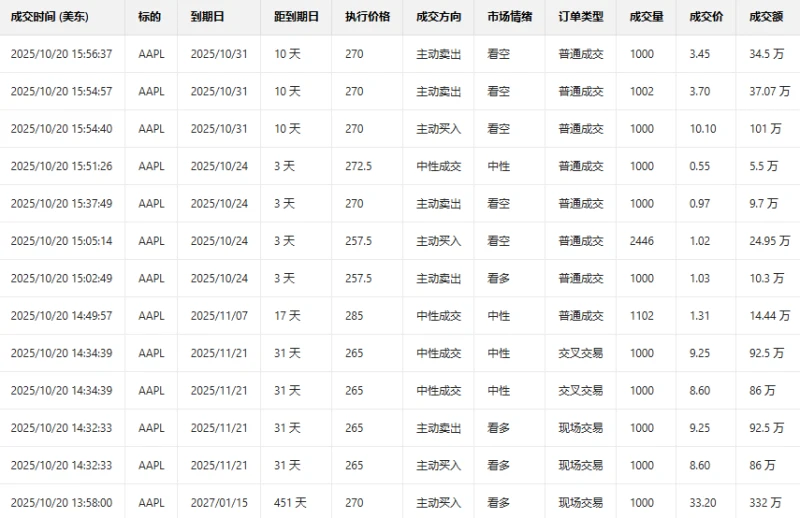

1. Apple The stock rose 3.94% in the previous trading day. The put/call ratio declined slightly the day before, and trading volume increased, indicating active bullish trading.

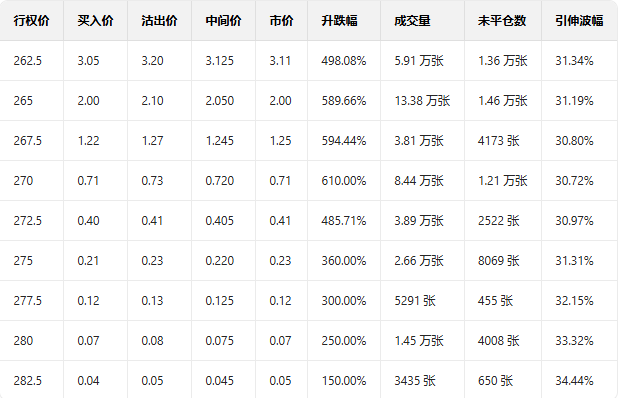

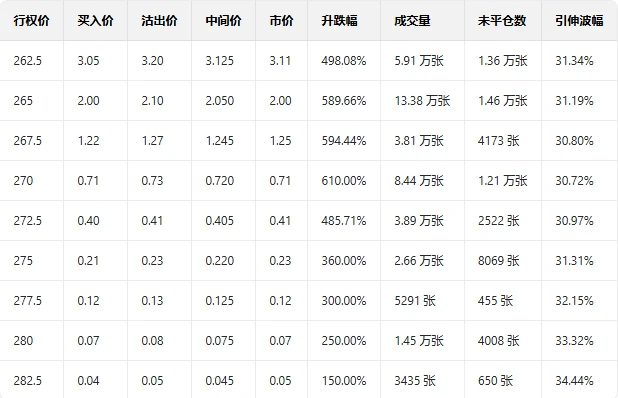

Looking at the call orders expiring this Friday, the highest increase reached 6 times.

Near the close of trading, unusual options trading activity indicated that large investors were predominantly bearish.

In terms of news, Apple's stock price rose nearly 4%, hitting a new all-time high for the first time since 2025, surpassing Microsoft's. Apple has become the second-largest company by market capitalization in the US. This strong rebound was mainly driven by better-than-expected sales of the iPhone 17 series. Data shows that in the first 10 days after its launch in both China and the US, iPhone 17 sales were 14% higher than its predecessor, with the base model selling well in China and the Pro Max experiencing strong demand in the US. Analysts believe that Apple is entering a long-awaited replacement cycle.

2. Oracle bone script The stock fell 4.85% in the previous trading day. The put/call ratio declined slightly the day before, and trading volume decreased, indicating a relatively balanced market between buyers and sellers.

Observe the put orders expiring this Friday; many have doubled in value.

Observing the unusual activity in options trading, it is clear that there is intense competition between large investors who are either bullish or bearish.

Top 10 US Stock Options Trading Volume Ranking

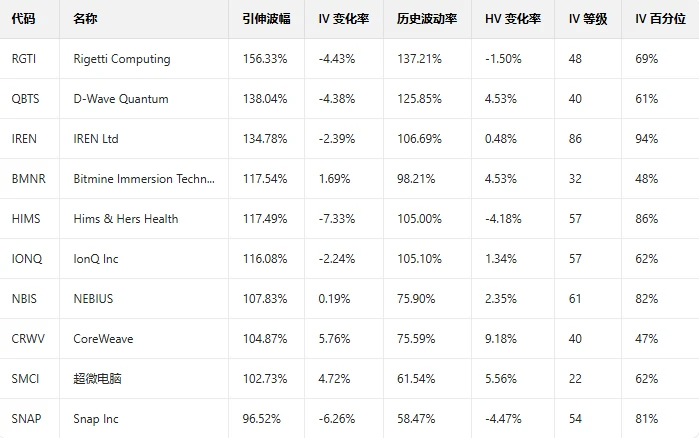

Top 10 US Stocks by Implied Volatility (Underlying Asset Market Cap > $10 Billion, Options Trading Volume > $100,000)

III. Top Ten US Stock ETF Options Trading Volume Ranking

Top 10 US Stock ETFs by Implied Volatility (Based on: Market Cap > $10 billion)

(Article source: Hafu Securities) )