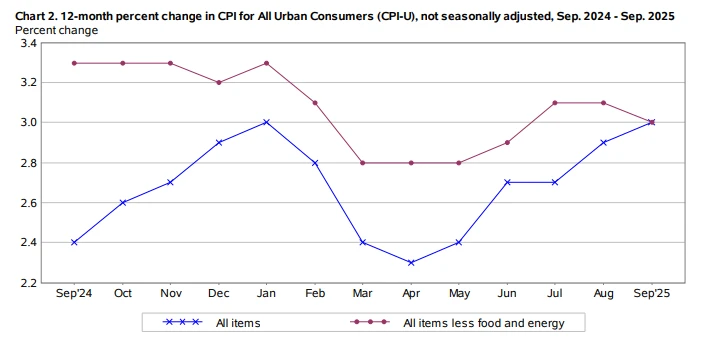

① The US September CPI data indicates that inflationary pressures have eased somewhat, but the 3% year-on-year increase is still the highest level since June 2024; ② Excluding volatile food and energy prices, the core CPI rose 0.2% month-on-month and 3% year-on-year in September, both 0.1 percentage points lower than the previous month's increase and market expectations.

On Friday (October 24), local time, the latest data released by the U.S. Bureau of Labor Statistics showed that September inflation data was lower than expected across the board.

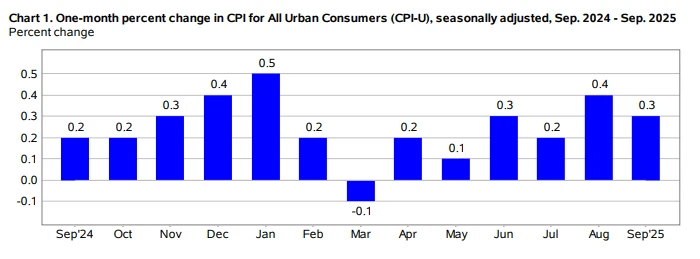

Data shows that the U.S. Consumer Price Index (CPI) rose 0.3% month-on-month in September, lower than August's figure and market expectations of 0.4%.

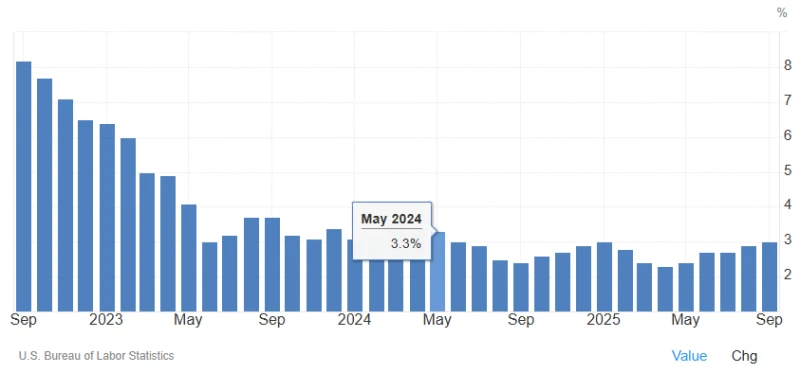

The year-on-year increase was 3%, which was 0.1 percentage points lower than expected, but 3% is still the highest level since June 2024.

Excluding volatile food and energy prices, the core CPI rose 0.2% month-on-month and 3% year-on-year in September, both 0.1 percentage points lower than the previous month's increase and market expectations.

(Article source: CLS)