Wall Street is struggling to digest the flood of bonds issued by tech companies for AI investments, and the massive issuance of AI corporate debt is causing serious price discrepancies and misalignments in the US corporate bond market—AI tech company bonds now have high ratings, but their actual credit spreads are higher than those of lower-rated corporate bonds…

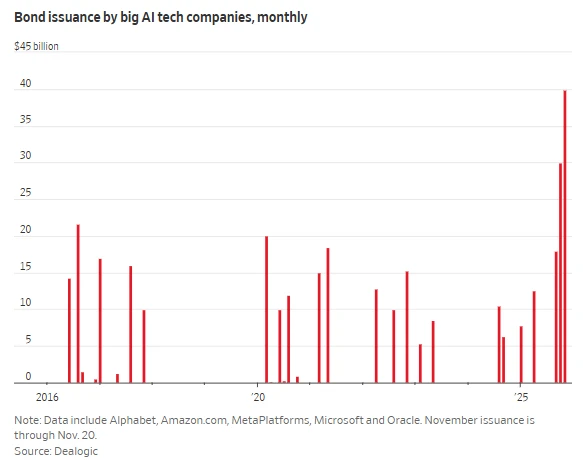

According to Dealogic data, since the beginning of September, Amazon... Google's parent company Alphabet, Meta, and Oracle So-called AI giants (hyperscalers) have issued nearly $90 billion in investment-grade bonds, exceeding their total issuance over the past 40 months...

Meanwhile, emerging AI data centers such as TeraWulf and Cipher Mining, which originated from Bitcoin miners, are also emerging. Developers are also aggressively entering the speculative-grade bond market, issuing over $7 billion in low-rated bonds.

However, while these companies successfully completed their bond auctions, some were forced to pay unexpectedly high interest rates. As bond prices continued to decline, this indicated that investors were caught off guard by the massive influx of supply into the bond market and that concerns about deteriorating corporate credit metrics were growing.

Are AA-rated bonds worse than A-rated bonds?

Similar to stock price performance, the recent pressure on tech company bonds is not evenly distributed —Alphabet, Amazon , and Microsoft are among the top performers. Because it can cover most of the artificial intelligence with huge quarterly cash flow The expenditures were spared from the most severe impact.

Another tech giant, Meta, has slightly less cash reserves, and the market generally believes it needs more debt to realize CEO Mark Zuckerberg's ambitious vision. Therefore, when the social media company issued $30 billion in bonds at the end of October, it had to attract investors with yields far exceeding those of its existing bonds.

Amid recent skepticism about an AI bubble, the bond prices of some of these companies have declined slightly in the secondary market—corresponding to rising bond yields. Although these bonds generally have a fairly good AA rating, their yields are now roughly the same as those of IBM bonds—which are rated A by several major credit rating agencies.

Looking further down the line, Oracle 's situation is even more challenging. The company is rapidly depleting its cash reserves, planning to burn through tens of billions of dollars over the next few years as it attempts to transform itself from a leading software company into an AI and cloud computing powerhouse. The giants support the operation of their clients' applications, such as OpenAI's ChatGPT, by leasing the computing power of massive clusters of advanced computer chips.

Looking at Oracle 's bond performance, although Oracle's bond rating is two levels higher than speculative grade (junk bonds), its yield has surpassed almost all of its investment-grade technology peers.

In the market, bonds with a credit rating of BBB- or Baa3 or higher are called investment-grade bonds, while bonds below investment grade are called speculative-grade bonds or junk bonds.

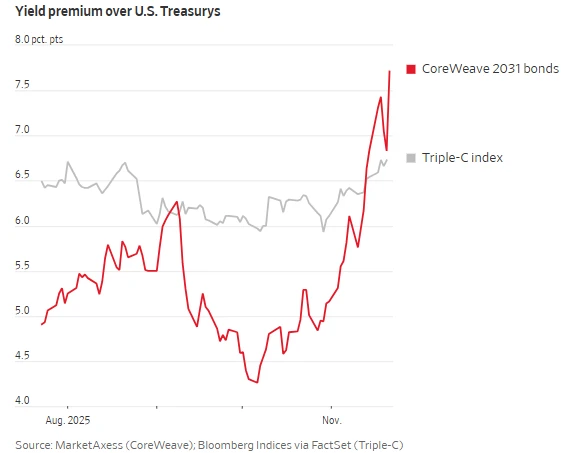

Meanwhile, smaller AI companies are facing even higher yield premiums demanded by investors. CoreWeave, for example, is currently the only major AI cloud service provider to issue non-investment-grade bonds.

The company's 2031 bonds, issued in July, recently traded at just 92% of face value, equivalent to an annual yield of approximately 11% —roughly the same as the average yield for CCC-rated bonds (at the lowest end of the rating range). Meanwhile, CoreWeave's long-term debt rating remains BB- according to Fitch.

Are bond market trends more noteworthy than stock market trends?

Many industry insiders say that stock investors were already uneasy about the previously skyrocketing valuations of AI companies, and now many are also beginning to notice the weakness of these companies in the bond market. Meanwhile, credit default swaps (CDS) are being used to insure these bonds. Costs are also continuing to rise, and negative sentiment among different investor groups is beginning to spread.

“The market is highly interconnected right now,” noted John Lloyd, global head of multi-sector credit at Janus Henderson Investors. “If AI stocks are sold off, the credit market will struggle to recover, and vice versa.”

In recent years, investor enthusiasm for artificial intelligence has provided strong momentum for the US stock market. However, the situation has been challenging in recent weeks, particularly for the Nasdaq , which has a high weighting in technology stocks. The composite index has fallen 6.1% this month. Bond investors are also particularly concerned about the risk that large-scale AI investments may not achieve the advertised results; even a rating downgrade could damage returns, not to mention default…

While most investors still believe that even continued bond selling will not hinder the construction of AI data centers —after all, funding is not an issue for the giants bearing the main expenses—many have begun to notice a persistent negative feedback loop between stocks and bonds, especially as the rising cost of Oracle default insurance has drawn widespread attention on Wall Street.

In recent weeks, trading volume of Oracle CDS has surged—this financial instrument, which provides default protection, is often associated with the 2008-09 financial crisis by industry insiders. While bond investors generally find such CDS purchases unsurprising, market attention to the topic is putting pressure on Oracle's stock price—which has fallen 24% this month.

Jordan Chalfin, a senior analyst at research firm CreditSights, points out that Oracle may issue approximately $65 billion in bonds over the next three years. Given that its interest expenses remain far lower than its capital expenditures, the slight increase in debt costs will have a limited impact on the company. However, he emphasizes that Oracle must maintain its investment-grade rating, as the financing available to lower-rated companies simply cannot meet its needs.

Some also pointed out that rising debt costs could ultimately affect the marginal investment decisions of speculative-grade technology companies such as data center developers. They stated that if costs continue to climb, the size of such companies' bond issuance next year may only reach the low end of Wall Street's estimated range (approximately $20 billion to $60 billion).

“The fact that investors are generally demanding higher yield premiums means that the future growth curve may no longer be a straight line,” said Will Smith, credit director at AllianceBernstein. “People will really demand that only truly reasonable projects—projects structured in a way that fits the debt market and have the right cost of capital—are truly worth implementing.”

(Article source: CLS)