On October 24 local time, all three major U.S. stock indexes closed higher, hitting new record highs. The Nasdaq rose 1.15%, up 2.31% for the week; the Dow Jones Industrial Average rose 1.01%, up 2.2% for the week; and the S&P 500 rose 0.79%, up 1.92% for the week.

Most major tech stocks rose, with Nvidia among them. Google rose more than 2%; Amazon rose more than 2%. , apple Microsoft rose more than 1%; , Intel Meta rose slightly; Netflix Ford Motor Co., Ltd. fell by more than 1%. Micron Technology surged over 12%, marking its best single-day performance since March 2020. It rose nearly 6%, hitting a record high; Unusual Machines rose more than 8%.

Tesla It closed at $433.72, down 3.40%, with a market capitalization of $1.44 trillion, representing a loss of $50.8 billion (approximately 361.8 billion yuan) overnight.

Nasdaq The China Golden Dragon Index closed up 0.27%, with a cumulative gain of 2.4% this week. (WeRide ) Kingsoft Cloud rose more than 5%. Baidu rose more than 2%. Bilibili Up nearly 2%; iQiyi It fell by nearly 1%.

The FTSE A50 futures index closed up 0.35% in overnight trading, at 15,544 points.

COMEX gold futures fell 0.65% to $4,118.5 per ounce, a weekly decline of 2.25%. COMEX silver futures fell 0.6% to $48.42 per ounce, a weekly decline of 3.36%.

International crude oil futures prices settled slightly lower. WTI crude oil futures settled down 0.47% at $61.5 per barrel, up 7.6% for the week. Brent crude oil fell 0.08% to $65.94 per barrel, up 7.59% for the week.

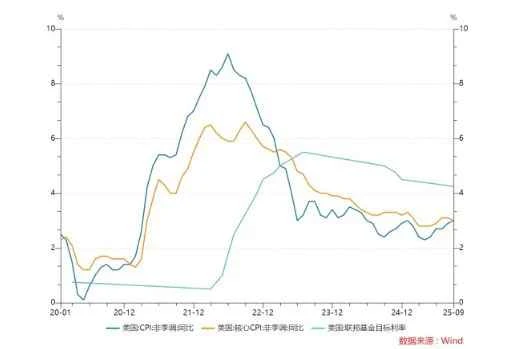

According to media reports, on the evening of October 24th, Beijing time, the U.S. Bureau of Labor Statistics released the September Consumer Price Index (CPI) report, which showed that the U.S. CPI rose 3% year-on-year in September, lower than the market expectation of 3.1% and the previous value of 2.9%; the month-on-month increase was 0.3%, also lower than the market expectation of 0.4% and the previous value of 0.4%.

The core inflation indicator, which is closely watched by the Federal Reserve, also sent a clearer signal of cooling. The report showed that the U.S. core CPI (excluding food and energy prices) rose 3% year-on-year in September, lower than the expected 3.1% and the previous value of 3.1%; the month-on-month increase was 0.2%, also lower than the expected 0.3% and the previous value of 0.3%.

US CPI and benchmark interest rate trends (January 2020 to present). Image source: Securities Times . Times

Due to the US government shutdown, most economic data releases have been suspended, and the CPI data, originally scheduled for release on October 15, has been repeatedly postponed. The US Bureau of Labor Statistics releases this data specifically because the Social Security Administration uses it as a benchmark for adjusting the cost of living in benefit checks. Furthermore, the CPI data is the last important data the Federal Reserve will receive before making its interest rate decision next week.

Following the release of lower-than-expected inflation data, the market widely believes that the Federal Reserve will continue its rate-cutting pace next week, lowering the benchmark interest rate by 25 basis points from the current target range of 4% to 4.25%. Traders also expect another rate cut in December. Currently, the CME Group's FedWatch Tool shows a 98.9% probability of a 25-basis-point rate cut next week.

However, the outlook for monetary policy next year is rather unclear, with the question of whether tariffs will trigger inflation remaining the biggest focus of market attention.

Art Hogan of B. Riley Wealth said, "Great news on October 24! This report will clearly lead the Fed to cut rates as planned at its next meeting. The Fed has made it clear that they are more focused on the softening labor market data and will continue to defend their mandate of full employment even though core CPI is well above its 2% target."

Goldman Sachs Lindsay Rosner, an asset manager, said, "Today's modest CPI report is unlikely to 'disturb' the Fed, and we continue to expect further policy easing at next week's meeting. Given the current lack of data, the likelihood of another rate cut in December remains high, and the Fed has little reason to deviate from the path indicated by the dot plot."

Morgan Stanley Ellen Zentner, a wealth manager, said the lower-than-expected CPI is consistent with what we’ve seen in private data during the government shutdown – there are few signs that inflation is soaring or the labor market is experiencing a precipitous decline.

She said, "For a Fed focused on prudent risk management, this means another rate cut next week, and likely more after that."

Analysts say this CPI report means the Federal Reserve will almost certainly cut interest rates again next week. They also point out that data shows gasoline prices appear to be a driving factor for the overall index: the gasoline price index rose 4.1% in September, the largest monthly increase among all items.

White House National Economic Council Director Kevin Hassett stated that inflation is slowing and pressure on the Federal Reserve is easing. He expects inflation figures in future reports to decline further. There is no evidence that tariffs are causing inflation.

However, it's worth noting that some institutions have pointed out that housing cost data distortion may have led to a misrepresentation of the September CPI. Omair Sharif, president and founder of Inflation Insights, noted that anomalies in housing data may have suppressed September's inflation figures in one fell swoop. The real equivalent rent index, representing the cost of owning a home, rose only slightly by 0.1% month-on-month in September, marking the smallest monthly increase in over four years; while the rental housing index rose by 0.2%.

Omair Sharif further stated that the huge difference between rent and actual equivalent rent is almost certainly due to data noise, and from this perspective, the current core inflation readings clearly exaggerate the underlying inflation trend.

Daily Economic News, compiled from Securities Times, China Fund News, Securities Times, and publicly available market data.

(Source: Daily Economic News)