Tesla Revenue rebounded in the third quarter, but net profit continued to decline.

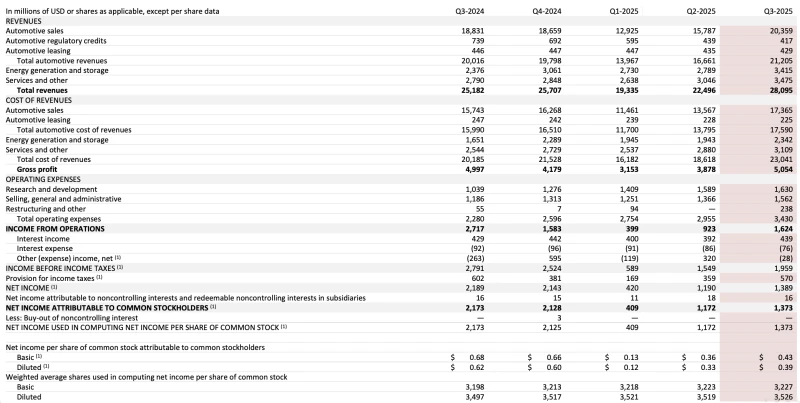

On October 23, Beijing time, Tesla released its Q3 2025 results, showing that the company's revenue reached $28.095 billion, a record high for quarterly revenue, representing a year-on-year increase of 11.57%, exceeding Wall Street's expectations.

The revenue growth was primarily driven by increased new vehicle deliveries. Tesla achieved a record high in deliveries in the third quarter of this year, reaching 497,000 vehicles, a 7.4% year-over-year increase, breaking the quarterly delivery record and significantly exceeding analysts' expectations of 448,000 vehicles.

Tesla benefited from a rush of purchases by American consumers before the government's tax credit for electric vehicle purchases expired. Third-quarter revenue rebounded strongly, exceeding expectations. In the US market, the federal government subsidy of up to $7,500 expired on September 30, prompting consumers to purchase electric vehicles before the policy ended.

In addition, the financial report stated that energy storage The significant growth in its business was also a major reason for its surge in revenue. Tesla's energy storage product installations reached 12.5 GWh in the third quarter, setting a new record.

It should be noted that Tesla's revenue from the one-off FSD (Full Self-Driving) suite decreased year-over-year in the third quarter.

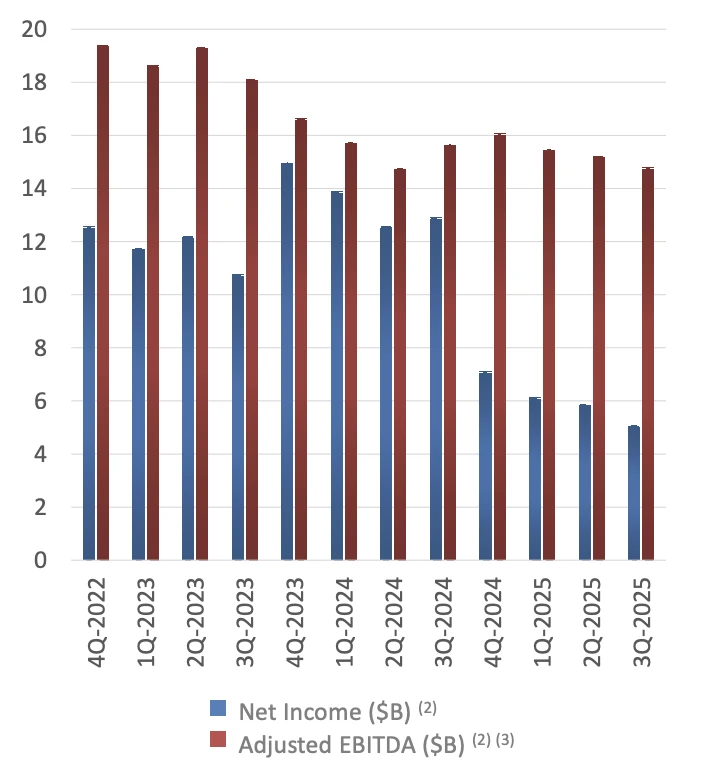

However, increased revenue did not translate into increased profits. Tesla's operating profit in the third quarter was $1.624 billion, slightly below market expectations, a year-on-year decline of 40.23%; net profit was $1.373 billion, a year-on-year decrease of 36.81%; adjusted earnings per share were $0.39, compared to $0.62 in the same period last year, a year-on-year decline of 37.1%. This marks the third consecutive quarter of declining net profit for Tesla. Gross margin was 18%, compared to 19.8% in the same period last year and 17.2% in the second quarter.

Tesla stated that this was primarily due to sales, general administrative expenses, and artificial intelligence. The increase in operating expenses driven by R&D projects, the increase in stock-based compensation (SBC) and other expenses, and the year-on-year decrease in one-time fully autonomous driving (FSD) revenue recognition were among the reasons for the decline.

Regarding products, the financial report states that Cybercab, the Tesla Semi electric semi-truck, and the Megapack 3 energy storage unit are all scheduled to begin mass production in 2026. To prepare for mass production, humanoid robots... The first-generation production line for Optimus is under construction.

In its earnings report, Tesla stated that adjustments to global trade policies have impacted the automotive and energy supply chain, cost structure, and demand for durable goods and related services. The company will continue to develop and expand its product line, focusing on cost, scale, and artificial intelligence services.

Tesla shares closed down 0.82% at $438.97 on Wednesday; as of press time, Tesla shares were down nearly 4% in after-hours trading.

(Source: The Paper)