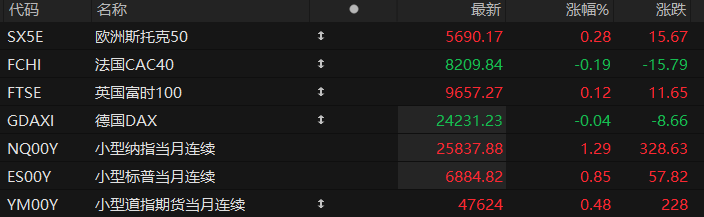

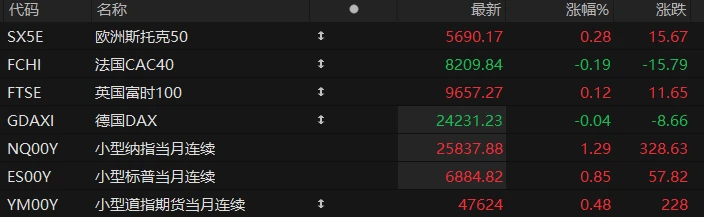

U.S. stock index futures rose across the board in pre-market trading on Monday, while major European indices showed mixed results. As of press time, the Nasdaq... S&P 500 futures rose 1.29%, S&P 500 futures rose 0.85%, and Dow Jones futures rose 0.48%.

In terms of individual stocks, US semiconductor stocks Most sectors rose in pre-market trading, with Micron Technology leading the gains. Nvidia shares rose nearly 4%. Broadcom ASML It rose by more than 2%.

Cryptocurrency stocks rallied in pre-market trading, with IREN ($IREN) rising over 6% and Strategy ($MSTR) gaining over 4%; Coinbase rose over 3% ahead of its upcoming earnings report. Rare earth stocks fell in pre-market trading, with UAMY plunging over 16% and CRML dropping over 10%.

Popular Chinese concept stocks generally rose in pre-market trading, with Alibaba among them. JD.com NIO shares rose nearly 3%. XPeng Motors rose more than 2%. Pinduoduo TSMC rose nearly 2% Baidu rose over 1%. The stock rose nearly 5%, driven by news that a Sullivan report indicated Baidu Smart Cloud ranked second in market share in China's AI cloud market.

Nvidia will hold its GTC Washington, D.C. summit from October 27 to 29. Jensen Huang will deliver a keynote address at 12:00 PM ET on October 28. In addition to product news, his speech will include a roadmap on "How AI Will Reshape Industries, Infrastructure, and the Public Sector."

In addition, a research report published by CLSA indicated that although the current revenue of the AI industry is not yet sufficient to cover the huge investments involved, the revenue of the AI industry is expected to grow by 160% year-on-year in 2026, reflecting that the industry is moving in the right direction.

Hot News

Government shutdown exacerbates chaos in the US: flight delays could worsen the situation where military personnel may not receive their paychecks.

The US federal government shutdown has reached its second-longest in history, but markets still see no hope of an end. Last week, the White House announced on social media that even if the shutdown ends, US inflation data for October may not be released because the government cannot deploy statisticians to the field, potentially causing irreparable economic consequences.

Meanwhile, U.S. Transportation Secretary Duffy warned that air traffic controllers were furious and that he could not guarantee flights booked by U.S. residents would operate normally as safety concerns escalated. Air traffic controllers were due to receive their paychecks for the past month on Tuesday, but these payments were canceled due to the government shutdown. Under U.S. law, federal workers will receive back pay, but may have to wait until the government reopens. Previously, the Trump administration had threatened not to pay back federal workers. According to FlightAware data, the number of flights delayed nationwide for various reasons surged from approximately 4,000 per day earlier this week to 6,158 on Thursday. With Thanksgiving (November 27) approaching, these delays will further disrupt normal travel for U.S. consumers.

At the end of October, U.S. federal soldiers will receive their paychecks, but if the government shutdown continues, they may not receive their pay on time. However, Trump announced last Friday that he had received a donation of $130 million, which will be used to pay the salaries of U.S. soldiers. Reports indicate that this donation came from American billionaire Timothy Mellon. But even with this $130 million, it is still insufficient to fully cover the salaries of the 1.3 million active-duty U.S. soldiers. Starting in November, at least 25 more states will shut down their nutrition assistance programs due to lack of funding, affecting an estimated 41 million people.

Is the US following in Greece's footsteps? The IMF sounds the alarm: debt ratio could soar to 143% by 2030.

According to the latest forecast from the International Monetary Fund (IMF), the U.S. government's debt situation will be worse than that of Italy and Greece by 2030. This highlights the perilous state of U.S. public finances, as Italy and Greece are two of Europe's most notoriously fragile public finances.

The IMF predicts that by 2030, the ratio of US government debt to GDP will rise by more than 20 percentage points from the current level, reaching 143.4%, breaking the record set after the COVID-19 pandemic .

Meanwhile, the IMF estimates that the U.S. budget deficit as a percentage of GDP will hover above 7% annually until 2030. This would be the highest deficit rate among all the wealthy countries tracked by the institution.

Just as the IMF made the above prediction, the US government's national debt surpassed $38 trillion last Wednesday, marking the first time in history that it has exceeded this threshold. This is also the fastest increase of $1 trillion in US debt outside of the COVID-19 pandemic period. Currently, it has only been a little over two months since the total US national debt surpassed $37 trillion.

The shortlist of five potential successors to the Federal Reserve Chair has been confirmed, with the final candidate to be announced before the end of the year.

U.S. Treasury Secretary Bessant confirmed a shortlist of five finalists on Monday to succeed Federal Reserve Chairman Jerome Powell. President Trump stated that a final decision is expected by the end of the year.

Aboard Air Force One, Bessant revealed that the shortlist has been narrowed down to five candidates: current Federal Reserve Board members Christopher Woller and Michelle Bowman, former Federal Reserve Governor Kevin Warsh, White House National Economic Council Director Kevin Hassett, and BlackRock. Executive Ridley.

Bessant, who is in charge of the selection process, reiterated that he plans to conduct a new round of interviews and expects to submit a "list of high-quality candidates" to Trump after the Thanksgiving holiday. Trump himself has also stated that he expects to finalize his nominee by the end of the year.

US Stocks Focus

Five of the seven major US stock exchanges will release their earnings this week. How will their financial reports perform amid the AI boom?

This week marks the busiest week of the Q3 earnings season for US stocks, with over 170 companies releasing their latest results, including five of the market's most closely watched "Big Seven" —Microsoft , for example. , apple Alphabet (Google's parent company), Amazon and Meta.

The remaining two companies in the "Big Seven" are Tesla. As for Nvidia , the former released a mixed earnings report last week, while the latter's results will not be released until November 19th, Eastern Time.

These tech giants are artificial intelligence Key players in the (AI) industry, and the AI boom has been a major driver of the stock market's rise in recent years. "The market is at a critical juncture, and concerns about an AI bubble are rising," said Victoria Scholar, Head of Investment at Interactive Investor. "Therefore, this earnings season is crucial, especially for the tech giants that have invested heavily in AI and are driving the overall market up."

The earnings reports of the five major tech giants will be released in a concentrated period over two days. Microsoft , Google, and Meta will release their quarterly reports after the US stock market closes on Wednesday, followed by Apple and Amazon releasing their results after the market closes on Thursday.

Former Ford CEO: Subsidy phase-out may lead to a short-term sales decline, but the US electric vehicle market will see steady and gradual growth.

Ford Motor Company Former CEO Mark Fields recently stated that despite the Trump administration's cancellation of electric vehicle subsidies, demand for electric vehicles in the U.S. market will gradually increase.

In July of this year, US President Trump signed the "Big and Beautiful" tax and spending bill. The bill stipulates that the US federal government will no longer provide tax credits for electric vehicles starting September 30th of this year. Prior to this, thanks to policies introduced during former President Biden's administration, consumers could receive a tax credit of up to $7,500 for purchasing a new electric vehicle and up to $4,000 for a used car.

“Obviously, you’ll see a short-term pullback due to the elimination of federal subsidies, but I think the electric vehicle market will see gradual growth,” Fields said in an interview. Fields believes that in the long run, consumers will ultimately choose clean energy vehicles over internal combustion engine vehicles because “oil is a non-renewable resource.”

Apple plans to introduce the same thermal system as the iPhone 17 Pro into the 2027 iPad Pro.

Apple plans to introduce the same vapor chamber (VC) cooling system as the iPhone 17 Pro in the iPad Pro, which is slated for release in 2027. This move is part of a broader strategy by Apple to improve device performance and further differentiate the high-end iPad Pro from the iPad Air.

It is reported that Apple has adopted the VC cooling system for the first time in the iPhone 17 Pro and Pro Max models. Although this technology has already been used by manufacturers such as Samsung, Apple still uses it as a flagship selling point to enable the device to run demanding games. It can maintain a comfortable body temperature even when performing video editing or artificial intelligence (AI) tasks.

The 11-inch and 13-inch M5 iPad Pro do not use the same VC cooling system design. However, the iPad Pro with the M6 chip, to be released in 2027, will feature the VC cooling system.

(Article source: Hafu Securities) )