On Tuesday, October 28, local time, the two-day Federal Reserve interest rate meeting officially began in Washington, D.C.

It is widely expected that the Federal Reserve will cut interest rates by another 25 basis points, and the market will be watching closely to see if Fed Chairman Powell signals further easing measures. This year, the Trump administration has repeatedly pressured Powell to lower interest rates, putting him under immense political pressure. At the same time, he also faces serious internal divisions within the Fed's policymaking body. Since the Fed restarted its easing measures in September, several policymakers have called for caution in pursuing further easing.

Two major responsibilities facing a data fog

The US government shutdown has entered its fourth week, resulting in the delayed release of several key economic data points and casting a shadow of uncertainty over the Federal Reserve's policy meeting. Policymakers are currently divided on which risks should be prioritized, and the lack of data undoubtedly exacerbates this situation.

The current macroeconomic situation presents multiple contradictory signals: the inflation rate remains above the Federal Reserve's 2% target, and businesses are warning of future price increases; hiring is lukewarm, and the job market faces a demand test; as the scale of corporate investment becomes clearer, overall economic growth expectations are being revised upward; in addition, next year's new tax law (including tax exemption provisions for tips and overtime pay) will increase household tax refunds, which may inject unexpected momentum into the economy.

Regarding prices, tariffs remain a significant variable. The Federal Reserve's benchmark for inflation—the Personal Consumption Expenditures Price Index (PCE)—has risen from a low of 2.3% in April to 2.7% in August. This trend carries the risk of worsening inflation: for the past four and a half years, price increases have consistently exceeded the 2% target, and if households and businesses become accustomed to this, inflation may be more difficult to control.

Federal Reserve Chairman Jerome Powell softened his stance in his most recent public appearance, stating that the "reasonable baseline scenario" is that tariffs would only have a one-off upward impact on inflation.

In contrast, Federal Reserve Governor Barr believes that trade policy poses some significant risks to the Fed's goal of maintaining low and stable inflation. Barr stated that, based on the core personal consumption expenditures price index (PCE), which the Fed closely monitors, he predicts core inflation will rise above 3% by the end of this year, and points out that overall inflation will not fall back to the 2% target level until the end of 2027. "The American people have already borne the brunt of Qualcomm's..." "After inflation, it will take another two years to return to the inflation target, which is too long, and this possibility affects my judgment on the appropriate monetary policy," he said.

Jeffrey Schmid, president of the Kansas City Federal Reserve who has a voting right on the FOMC this year, is also hesitant about further interest rate cuts, fearing that this could lead to a renewed rise in inflation.

Meanwhile, the continued absence of non-farm payroll reports, a key driver of interest rate cuts and the resumption of the job market, has made it difficult to assess the actual supply and demand of labor. From June to August, the U.S. averaged only 29,000 new jobs per month, far below the pre-COVID-19 average.

Nomura Securities David Seif, an economist in developed markets, said the Federal Reserve is currently making completely unfounded judgments. "The biggest question right now is what state the labor market is in, and we simply won't get the answer until we see the Bureau of Labor Statistics' monthly employment report." Due to the government shutdown, Federal Reserve officials have been unable to obtain complete data on the labor market since early September.

San Francisco Federal Reserve President Mary Daly revealed that her focus has shifted more towards the labor market. "The current situation is that if we don't take risk management measures, the weakness in the labor market could become more worrying," Daly said. "Our previous rate cuts were aimed at achieving a better balance between our inflation and employment goals through risk management."

Bob Schwartz, a senior economist at Oxford Economics, previously told CBN reporters that data from the non-governmental sector shows no widespread layoffs or spending cuts; even with a slowdown in hiring, household income growth and retail spending remain resilient. However, the trajectory of the government shutdown is introducing another layer of uncertainty. He cautioned that while federal government employees have not yet experienced a full payroll interruption, they may face an income shock equivalent to 0.4% of GDP by the end of the month. If furloughed employees are laid off, the impact of this shutdown on consumer spending could be more severe than usual.

Is the easing path clearer?

Although a rate cut is a foregone conclusion this week, internal disagreements within the Federal Reserve may create uncertainty about the next policy direction.

Federal Reserve Governor Christopher Waller said earlier this month that the current situation is particularly challenging: private sector data shows hiring remains weak, but economic growth may be accelerating. Business investment is gradually expanding, but apart from artificial intelligence... While the top sectors attract significant capital, investment in other sectors remains moderate; although the stock market continues to rise and corporate financing costs are relatively low, mortgage rates remain high; high-income households maintain stable consumption, while ordinary households need to "compare prices" to cope with rising prices.

The leading candidate to succeed Powell as Federal Reserve Chairman next year stated that the current economic situation is diverging on multiple levels, making it difficult to predict the economic trend. He advocates for "cautiously continuing interest rate cuts," but emphasizes that whether further rate cuts will occur depends on the trend of inflation and whether job growth weakens further.

Kansas City Fed President Schmid believes that the current policy rate is at an "appropriate level" and is still sufficient to exert downward pressure on inflation. However, the extent of this pressure remains controversial; and the impact of disruptions in government data releases will become increasingly apparent over time.

In contrast to the Federal Reserve's cautious stance, federal funds rate futures pricing indicates that the market expects the probability of the Fed cutting rates consecutively at its remaining two meetings this year to rise to over 90%, with further rate cuts expected 2-3 times next year.

Many Wall Street analysts expect Federal Reserve Chairman Jerome Powell to likely not hint that another rate cut in December is a done deal. Too many factors could change before then: the uncertain global trade negotiations could fundamentally alter the outlook for prices and economic growth. Furthermore, if the government shutdown ends and data releases resume, Fed policymakers may have three months of employment data before their December meeting, which could reshape their views on the labor market.

Deutsche Bank Economists say Powell is likely to retain flexibility in policy options and will not commit to any specific action before the end of the year.

Schwartz told CBN that while maintaining an accommodative stance, Federal Reserve officials will continue to monitor downside risks to the labor market. However, if employment does not deteriorate further, the Federal Open Market Committee will be cautious in introducing further interest rate cuts. As downside risks to the economy gradually subside, inflation risks will play a significantly greater role in the Fed's policy considerations next year, providing a reasonable basis for a "more moderate pace of interest rate cuts."

The balance sheet reduction may be about to reach a turning point.

In addition to the interest rate decision itself, the Federal Reserve may also signal this week that it will soon stop shrinking its balance sheet – possibly ending the so-called “quantitative tightening” (QT) policy as early as this month.

Federal Reserve Chairman Jerome Powell stated in a speech on October 14th that quantitative tightening "may end in the coming months"; however, he also echoed recent views from other Fed officials that there is still ample liquidity in the financial system. Fed Governor Waller stated that, if banks... Using the size of business reserves as a benchmark, it is approaching the point where the financial system has adequate liquidity.

The initial purpose of the quantitative tightening program was to absorb the liquidity injected into the financial system during the COVID-19 pandemic in 2020. At that time, to stimulate the economy and maintain the stability of the bond market, the Federal Reserve purchased large amounts of U.S. Treasury bonds and mortgage-backed securities to lower long-term interest rates. This round of bond purchases, which began in the spring of 2020, was massive. By the summer of 2022, the Fed's total asset holdings had exceeded $9 trillion, more than doubling from the previous amount. Subsequently, the Fed began allowing a certain amount of bonds to mature without being renewed, gradually reducing the size of its asset holdings, which has now been reduced to $6.6 trillion.

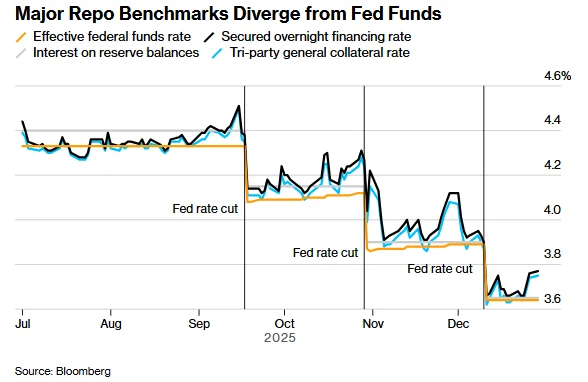

Some Wall Street analysts believe the Federal Reserve may end its long-term balance sheet reduction program at this meeting. Wrightson ICAP stated in a report that while they are skeptical about whether there is a genuine liquidity crunch in the money market, the recent volatility in the short-term lending market is clearly a sufficient warning sign that the Fed should move to the next phase of its monetary policy normalization program.

Analysts at Jefferies told clients, "We expect the Federal Reserve to completely halt quantitative tightening at its next meeting at the end of this month." However, they also noted that due to the complex housing market environment, the Fed's holdings of mortgage-backed securities (MBS) have been reduced very slowly, so the Fed may allow these securities to continue maturing at the current pace without reinvestment.

(Article source: CBN)