A survey conducted by the Federal Reserve shows that respondents expect the Fed to conduct more than $200 billion in reserve management purchases (RMPs) over the next 12 months as part of efforts to ease pressures in the money markets.

Federal Reserve policymakers decided to launch this short-term Treasury bill (T-bills) purchase program at their December 9-10 meeting, after determining that reserves in the financial system had fallen to levels that were merely considered adequate—evidence of rising short-term funding costs. Despite banks Reserve levels tend to fluctuate over time, but cash demand often increases at the end of the month and quarter when taxes and other settlements are due.

The minutes of the Federal Reserve’s December 9-10 meeting, released Tuesday, showed that “although respondents had varying expectations of the size of the expected bond purchases, on average, they expected net purchases of about $220 billion over the first 12 months of the purchase program.”

The Federal Reserve previously stated that it would purchase approximately $40 billion in Treasury bills each month, and then gradually reduce the scale of its bond purchases. So far this month, the Fed has indeed purchased approximately $38 billion in short-term Treasury bills and plans to conduct two more purchase operations in January.

Federal Reserve policymakers have emphasized that such bond purchases are merely a tool for managing reserves and are unrelated to the central bank's broader monetary policy or economic stimulus measures.

Market pressure and policy response

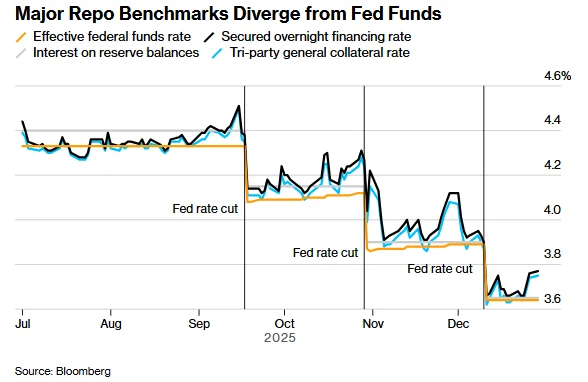

The minutes show that the decision to implement the RMP was made after some participants at the December meeting observed that money market rates were rising faster than during the 2017-2019 balance sheet reduction period.

As signs of pressure emerged in the $12.6 trillion repurchase agreement market, the Federal Reserve halted its balance sheet reduction process (i.e., quantitative tightening) earlier this month. The surge in Treasury bill issuance since the summer, coupled with quantitative tightening, has continuously drained funds from the money market, depleting the central bank's main liquidity tools and pushing up short-term interest rates.

The market's concern is that insufficient liquidity will disrupt the financial market's critical "pipeline" function, weaken the Federal Reserve's ability to control interest rate policy, and in extreme cases, could trigger position liquidation, thereby affecting the broader government bond market, which serves as a global benchmark for borrowing costs.

Discussion on adequate reserve levels

The minutes of the December meeting also recorded discussions among Federal Reserve officials about how to precisely control the level of reserves in the banking system.

Some participants emphasized that, given the potential for changes in demand, more attention should be paid to the relationship between money market rates and reserve balance rates than to setting specific reserve levels.

According to data released by the Federal Reserve Bank of New York on Tuesday, the secured overnight funding rate (SOFR), a key benchmark in the overnight funding market, was set at 3.77% on December 29, 12 basis points higher than the rate offered by the Fed’s reserve balance.

The minutes stated that "several participants expressed the view that if the definition of 'adequate reserves' leads to a supply of reserves exceeding the level required by the Executive Committee framework, it could result in leveraged investors taking excessive risks."

Some Federal Reserve officials have suggested that the Standing Repurchase Operations (RMP), as a liquidity backing, could play a "more active role" in interest rate control, a tool that could shrink the average size of the balance sheet. However, other officials have indicated a preference for relying on the RMP.

Despite increased use of the Federal Reserve’s Standing Repurchase Facility in recent months, market participants have resisted urging from officials to use the tool more, partly due to concerns that borrowing directly from the central bank could have a stigmatizing effect.

(Article source: CLS)