US Stock Market: The three major US stock indexes closed mixed on October 29, with the Nasdaq continuing to hit a record high. At the close, the Dow Jones Industrial Average fell 74.37 points to 47,632.0, a decline of 0.16%; the S&P 500... The S&P 500 index fell 0.3 points to close at 6890.59, a decline of -0.0%; the Nasdaq... The composite index rose 130.98 points to close at 23,958.47, a gain of 0.55%. The Federal Reserve cut interest rates for the second consecutive time by 25 basis points and announced that it would stop shrinking its balance sheet in December. Powell said that rate cuts might be paused in December.

Major tech stocks rose across the board, with Nvidia leading the gains. Apple rose nearly 3%, pushing its total market capitalization past the $5 trillion mark. Slightly higher, closing with a total market capitalization exceeding $4 trillion for the first time. Google rose over 2%, hitting a new record high; Amazon... Meta, Tesla Slight increase; Intel , Microsoft Netflix Slight decline. Caterpillar It rose 12%, marking the largest single-day increase since 2009.

Several US-listed companies released their earnings reports after the market closed. Google's US-listed shares rose more than 6% in after-hours trading. Alphabet reported third-quarter revenue of $102.35 billion, exceeding the estimated $99.85 billion; Google Cloud revenue was $15.16 billion in the third quarter, exceeding analysts' expectations of $14.75 billion; Meta's US-listed shares fell more than 8% in after-hours trading. The company's third-quarter earnings per share were $1.05, compared to $6.03 in the same period last year. Full-year capital expenditures are projected to be between $70 billion and $72 billion, compared to market expectations of $69.3 billion. Microsoft's shares fell more than 4% in after - hours trading. The company reported first-quarter revenue of $77.67 billion, a year-over-year increase of 18%, exceeding the estimated $75.55 billion; net income was $27.747 billion, a year-over-year increase of 12%; Intelligent Cloud revenue was $30.9 billion, exceeding the estimated $30.18 billion.

US storage stocks rose across the board, with SanDisk leading the gains. Western Digital surged over 16%. Seagate Technology surged over 13%. Micron Technology surged over 19% It rose by more than 2%.

Popular Chinese concept stocks showed mixed performance, while the Nasdaq China Golden Dragon Index closed essentially flat. Pony.ai Li Auto fell more than 3%, Aihuishou fell more than 2%, and Li Auto fell more than 3%. Down 1.64%; Alibaba Bilibili rose nearly 2%. It rose by more than 1%.

European stock markets: The three major European stock indices closed mixed on October 29. The FTSE 100 index in London closed at 9756.14 points, up 59.4 points, or 0.61%, from the previous trading day; the CAC 40 index in Paris closed at 8200.88 points, down 15.7 points, or 0.19%, from the previous trading day; and the DAX index in Frankfurt closed at 24124.21 points, down 154.42 points, or 0.64%, from the previous trading day.

Commodity Markets: International oil prices rose on October 29. At the close of trading that day, the settlement price of the current month's WTI crude oil futures contract on the New York Mercantile Exchange rose $0.33 to settle at $60.48 per barrel, an increase of 0.55%; the settlement price of the current month's Brent crude oil futures contract on the London ICE Futures Exchange rose $0.49 to settle at $64.32 per barrel, an increase of 0.77%. The settlement price of the current month's COMEX gold futures contract rose $17.60, an increase of 0.44%, to $4000.7 per ounce.

Overnight news

The Federal Reserve cut interest rates by 25 basis points and announced the end of its balance sheet reduction on December 1.

Early Thursday morning (October 30) Beijing time, the Federal Reserve concluded its two-day monetary policy meeting and announced a 25 basis point cut to the target range for the federal funds rate, bringing it to between 3.75% and 4.00%, in line with market expectations. This is the Fed's second rate cut this year (2025), and the second consecutive rate cut since September. For the first eight months of this year, the bank had remained on hold, awaiting an assessment of the impact of tariffs and other policy adjustments on the economy.

Powell slaps Wall Street: Don't take the December rate cut for granted.

Federal Reserve Chairman Jerome Powell stated at a press conference that the market's expectation of another rate cut in December is "far from certain"—a statement that severely impacted risk assets that were being traded at the time. Earlier in the day, the Fed announced a 25 basis point cut to the target range for the federal funds rate, bringing it to between 3.75% and 4.00%. This was the Fed's second rate cut since September 17, following a 25 basis point cut on September 17, and the fifth rate cut since September 2024.

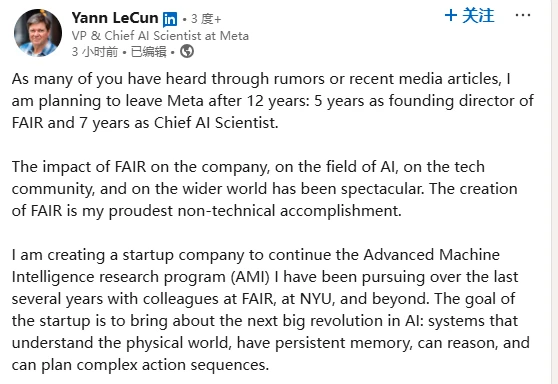

Meta's third-quarter earnings per share were significantly lower than the same period last year, and its stock price fell nearly 8% in after-hours trading.

Meta's shares fell nearly 8% in after-hours trading. The company reported third-quarter revenue of $51.24 billion, a 26% year-over-year increase, exceeding the market estimate of $49.59 billion. Meta projects fourth-quarter revenue of $56 billion to $59 billion, compared to market expectations of $57.38 billion.

Google's parent company reported third-quarter revenue that beat market expectations, with shares rising more than 6% in after-hours trading.

Google shares rose more than 6% in after-hours trading. Its parent company, Alphabet, reported third-quarter revenue of $102.35 billion, exceeding the estimated $99.85 billion; Google Cloud revenue for the third quarter was $15.16 billion, compared to analysts' expectations of $14.75 billion.

Microsoft's first-quarter revenue of $77.67 billion exceeded market expectations.

Microsoft reported first-quarter revenue of $77.67 billion, up 18% year-over-year, compared to an estimated $75.55 billion; net income of $27.747 billion, up 12% year-over-year; revenue from its Intelligent Cloud business of $30.9 billion, compared to an estimated $30.18 billion; capital expenditures of $19.39 billion, compared to an estimated $23.04 billion; and earnings per share of $3.72.

New Capital Strategies in the AI Era: Meta Data Center Raises $27.3 Billion Without Incurring On-Balance-Sheet Debt

In recent months, whenever tech billionaire Mark Zuckerberg discusses Meta's AI vision, he invariably posts images showcasing the Hyperion super data center the company is building. "Spanning an area comparable to Manhattan, New York." Latest news indicates that this mega- data center is also backed by US financial institutions. The “top wisdom” of legal elites – the world’s sixth-largest listed company by market capitalization – ensured that its balance sheet was not immediately affected while raising $27.3 billion, an operation that reportedly received tacit approval from US financial regulators and bond rating agencies.

OpenAI has reportedly pledged to remain in California to overcome regulatory hurdles and pave the way for its IPO.

According to sources, artificial intelligence AI research firm OpenAI has paved the way for its restructuring plans and even an IPO by pledging to remain in California. Microsoft and OpenAI announced a new agreement on Tuesday, marking the formal implementation of the latter's restructuring plan.

AI companion sparks controversy! Character.AI to ban minors from interacting with its chatbot.

Amid regulatory scrutiny and multiple lawsuits, AI startup Character.AI announced on Wednesday that it will ban minors from interacting with chatbots on its platform. Engaging in conversations. The company stated that, starting November 25th, it will completely prohibit users under the age of 18 from engaging in open communication with chatbots on the platform. Currently, users can create and converse with these virtual avatars, which are drawn from popular video games. The figures range from individuals to "copies" of billionaire Elon Musk.

The Bank of Canada cut its policy rate by 25 basis points as expected, suggesting that "the rate cuts have reached a point where they are sufficient."

Late Wednesday night Beijing time, as the prelude to the "24 Hours of Global Central Banks," the Bank of Canada cut interest rates by 25 basis points as expected. Also as anticipated, the Bank of Canada hinted in its policy decision that it is nearing the end of this rate-cutting cycle—unless the trade conflict with the United States brings a more severe economic shock.

Disclaimer: This article is generated by AI and is for reference only. It does not constitute any investment advice, and any actions taken based on it are at your own risk.

(Article source: Eastmoney) Research Center