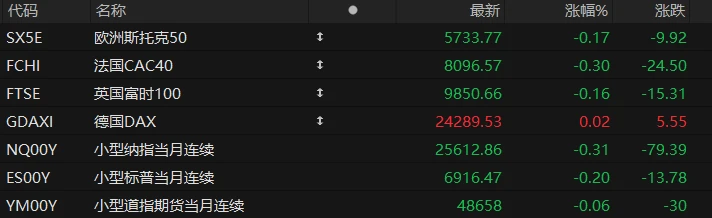

U.S. stock index futures fell across the board in pre-market trading on Tuesday, while most major European indices also declined. As of press time, the Nasdaq ... S&P 500 futures fell 0.31%, S&P 500 futures fell 0.20%, and Dow Jones futures fell 0.06%.

In terms of individual stocks, star tech stocks showed mixed performance, with Tesla... TSMC Nvidia shares rose nearly 0.5%. AMD, Micron Technology Oracle bone script It fell by nearly 0.5%.

On the 23rd, preliminary data released by the U.S. Bureau of Economic Analysis (BEA) showed that the annualized quarter-on-quarter growth rate of U.S. real GDP in the third quarter was 4.3%, in line with expectations of 3.3% and the previous value of 3.8%; the annualized quarter-on-quarter growth rate of the U.S. core personal consumption expenditures (PCE) price index in the third quarter was 2.9%, in line with expectations of 2.9% and the previous value of 2.6%.

Hot News

2025 Gold Year-End Review: Changing Macroeconomic Environment, Yet Still Reasons for Gold Price Increases

2025 for precious metals It was a legendary year for investors, with international gold prices rising by more than 70% throughout the year, surprising most people and causing Wall Street investment banks to tear up their reports one after another.

The primary driver of gold prices' rise in the first quarter was global investors' cautious stance towards the new US administration. President Trump's repeated threats and subsequent postponements of tariffs, coupled with ongoing geopolitical conflicts in the Middle East and Russia-Ukraine, heightened market uncertainty and amplified gold's safe-haven appeal. Gold prices briefly dipped in early April when Trump announced retaliatory tariffs, before surging again on April 21, breaking through the $3,500/ounce mark. Safe-haven demand was the main force behind this record-breaking gold price. The key factor triggering another surge in gold prices was the Federal Reserve's interest rate cut on September 17. Some analysts believe that the rate cut suggests the US economy may be on the verge of stagflation; in other words, investors need to include more physical assets in their portfolios.

On Tuesday, London gold prices once again broke historical records, rising to $4497.41 per ounce. The market continues to be influenced by expectations of a Federal Reserve rate cut and currency devaluation trades resulting from a weakening dollar and US credit, which has given gold a strong finish to the year. According to reports from various Wall Street institutions, the mainstream view is that the average gold price next year will be between $4500 and $5000 per ounce, implying a potential upside of 0.3% to 11.5% from current prices.

The US dollar is expected to have its worst annual performance in eight years, with Wall Street speculating: will it fall further next year?

As the yuan approaches the 7.0 mark against the dollar nears the end of the year, exchange rate trends have once again become a hot topic of discussion among many domestic investors. On Wall Street, there is also considerable discussion about the dollar's specific trajectory next year – many investors believe that with accelerating global economic growth and further easing by the Federal Reserve, the dollar's depreciation trend may continue next year.

The dollar has fallen 9% against a basket of major currencies so far this year, on track for its worst annual performance in eight years. The decline is attributed to a combination of factors, including expectations of a Federal Reserve rate cut, narrowing interest rate differentials with other major currencies, and concerns about the US fiscal deficit and political uncertainty.

With other major central banks maintaining or tightening their policies, and the new Federal Reserve chairman set to take office in the second quarter of next year—a shift expected to make the Fed's policy more dovish—most institutional investors currently anticipate further weakening of the dollar.

"From a fundamental perspective, the US dollar remains overvalued," said Karl Schamotta, chief market strategist at global corporate payments company Corpay.

Bank of America CEO: AI's economic influence is gradually increasing, and there is no need to worry too much even if the industry contracts.

On Monday, Eastern Time, Bank of America Group CEO Brian Moynihan stated that artificial intelligence This is having an increasingly significant impact on the US economy. Moynihan stated that the company expects the US economy to perform strongly next year, with a projected growth rate of 2.4%, up from approximately 2% in 2025. While the US labor market has clearly begun to slow, Moynihan indicated that this is more a sign of normalization in the job market than a indication of a sharp economic downturn.

In recent months, AI companies, including OpenAI, have attracted tens of billions of dollars in funding as numerous investors rush to bet on the sector. Moynihan argues that even if the AI industry overheats and eventually has to shrink, the impact of a so-called "AI bubble burst" on the overall economy—including its effects on consumers and unemployment—would be relatively limited, given that the industry is currently led by only a few companies.

Moynihan stated, "As lenders, we will review the leverage ratios of these projects and ensure we are comfortable with them, while also confirming the responsibilities of those using the data centers." The term of the contracts signed by the personnel.

US Stocks Focus

Apple under "storage shortage" The supply landscape is changing; Samsung is reportedly set to monopolize 70% of the DRAM supply for the iPhone 17.

Samsung Electronics of South Korea has always played a crucial role in Apple's supply chain, and with the global "memory shortage" intensifying, Apple's supply of memory chips for iPhones is facing increasing pressure. The company's reliance on Samsung Electronics is increasing significantly.

According to media reports, as memory chip prices rise rapidly, Apple will increase its reliance on Samsung for iPhone memory chips . This shift is expected to result in Samsung supplying approximately 60% to 70% of the low-power dynamic random-access memory (DRAM) in the iPhone 17. In previous generations, the supply share was more balanced between Samsung and SK Hynix, while Micron participated in the supply with a smaller share.

The iPhone uses low-power double data rate (LPDDR) memory chips. Although Samsung, SK Hynix, and Micron all have the capability to mass-produce LPDDR, industry sources indicate that SK Hynix and Micron have gradually shifted their production capacity to high-bandwidth memory. (HBM) – This type of product is in high demand in the fields of artificial intelligence accelerators and data center hardware. In contrast, Samsung is clearly still maintaining large-scale production of general-purpose and mobile-specific DRAM, thus being able to meet Apple's ultra-high-volume, high-stability supply requirements for memory chips.

This shift in supply patterns comes against the backdrop of a continued tightening of the global memory market. Concentrating a larger proportion of orders with Samsung will help Apple secure more predictable chip deliveries, while also potentially allowing it to reduce costs through economies of scale.

Google is betting on a "world model," hoping smart glasses will become a true "killer app" for AI.

Google is seeking the next leap forward in AI technology by betting on a “world model” that can understand the physical world.

According to a Bloomberg columnist Parmy Olson on the 23rd, Google plans to launch a new AI smart glasses next year (2026), aiming to differentiate itself from competitors like Meta through "world model" technology. These glasses, manufactured in collaboration with Samsung, will differ from competing products that can only describe images through cameras; this device aims to understand three-dimensional space, relationships between physical objects, and environmental dynamics. This is seen as a key attempt by Hassabis in the product field, potentially reversing Google's past reputation in smart glasses and establishing a new industry standard.

This move comes as Google gradually regains ground in the AI race. With the successful release of the Gemini 3 model, Google has topped the performance charts and is making a strong push to catch up with OpenAI in terms of user base, forcing competitor Sam Altman to respond to market pressure by releasing "Code Red." Market observers believe that if this world-model-based smart glasses achieves commercial success, it will not only signify a recovery for Google's hardware business but could also mark a paradigm shift in AI applications from simple language processing to physical world interaction.

Novo Nordisk Oral weight loss drugs The tablet received FDA approval, alongside Eli Lilly. The "war on diet pills " enters a new round.

Novo Nordisk shares rose 7.5% in pre-market trading on Tuesday after the U.S. Food and Drug Administration (FDA) approved its weight-loss pills . This gives the company a competitive edge in the rapidly evolving obesity treatment market.

This approval puts Novo Nordisk ahead in the race to develop potent oral weight-loss drugs, as the company works to regain market share lost to Eli Lilly (LLY.US). Novo Nordisk faced significant supply chain challenges when launching its injectable drug Wegovy in 2021, but the company says it is better prepared this time.

CEO Mike Dustas stated in November that the company had "more than enough pills" and would "go all out" to bring the product to market.

Tesla's European sales fell nearly 12% in November, while BYD... Market share steadily increased

Data released on Tuesday showed that Tesla 's sales in Europe continued to decline in November, while its Chinese rival BYD recorded strong year-on-year growth in the region, steadily increasing its market share.

Data from the European Automobile Manufacturers Association (ACEA) shows that Tesla ... Sales in the EU, EFTA, and UK fell 11.8% year-on-year to 22,801 vehicles. Tesla 's market share in Europe also declined to 2.1% in November from 2.5% a year earlier, but recovered from a dismal 0.6% in October.

In contrast, BYD 's sales in Europe surged 221.8% year-on-year in November to 21,133 vehicles, while its market share rose from 0.6% a year ago to 2%. BYD's market share also improved from 1.6% in October. ACEA data also shows that while Tesla sales continued to decline, new car registrations in Europe increased by 2.4% year-on-year in November to 1.08 million vehicles. This growth was mainly driven by battery sales . This was driven by improved sales of hybrid vehicles, which have the highest market share in Europe, reaching 34.6%.

Although Tesla's sales decline in Europe narrowed in November compared to previous months, it still reflects the electric vehicle manufacturer's continued sluggish sales in the region. Currently, Tesla faces fierce competition from both European and Chinese automakers. Tesla is still struggling to rebuild its brand image. Earlier this year, CEO Elon Musk's political actions sparked a boycott in Europe, leading to setbacks in its brand and sales.

(Article source: Hafu Securities) )