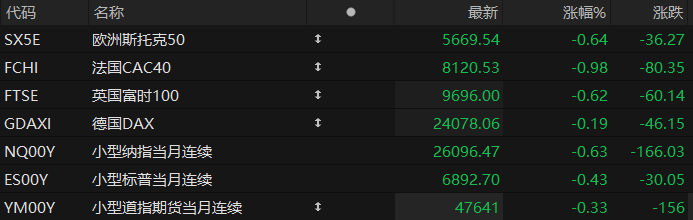

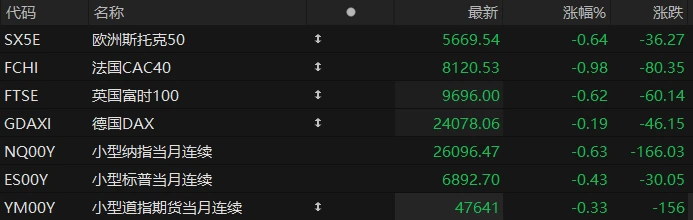

U.S. stock futures fell across the board in pre-market trading on Thursday, while major European indices also declined. As of press time, the Nasdaq... S&P 500 futures fell 0.63%, S&P 500 futures fell 0.43%, and Dow Jones futures fell 0.33%.

In terms of individual stocks, popular Chinese concept stocks generally fell in pre-market trading, with Bilibili among them. Baidu fell nearly 5%. Alibaba fell nearly 3%. JD.com Pinduoduo Li Auto NIO All fell by more than 1%. Eli Lilly The stock rose more than 7% in pre-market trading; in terms of news, the company raised its full-year revenue forecast to $630-635 billion.

Market sentiment was influenced by hawkish comments from Federal Reserve Chairman Jerome Powell. The Fed announced a 25-basis-point rate cut on Wednesday, in line with market expectations, but Powell stated in a press conference, "Further rate cuts at the December meeting are not a certainty, far from it."

Investors are trying to assess companies' capabilities in artificial intelligence. Spending speed and return on investment in the (AI) field: three tech giants – Alphabet (Google's parent company), Meta, and Microsoft. All three companies released their quarterly results after the market closed on Wednesday. Alphabet's stock surged 8% in pre-market trading due to strong earnings; however, Meta and Microsoft shares fell by about 10% and over 2%, respectively. The market's reaction to these results dragged down the overall market performance.

Sam Stovall, chief investment strategist at CFRA, pointed out that if tech company earnings reports show AI-related productivity growth faster than expected, the Federal Reserve may be forced to cut interest rates more aggressively than originally planned. He also cautioned that October is historically one of the most volatile months, and future price uncertainty could actually present attractive buying opportunities for traders.

apple and Amazon The company will release its earnings report after the market closes on Thursday.

Hot News

With the Fed's December rate cut uncertain, Wall Street may witness more "scary moments"!

Despite investors' previous hopes for further monetary easing, the Federal Reserve's policy meeting, which concluded on Wednesday, revealed that the path of future rate cuts is increasingly uncertain amid data shortages, persistent inflation stickiness, and internal disagreements within the central bank.

Federal Reserve Chairman Jerome Powell's remarks surprised the market, as he questioned the prospect of an interest rate cut at the next meeting in December, stating that it was "not a done deal," even though the market had previously considered it almost a certainty. Following his speech, US stocks erased earlier gains, and bonds were sold off.

The Federal Reserve lowered its benchmark interest rate by 25 basis points to a range of 3.75% to 4%, as expected, a decrease of 150 basis points from last year's peak, and halted its balance sheet reduction program. Although these measures are beneficial to the market, they had already been anticipated and priced into asset prices.

The US government shutdown has made it impossible to obtain labor market and other economic data that the Federal Reserve traditionally relies on, casting a shadow over policymakers' decisions and creating more uncertainty for investors.

Bessant: A Fed Chair nominee may be chosen before Christmas; dislikes the wording of this rate cut.

On Thursday local time, U.S. Treasury Secretary Bessant said that the second round of interviews for Federal Reserve Chairs is about to begin.

The pool of candidates for Federal Reserve Chair has been narrowed down to five. They are: current Federal Reserve Governors Christopher Waller and Michelle Bowman, former Federal Reserve Governor Kevin Warsh, White House National Economic Council Director Kevin Hassett, and BlackRock. Rick Rieder, an executive at BlackRock Inc.

Bessant said he appreciated the Fed's 25-basis-point rate cut, but "didn't like the wording." Powell, in his hawkish press conference following Wednesday's rate decision, said inflation still faces upward pressure in the short term, employment faces downside risks, and the current situation is quite challenging. He added that the committee remains largely divided on whether to cut rates again in December, and a rate cut is not a certainty.

This five-person shortlist includes senior figures from the Federal Reserve, the White House, and Wall Street. Bessant himself is leading the interview process for this selection. Bessant stated that he plans to submit the final shortlist to the President after Thanksgiving, after conducting further interviews.

Global central bank gold purchases surged 28% quarter-on-quarter in Q3! A WGC report shows gold demand remains robust.

The World Gold Council released its third-quarter Global Gold Trends report on Thursday. Data shows that in the third quarter of 2025, global gold demand increased by 3% year-on-year to 1,313 tons, a record high; while the value of gold demand increased by 44% year-on-year, reaching a record $146 billion.

The surge in aggregate demand for gold reflects the reality of soaring gold prices in the third quarter, with spot gold rising 16.8% from $3,300/oz at the end of June to $3,858/oz at the end of the quarter. Subsequently, gold hit a record high of $4,380/oz in October, highlighting the current market frenzy for the asset.

The World Gold Council report indicates that gold demand has increased by 1% so far this year, reaching 3,717 tons, valued at $384 billion, representing a year-on-year increase of 41%.

The central bank's purchases in the first three quarters of this year totaled 634 tons, slightly lower than the 724 tons in the same period last year. However, the central bank's purchases remained at a high level of 220 tons in the third quarter, representing a 28% increase compared to the previous quarter.

Investors were also active in the third quarter, with gold ETF purchases reaching 222 tons. In addition, demand for gold bars and coins exceeded 300 tons for the fourth consecutive quarter, driving the overall growth in gold demand.

US Stocks Focus

Novo Nordisk Wins bid for US company Metsera, outbidding Pfizer. $4.9 billion offer

Danish pharmaceutical giant Novo Nordisk said on Thursday that it has made a takeover offer for U.S. biopharmaceutical company Metsera, following Pfizer's offer last week.

In pre-market trading, Metsera shares surged nearly 20%. As of Wednesday's close, Metsera's stock price has risen 190% year-to-date to $52.21, giving it a market capitalization of approximately $5.5 billion.

Novo Nordisk claims it has made an all-cash offer of $56.50 per share, valuing the company at approximately $6 billion; while Pfizer previously offered $47.50 per share in cash, valuing the company at approximately $4.9 billion.

In addition, both Novo Nordisk and Metera have provided contingent value warrants (CVRs), which could increase the total acquisition price by billions of dollars if the latter achieves its set goals in clinical and regulatory approvals.

According to sources familiar with the matter, Novo Nordisk has made a higher offer to acquire weight-loss drug startup Metsera, aiming to snatch the deal already agreed by Pfizer and further solidify its position in the weight-loss drug market. Market leadership.

Amazon AWS CEO: "Very pleased" with large-scale AI bets, confident they will pay off.

Amazon is investing heavily in artificial intelligence infrastructure, and its cloud business head said the company is confident these investments will pay off.

In an interview on Wednesday (October 29), Amazon Web Services (AWS) CEO Matt Garman said that despite concerns that the AI boom might turn into a bubble, the company is “quite pleased” with its massive investments in the field.

Garman stated, "Others might make more speculative investments. We, on the other hand, focus very much on how to reasonably assess the risks and consider our long-term outlook for this business." Garman made these remarks as Amazon announced the launch of a data center project. The plan, called Project Rainier, is an $11 billion artificial intelligence data center project located in Indiana.

Rainier is one of the world's largest AI data centers , dedicated to training and running the Claude model from Anthropic, a key AI partner of Amazon and a major competitor of OpenAI. The data center is currently fully operational and has deployed over 500,000 AWS Tranium 2 chips. According to Garman, Rainier plans to double its size by the end of the year.

Eli Lilly's third-quarter results significantly exceeded expectations, prompting the company to raise its full-year guidance. Shares surged 5% in pre-market trading.

U.S. pharmaceutical giant Eli Lilly reported on Thursday that its third-quarter revenue and profit significantly exceeded market expectations, driven by continued strong demand for its star weight-loss drug Zepbound and diabetes drug Mounjaro. The company also raised its full-year guidance.

Boosted by the news, Eli Lilly's stock price surged as much as 7% in pre-market trading, but has since narrowed to 5%.

The financial report shows that Eli Lilly's revenue in the third quarter was $17.6 billion, a year-on-year increase of 54%; the adjusted earnings per share in the third quarter were $7.02, far exceeding analysts' estimates of $5.69.

Eli Lilly raised its full-year 2025 revenue forecast to $63 billion to $63.5 billion, up from its previous forecast of $60 billion to $62 billion. The company expects adjusted earnings per share for the full year to be $23.00 to $23.70, higher than its previous forecast range of $21.75 to $23.00.

Investors are paying close attention to Eli Lilly's latest earnings report because of high market expectations for its GLP-1 drug portfolio, as well as concerns about potential pressure from drug price negotiations initiated by the U.S. government.

Eli Lilly and Novo Nordisk are vying for the top spot in the global weight-loss drug market, which is widely expected to reach $150 billion by 2030.

(Article source: Hafu Securities) )