As the yuan approaches the 7.0 mark against the dollar nears the end of the year, exchange rate trends have once again become a hot topic of discussion among many domestic investors. On Wall Street, there is also considerable discussion about the dollar's specific trajectory next year – many investors believe that with accelerating global economic growth and further easing by the Federal Reserve, the dollar's depreciation trend may continue next year.

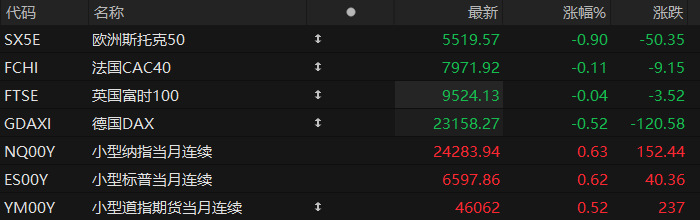

The dollar has fallen 9% against a basket of major currencies so far this year, on track for its worst annual performance in eight years. The decline is attributed to a combination of factors, including expectations of a Federal Reserve rate cut, narrowing interest rate differentials with other major currencies, and concerns about the US fiscal deficit and political uncertainty.

With other major central banks maintaining or tightening their policies, and the new Federal Reserve chairman set to take office in the second quarter of next year—a shift expected to make the Fed's policy more dovish—most institutional investors currently anticipate further weakening of the dollar.

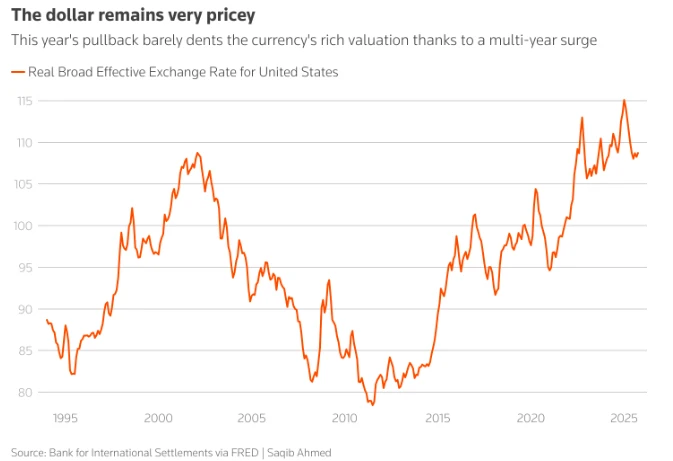

"From a fundamental perspective, the US dollar remains overvalued," said Karl Schamotta, chief market strategist at global corporate payments company Corpay.

Given the central role of the US dollar in the global financial system, accurately grasping its trends is crucial for investors. A weaker dollar can enhance the profitability of US multinational corporations—overseas earnings will be worth more when converted back to dollars; however, at the same time, a weaker dollar can also enhance the attractiveness of markets outside the US by providing exchange rate gains that exceed the performance of underlying assets.

Will the US dollar fall further next year?

Despite the dollar index rebounding in recent months—rising nearly 2% from its September lows—an industry survey conducted from November 28 to December 3 showed that most foreign exchange strategists surveyed maintained their forecast that the dollar will depreciate in 2026.

Bank for International Settlements Data shows that the real broad effective exchange rate index of the US dollar in October—that is, the value of the dollar relative to a basket of non-US currencies after adjusting for inflation—was 108.7, only slightly lower than the record high of 115.1 set in January. This suggests that the US dollar may still be overvalued.

Analysts point out that whether the expectation of a weaker dollar will materialize will essentially depend on whether global growth rates converge. As other major economies gain momentum, the US growth advantage is expected to diminish.

“I think the difference is that growth will accelerate in the rest of the world next year,” said Anujeet Sareen, portfolio manager at Brandywine Global.

Some industry insiders have noted that German fiscal stimulus, Chinese policy support, and an improved growth trajectory in the Eurozone are likely to weaken the US growth premium that has supported the dollar in recent years. Paresh Upadhyaya, Head of Fixed Income and Currency Strategy at AXA Investment Management, Europe's largest asset manager, pointed out, "When the rest of the world starts to look better in terms of growth..." This will push the dollar lower.

Even investors who believe the worst of the dollar's decline is over say any major blow to U.S. economic growth could drag the dollar down again.

"If there are signs of economic weakness at any point next year, financial markets could come under pressure, and the dollar will certainly be affected," said Jack Herr, an investment analyst at GuideStone. However, his baseline expectation is that the dollar will not depreciate significantly in 2026.

Policy divergences among central banks are expected to become more pronounced.

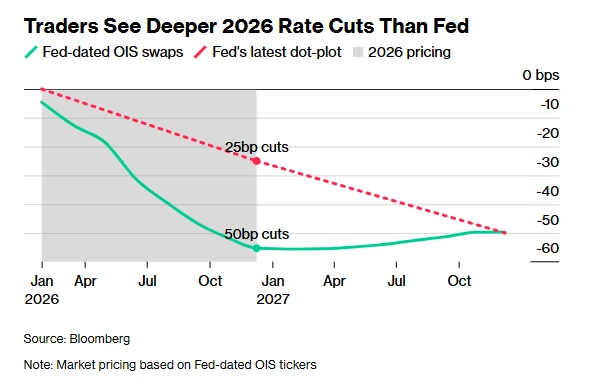

In terms of central bank monetary policy, when other major central banks maintain or raise interest rates, the market expects the Federal Reserve to continue cutting interest rates, which could also drag down the dollar.

At its December policy meeting, the Federal Reserve, which was deeply divided internally, announced its third interest rate cut this year, lowering the target range for the federal funds rate to 3.50%-3.75%. At the same time, the Fed's dot plot showed that policymakers expect a median rate cut of 25 basis points next year.

However, given that the Trump administration is pushing the Federal Reserve to continue cutting interest rates, and with Powell's term coming to an end, the market is currently speculating that the Fed will adopt a more accommodative monetary policy next year.

Several known candidates for Federal Reserve Chair—including White House economic advisor Kevin Hassett, former Federal Reserve Governor Kevin Warsh, and current Governor Chris Waller—have advocated for lowering interest rates below current levels.

“Despite market expectations that the Fed’s actions next year will be limited, we believe economic growth will slow and the employment situation will weaken,” said Eric Merlis, co-head of global markets at Boston Citizens Bank , which is currently shorting the dollar against other G10 currencies.

Meanwhile, traders currently believe the European Central Bank (ECB) will keep interest rates unchanged in 2026, and even do not rule out the possibility of a rate hike. The ECB kept its policy rate unchanged at its December meeting and raised some of its economic growth and inflation forecasts.

Of course, some investors also warn that while the dollar is expected to weaken in the long term, a short-term rebound cannot be ruled out. Investors are also concerned about artificial intelligence . The continued enthusiasm for the stock market and the resulting inflow of funds into the US stock market may support the dollar in the short term.

In response, Brandywine's Sareen stated that the reopening of the US government after this year's shutdown, coupled with tax cuts passed this year, will boost US economic growth, which could lift the dollar in the first quarter. "However, we tend to think that this is unlikely to be a driving force for a sustained strengthening of the dollar this year."

(Article source: CLS)