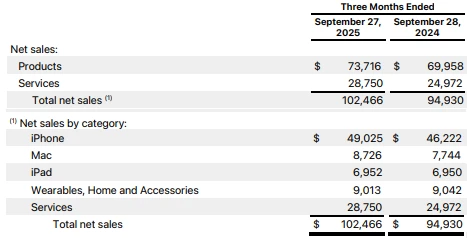

After the US stock market closed on Thursday (October 30), Apple... The company released its financial results for the fourth quarter of fiscal year 2025 (ending September 27, 2025 calendar year).

According to earnings data, Apple 's revenue reached $102.466 billion in the quarter, an increase of 8% year-over-year; diluted earnings per share were $1.85, an increase of 13% year-over-year, exceeding market expectations of $102.24 billion and $1.77, respectively.

In the itemized data:

iPhone sales reached $49.025 billion, a 6.1% year-over-year increase, but still fell short of market expectations of $50.19 billion.

Mac sales reached $8.726 billion, a 12.7% year-over-year increase, exceeding market expectations of $8.59 billion;

iPad sales reached $6.952 billion, compared to $6.95 billion in the same period last year, slightly below market expectations of $6.98 billion;

Sales of wearable, home, and accessory products reached $9.013 billion, compared to $9.042 billion in the same period last year and market expectations of $8.49 billion.

Revenue from services business was $28.75 billion, up 15% year-over-year, compared to market expectations of $28.17 billion.

In a press release, Apple CEO Tim Cook wrote, "Today, Apple is very proud to announce that the company's quarterly revenue has reached a new record of $102.5 billion." He also noted that iPhone quarterly sales and service revenue also hit record highs.

In an interview, Cook stated that the company's revenue for the first fiscal quarter of fiscal year 2026 will increase by 10% to 12% year-over-year, and iPhone sales will also achieve double-digit growth, "which means this quarter will be the strongest quarter in Apple's history."

Cook revealed that Apple's confidence in its performance outlook stems from the strong response to the new iPhone 17, released in mid-September—exceeding his own expectations. "Based on current sales results, consumers are responding very positively to the iPhone product line."

"We've seen a significant year-over-year increase in store traffic, and enthusiasm is rising globally." It should be noted that the Apple iPhone 17 series went on sale on September 19, so only a little over a week's worth of sales were recorded in the fourth fiscal quarter.

Cook stated that several iPhone models are experiencing supply constraints this fiscal quarter—including the latest iPhone 17 and last year's iPhone 16 series. "We currently have several iPhone 17 models that are still in short supply."

Apple's stock price initially fell more than 3.5% in after-hours trading following the release of its lackluster fourth-quarter results. However, influenced by Cook's optimistic outlook for the first fiscal quarter of fiscal year 2026, Apple's stock price briefly rebounded by 5%, before narrowing its gains to around 2.6%.

Regarding the services business, Cook stated that the division is "mostly accelerating and everything is going well." The services business is also Apple's fastest-growing and most profitable segment, as it provides sustainable, recurring high-margin revenue.

Apple CFO Kevan Parekh also stated in the conference call that the company expects its services business to maintain a similar level of growth in the first fiscal quarter.

The earnings report shows that Apple achieved year-over-year growth in almost all markets globally in the fourth fiscal quarter, with only Greater China experiencing a 4% decline. Cook stated, "We expect the Chinese market to resume growth this quarter, primarily due to the positive response to the iPhone 17 series in the region."

Cook also confirmed that Apple plans to release an upgraded version of Siri next year and will continue to advance more partnerships, such as the previously announced collaboration with OpenAI to develop chatbots . ChatGPT has been integrated into Apple Intelligence, and "our goal is to integrate with more partners in the future."

Cook also pointed out that Apple did not adjust product prices due to the Trump administration's tariff policies. "Our pricing strategy is the same as when there were no tariffs. We simply absorbed the tariff costs into our gross margin."

Parek added that Apple incurred an additional $1.1 billion in costs due to tariffs in the fourth fiscal quarter, and expects tariff costs to reach $1.4 billion in the next fiscal quarter, with gross margins between 47% and 48%.

(Article source: CLS)