The unexpectedly weak ADP nonfarm payroll data, highlighting the pressure of a sluggish job market, fueled expectations of a Federal Reserve rate cut, turning bad news into good news for the US stock market. On Wednesday, Eastern Time, the three major US stock indices opened lower but rallied to close higher, with the S&P 500 just 21 points shy of its record closing high of 6870.

At the close, the S&P 500 rose 0.3% to 6849.72 points; the Nasdaq... The composite index rose 0.17% to 23,454.09 points; the Dow Jones Industrial Average rose 0.86% to 47,882.9 points.

According to foreign media reports, several Wall Street giants have expressed their deep concerns to the U.S. Treasury Department regarding Hassett's potential nomination as the next Federal Reserve Chairman. Investors worry that if he takes the helm of the Fed, he might aggressively cut interest rates to appease Trump, thereby undermining the central bank's independence and triggering bond market turmoil.

The three major U.S. stock indexes all closed higher.

On Wednesday, Eastern Time, the three major U.S. stock indexes opened lower but rallied to close higher, with the S&P 500 just 21 points shy of a new closing high (6870 points).

At the close, the S&P 500 rose 0.3% to 6,849.72 points; the Nasdaq Composite rose 0.17% to 23,454.09 points; and the Dow Jones Industrial Average rose 0.86% to 47,882.9 points.

The "AI narrative" is facing renewed scrutiny. In pre-market trading on the US stock market, news broke that Microsoft... The company lowered its expectations for enterprise customers in the new artificial intelligence field . Although Microsoft immediately denied the expected investment in the product, the news still significantly dragged down the company's stock price.

Major tech stocks were mixed; Nvidia closed lower. Apple fell 1.03%. Google-A shares fell 0.71%. Microsoft rose 1.21%, Amazon fell 2.5%, and Amazon... Broadcom fell 0.87%. Down 0.25%, Meta down 1.16%, TSMC Tesla rose 1.15%. Berkshire Hathaway-A rose 4.08%. Down 0.28%, Eli Lilly It fell 1.2%.

Silver and copper both hit new highs, with the non-ferrous metals sector showing strong overall performance. (Alcoa) Kaiser Aluminum rose 6.37%. Glencore rose 5.89%, while McMoran Copper rose 3.63%. Following the announcement of its vision to become the "world's copper king" over the next 10 years, Glencore's US-listed ADRs closed up 7.29%.

Market rumors suggest the US government will introduce policies to support robots. Supporting policies for industry development have led to a surge in the stock prices of some small-cap stocks with " robot " in their names, in addition to robot giant Tesla . Nauticus Robotics closed up 115.89%, and robotic vacuum cleaner company iRobot jumped 73.85%.

Most Chinese concept stocks weakened, with the Nasdaq China Golden Dragon Index closing down 1.38% on Wednesday. As of the close, Alibaba... JD.com down 1.89% Baidu fell 0.6%. Pinduoduo fell 1.44%. Bilibili fell 1.43%. NIO fell 2.36%. NetEase fell 4.77%. Futu Holdings fell 0.96%. Li Auto fell 0.78%. XPeng Motors fell 3.65%. EHang Intelligent fell 4.02%. It fell by 0.8%.

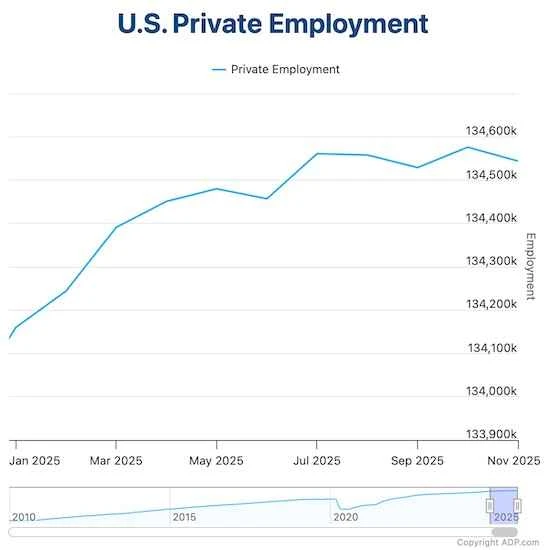

The "small non-farm payrolls" unexpectedly turned from an increase to a decrease.

The latest ADP nonfarm payrolls report shows that the U.S. private sector saw its largest layoffs in nearly two years in November, indicating signs of a weakening labor market.

U.S. stock market pre-market on Wednesday, Automatic Data Processing (ADP) Data released by ADP shows that the private sector lost 32,000 jobs in November, the last time such a decline occurred was in March 2023. An increase of 10,000 jobs was expected, and 47,000 jobs were added in October.

The ADP report states that U.S. job growth will stagnate in the second half of 2025, and wage growth will also decline. Hiring was particularly weak in November in the manufacturing, professional/business services, information technology, and construction sectors.

ADP Chief Economist Nela Richardson wrote, "The hiring market has been volatile due to cautious consumer spending and an uncertain macroeconomic environment. While the slowdown in hiring is widespread, the main reason is the contraction of small businesses."

Salary growth has also slowed, with the annual growth rate of salaries for retained employees at 4.4%, down 0.1 percentage points from October.

This "mini-nonfarm payrolls" report is the last employment data the Federal Reserve will receive before its December 9-10 meeting. Despite concerns from some officials about further easing, the market believes there is a near 90% probability of another 25 basis point rate cut by the Fed.

Markets are worried that Hassett's appointment as Federal Reserve Chairman could trigger a wave of interest rate cuts.

According to foreign media reports, several Wall Street giants have expressed their deep concerns to the U.S. Treasury Department regarding Hassett's potential nomination as the next Federal Reserve Chairman. Investors worry that if he takes the helm of the Fed, he might aggressively cut interest rates to appease Trump, thereby undermining the central bank's independence and triggering bond market turmoil.

According to multiple sources familiar with the matter, Treasury officials met with major Wall Street banks. During one-on-one conversations with executives from asset management giants and other key players in the U.S. bond market, feedback on Hassett and other candidates was solicited.

Hassett, the White House’s chief economic officer, has emerged as a leading candidate for the position in recent weeks, after Trump and Bessett narrowed down the list of potential candidates from an initial 11.

Trump said on Tuesday he plans to announce his nominee for Federal Reserve chair "early" next year, and hinted that Hassett is a "potential" contender. The dollar briefly fell after he mentioned Hassett.

Bankers and investors worry that Hassett may advocate for indiscriminate interest rate cuts even if inflation continues to rise above the Fed’s 2% target.

One market participant said that the combination of loose monetary policy and higher inflation could trigger a sell-off in long-term government bonds.

Trump: The meeting between the US special envoy and the Russian president was "quite good".

According to CCTV News, on March 3 local time, US President Trump commented on the previous talks between the US and Russia regarding a "peace agreement." Trump stated that the meeting between US special envoys Witkov and Kushner and Russian President Putin was "quite good."

However, Trump stated that he could not disclose the outcome of the US-Russia talks, as it required joint efforts from both sides. Trump also indicated that Putin wanted to end the conflict.

Earlier on the 3rd, a White House official stated that the US and Russia held a deep and productive meeting. Following their meeting with Russian President Putin on the 2nd, US special envoys Witkov and Kushner briefed US President Trump.

On December 2, local time, Russian President Vladimir Putin held talks with U.S. Special Envoy Sergei Witkov and Jared Kushner, Trump's son-in-law, on a "peace plan." Dmitriev, CEO of the Russian Direct Investment Fund, who participated in the talks, posted on social media early on December 3, Moscow time, that the talks with Witkov and Kushner were "productive." Presidential Press Secretary Dmitry Peskov previously stated that the talks between Putin and Witkov in Moscow were an important step towards a peaceful resolution to the Ukraine crisis—Russia hopes that the U.S.'s efficient mediation will be successful, and Russia is willing to make efforts to achieve peace.

(Source: Shanghai Securities) (Report)