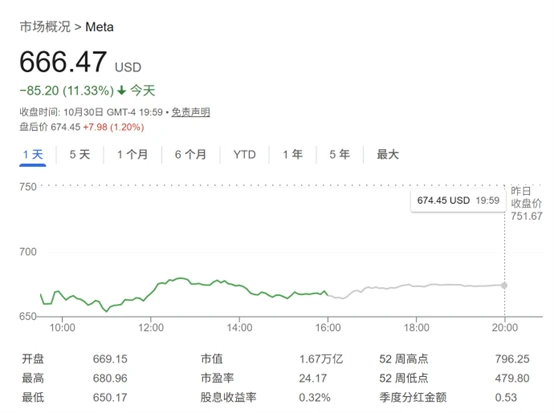

Meta shares were sold off sharply on Thursday, Eastern Time, after the company raised its capital expenditure forecast for the third time this year, alarming analysts who were concerned about its artificial intelligence. Spending is "out of control" .

Meta's stock price closed down 11.33% on Thursday, marking its biggest single-day drop in three years and wiping out $214.7 billion (approximately 1.53 trillion yuan) in market capitalization. According to Dow Jones Market Data, this is the tenth largest single-day market capitalization loss in U.S. corporate history, and the second largest in Meta's history—second only to the $232 billion loss recorded on February 3, 2022.

Meta released its Q3 2025 earnings report after the US stock market closed on Wednesday. In its latest earnings report, the company raised its 2025 capital expenditure forecast, now expecting it to be between $70 billion and $72 billion, up from its previous forecast of $66 billion to $72 billion. The company also stated that next year's capital expenditure growth is likely to be "significantly larger," primarily due to its continued spending on artificial intelligence infrastructure.

Meta CEO Mark Zuckerberg called the spending plan a means to keep up with the demands of artificial intelligence , adding that if the company overbuilds (AI infrastructure), it can absorb additional computing power in the future.

Zuckerberg also stated that the company's AI advertising tools have generated over $60 billion in annualized revenue. He emphasized that this demonstrates the investment has at least yielded returns, which is crucial.

However, this was not enough to change investors' concerns about the company's potential overspending.

Some analysts have compared Meta's latest spending plans to the company's previous spending plans, which were not well-received by Wall Street (its massive investment plans in the metaverse). On October 27, 2022, the company's stock price also plummeted by approximately 25% due to spending concerns.

The problem lies not only in Meta's increased investment in artificial intelligence, but also in whether the type of AI investment that Meta is so actively pursuing will generate corresponding financial returns.

Investment banks are intensively lowering their target prices for Meta.

It is worth noting that although Microsoft released its financial report on the same day... Alphabet, Google's parent company, is also increasing its AI spending, but market concerns about Meta's spending are clearly particularly intense. This is partly because, compared to Google and Alphabet, Meta's AI investment return path is less clear. On the other hand, due to the impact of a one-time income tax expense, the company's third-quarter earnings significantly missed expectations; furthermore, its metaverse business segment, Reality Labs, suffered an operating loss of over $4 billion in the quarter.

Following Meta's earnings release, analysts from several investment banks lowered their target prices for the company's stock. Bank of America... BofA Global Research analyst Justin Post lowered his price target for Meta from $900 to $810, but reiterated his "buy" rating on the stock.

Justin Patterson, an equity analyst at KeyBanc Capital Markets, also lowered his price target for Meta from $905 to $875, while maintaining an "overweight" rating.

TD Cowen analyst John Blackledge lowered his price target for Meta from $875 to $810, but maintained a "buy" rating.

In addition, Morgan Stanley Brian Nowak, Goldman Sachs Analysts such as Eric Sheridan of Citigroup, Ron Josey of Citigroup, and Deepak Mathivanan of Cantor Fitzgerald have also lowered their target prices for Meta while maintaining a "buy" or "overweight" rating on the stock.

Several investment banks have also downgraded Meta's rating. Oppenheimer downgraded the stock from "outperform" to "neutral" on the 30th, citing increasing uncertainty about the company's aggressive investments in artificial intelligence.

Oppenheimer drew parallels between Meta’s massive AI spending and the company’s previous high-cost but limited-return projects.

“Investing heavily in superintelligence amid an uncertain revenue outlook mirrors the Metaverse spending of 2021-2022,” Oppenheimer analysts wrote in a report. They were referring to Meta’s recently established Superintelligence Labs, which focuses on developing artificial intelligence that promises to surpass human cognition.

Oppenheimer pointed out that Meta's implied operating and capital expenditures in the fourth quarter were about 7% higher than Wall Street's expectations. At the same time, the company expects capital expenditure growth in fiscal year 2026 to be "significantly greater than in 2025" and expense growth to be "significantly faster" than the 23% growth in 2025, all of which exceeded Wall Street's expectations.

Oppenheimer believes that "investors will find it difficult to justify Meta's price-to-earnings ratio unless the earnings outlook becomes clearer by 2027," because "high spending has offset strong revenue growth." Oppenheimer analysts also compared Meta to Alphabet, stating that the latter has a "reasonable price-to-earnings ratio and predictable earnings."

On Thursday, analysts at investment bank Benchmark downgraded Meta's stock rating from "buy" to "hold." The analysts stated that they expect Meta's share price to "trade within a range at best until a reasonable return is found for its runaway capital expenditures."

Analysts wrote that although Meta's advertising business is dominant, the company "still needs to prove that investments outside of advertising will pay off."

Benchmark analysts stated that Meta's investments in artificial intelligence in other business areas, such as robotics, are significant. Its Llama AI foundational model has a "less certain future" due to competition from OpenAI, Google, and Tesla. Competition from rivals of similar capital size.

(Article source: CLS)