① Major Wall Street investment banks predict that US stocks will continue their upward trend next year, one of the main reasons being that the Federal Reserve is expected to continue cutting interest rates next year; ② However, Deutsche Bank... Analysts warn that their Wall Street counterparts may be overlooking a fatal risk—the Federal Reserve may not necessarily cut interest rates next year, and could even raise them instead.

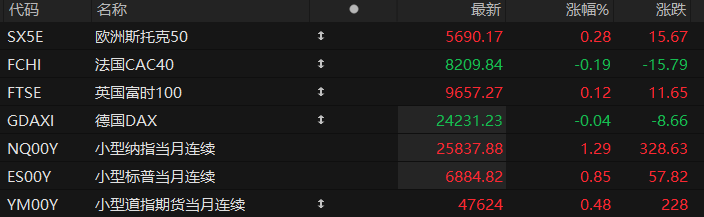

As the year draws to a close, major Wall Street investment banks have given optimistic forecasts for the US stock market next year, predicting that the S&P 500 index will continue its upward trend next year, building on the significant gains it has already made this year.

Almost without exception, major investment banks' analysis reports have mentioned a key supporting factor for US stocks: the Federal Reserve is expected to continue cutting interest rates next year. However, analysts at Deutsche Bank warn that their Wall Street counterparts may be overlooking a fatal risk—the Federal Reserve may not necessarily cut interest rates next year, and could even raise them instead.

Could the Federal Reserve actually raise interest rates?

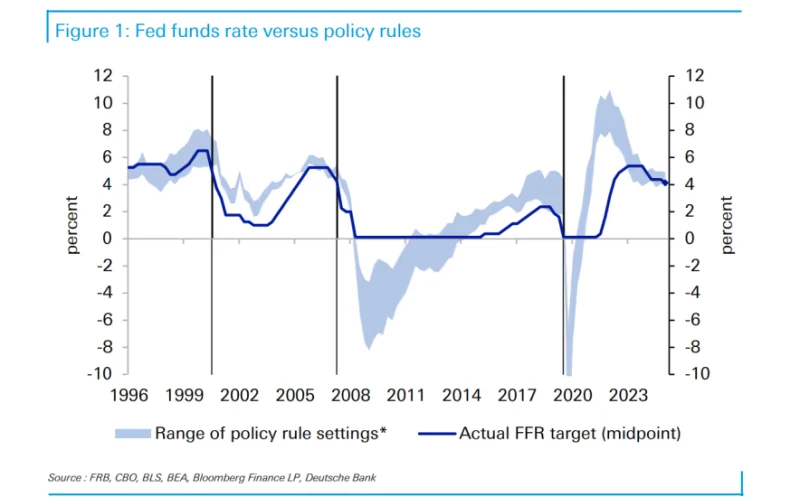

On Tuesday, Eastern Time, Deutsche Bank analyst Jim Reid warned in a report that the market's bets on a Federal Reserve rate cut next year may be a bit too optimistic. He argued that traditional policy rules and the impending fiscal turmoil brought about by Trump's "Big and Beautiful Act" will leave little room for the Fed to further ease monetary policy, and instead increase the risk of a further rate hike.

Reid warned that a Fed rate hike in 2026 is a “negative surprise” that should not be ruled out, especially after the fastest rate cuts in decades, excluding recessions.

"Many large-scale asset sell-offs in recent years (2015-16, 2018, and 2022) have occurred simultaneously with the Federal Reserve's interest rate hikes."

Despite the Federal Reserve's continued interest rate cuts and its expected further 25 basis point cut at its meeting early Thursday morning Beijing time, Deutsche Bank... Analysis based on various macroeconomic models concludes that, given that US inflation expectations will remain above target and the Trump administration's massive fiscal stimulus is imminent, the Federal Reserve's interest rates have effectively been pushed to the lower end of the appropriate range.

In this context, it is not actually appropriate for the Federal Reserve to cut interest rates further. Moreover, if US economic data strengthens or inflation shows signs of overheating again, the Fed's stance on monetary policy is likely to shift from continued easing to a possible return to raising interest rates.

The US stock market may experience significant volatility.

Given that Wall Street generally expects the Federal Reserve to cut interest rates around twice next year, with the only point of contention being the specific timing of these cuts, Deutsche Bank analysts believe that while their view contradicts mainstream market expectations, it is not without merit. If the aforementioned risks materialize, it could potentially lead to greater market volatility.

They pointed out that changes in international markets indicate that investors now believe a growing number of economies, including the Eurozone, Australia, New Zealand, Canada, and Japan, have already made interest rate hikes their next monetary policy move. Just weeks ago, some of these economies were considered more likely to cut interest rates.

Therefore, such a rapid shift in market expectations is not impossible in the United States.

Deutsche Bank warned that similar volatility in market expectations for the US economy could completely overturn the outlook for risk assets such as US stocks in 2026, especially given the recent sensitivity of the US stock market to changes in the Federal Reserve's rhetoric.

“We have just experienced the fastest rate cuts in decades, outside of recessions. This usually leads to a resurgence of the economy and subsequent rate hikes, and in rare cases, such large fluctuations can even lead to a recession… Therefore, central banks are now essentially walking a tightrope,” Deutsche Bank said.

"It is remarkable that more and more regions are viewing interest rate hikes as the next step. If this also happens in the United States, there is no doubt that risk assets and the economic outlook for next year will be dramatically changed."

(Article source: CLS)