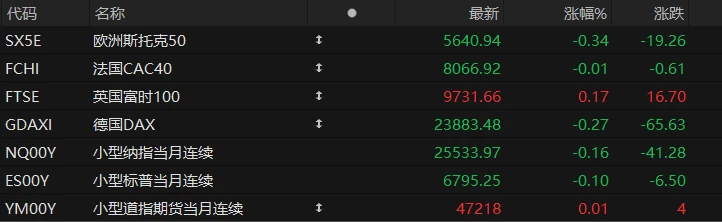

U.S. stock index futures were mixed in pre-market trading on Wednesday, while most major European indices declined. As of press time, the Nasdaq... S&P 500 futures fell 0.16%, S&P 500 futures fell 0.10%, and Dow Jones futures rose 0.01%.

US Automatic Data Processing Data released by ADP on Wednesday showed that U.S. ADP employment increased by 42,000 in October, significantly exceeding the expected 30,000, while employment decreased by 32,000 in September.

Following the data release, the US dollar index rose slightly in the short term, currently trading at 100.19; the yield on the 10-year US Treasury note also rose briefly, currently at 4.084%. Spot gold fell by about $5 in the short term, currently trading at $3964.83 per ounce.

In terms of individual stocks, large-cap tech stocks were mixed in pre-market trading, with Tesla showing mixed performance. Meta and Google rose more than 1% in pre-market trading; Nvidia also saw slight gains. Microsoft shares fell about 0.5% in pre-market trading. Amazon , apple The stock dipped slightly in pre-market trading.

Gold and precious metals The sector is strengthening, Jintian Harmony Gold Hekla Mining shares rose more than 4% in pre-market trading. Newman Mining rose nearly 2%, while Newman Mining rose more than 1%.

Supermicrocomputer Palantir shares fell nearly 10% in pre-market trading after the company's Q1 revenue plummeted 15% and gross margin plunged to 9%. The stock continued its pre-market decline, falling nearly 2%; the company had previously been heavily shorted by major short sellers, but the CEO responded by saying it was "absolutely insane."

Popular Chinese concept stocks were mixed in pre-market trading, with XPeng Motors among them. NIO rose more than 2%. Baidu rose more than 1%. JD.com Alibaba Bilibili saw a slight increase in pre-market trading; Weibo fell more than 2%. It fell by more than 1%.

The Supreme Court will hear a hearing this Wednesday (November 5) regarding US President Trump's power to unilaterally impose a wide range of tariffs. This case is seen as a crucial test of executive power, and its outcome could have trillions of dollars in impact on the global economy.

This lawsuit stems from a core part of Trump's economic agenda—tariff policy. A lower court had previously ruled that the Emergency Economic Powers Act, which Trump invoked, did not grant the president "virtually unlimited power to set and adjust import tariffs."

The U.S. Constitution explicitly states that the power to impose tariffs rests with Congress. However, the Trump administration argued that under a "national emergency," the president has the authority to adjust import taxes, including tariffs. Trump himself described the case as "one of the most important cases in American history" and warned that a loss would have "catastrophic consequences" for the U.S. economy.

Hot News

The US federal government shutdown has entered its 36th day, breaking historical records for duration.

According to the White House website, as of midnight Eastern Time on November 4th, the US federal government shutdown has entered its 36th day, breaking the previous record of 35 days set at the end of 2018 and the beginning of 2019, becoming the longest government shutdown in the United States. (The US ended Daylight Saving Time at 2:00 AM on November 2nd, with clocks set back one hour.)

Due to disagreements between Republicans and Democrats over spending on healthcare and other related benefits, the U.S. Senate failed to pass a new temporary funding bill before the end of the previous fiscal year on September 30. The federal government shut down again at midnight on October 1, Eastern Time, after nearly seven years. As of November 4, the temporary funding bill had been rejected 14 times in the Senate.

According to statistics from the U.S. Congress, the United States has experienced 15 federal government shutdowns since 1980. Eight of these occurred in the 1980s, with the vast majority lasting only one to three days; three occurred in the 1990s, the longest lasting 21 days; and four have occurred since 2010. Although the absolute number of government shutdowns in recent years has been relatively small, there have been several perilous shutdown crises each year.

The current US government shutdown is putting continued pressure on sectors such as civil aviation, food, and healthcare. The Congressional Budget Office recently stated that, depending on the duration of the shutdown, the annualized growth rate of US real GDP is expected to decline by 1 to 2 percentage points in the fourth quarter of this year, with an estimated $7 billion to $14 billion in economic output loss that cannot be recovered.

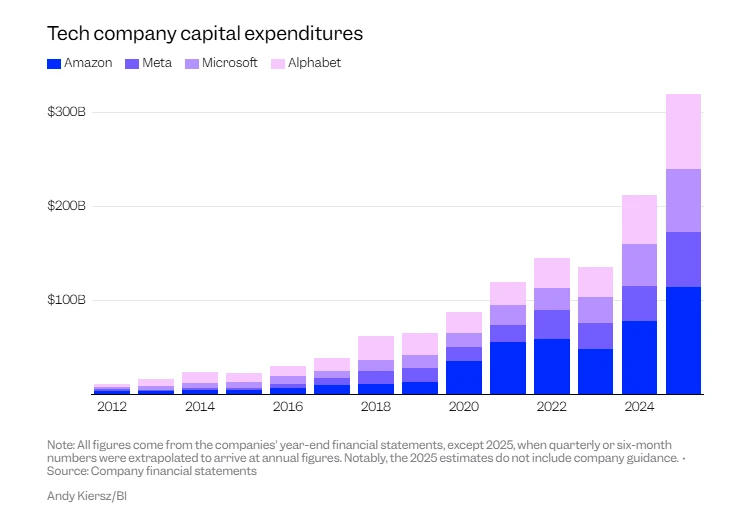

The sharp drop in tech stocks has sparked concerns, but analysts say it's a short-term correction and there's no need to panic.

Analysts say that while the sharp decline in tech stocks is certainly alarming, there is no need to panic at this time. Previously, the market had surged to record highs, and some stocks appeared overvalued.

On Tuesday, all three major U.S. stock indexes closed lower, with the Nasdaq falling 2%. The hardest hit sector in this decline was artificial intelligence , which had previously seen the largest gains. (AI) concept stocks – represented by chip manufacturers such as Nvidia , Nvidia fell nearly 4% on Tuesday, with a cumulative decline of about 7% from its high last month.

Over the past few months, the market has continued to rise despite risks such as high interest rates, persistent inflation, trade frictions, and a weak global economy, raising questions about whether the AI boom is a bubble. Goldman Sachs, one of Wall Street's two major investment banks... and Morgan Stanley CEOs have expressed concerns about the market overheating and warned that the market may experience a correction of more than 10%.

However, Angus McGeoch, head of Asian equity sales at Australian investment bank Barrenjoey, interpreted this as follows: "There was a widespread sell-off in almost all risk-averse sectors, which we believe is more like short-term profit-taking." He added that fund managers are currently focused on 2025 performance, so they will quickly avoid short-term corrections at the end of the year, but will not withdraw from the market on a large scale for the time being.

Is confidence crumbling? Bitcoin whales have sold off $45 billion in holdings over the past month.

Bitcoin experienced another sharp drop, but this time the market collapse was not caused by leverage, but by aggressive selling from "Bitcoin whales" (entities holding 1,000 to 10,000 Bitcoins). Bitcoin prices fell as much as 7.4% during US trading hours on Tuesday (November 4th), dropping below the $100,000 mark for the first time since June. Compared to its all-time high a month ago, its price has fallen by more than 20%. As of Wednesday's (November 5th) Asian morning session, Bitcoin had recovered some of its losses but remained stabilizing.

This decline differs from the crash of October last year, which was triggered by a chain reaction of sell-offs due to leveraged liquidations. This current drop is caused by sustained selling pressure in the spot market. Markus Thielen, head of 10x Research, pointed out that in the past month, some long-term Bitcoin holders have sold approximately 400,000 Bitcoins, withdrawing a total of about $45 billion, leading to market imbalances.

Overall, the growth rate of Bitcoin whale holdings has slowed significantly; looking ahead, Thielen warns that this sell-off could continue into next spring. However, Thielen did not predict a catastrophic crash, but believes there is still room for further decline: "I think we're going to enter a correction phase, possibly a slight drop from current levels. I think the price of Bitcoin will fall to at most $85,000."

US Stocks Focus

The US Department of Justice concludes its antitrust investigation, and Google's acquisition of Wiz crosses a key hurdle.

Google acquires cybersecurity The deal to acquire Wiz has crossed a key hurdle: the U.S. Department of Justice will conclude its antitrust investigation into the acquisition.

In March of this year, Google announced its acquisition of Wiz in an all-cash deal worth $32 billion. Upon completion of the transaction, Wiz will be integrated into Google Cloud Services. This is the largest acquisition in Google's history.

However, according to media reports in June, the U.S. Department of Justice was conducting an antitrust investigation into the deal, with regulators concerned that it could illegally restrict market competition. However, according to information on the Federal Trade Commission (FTC) website, the Department of Justice decided to terminate its review on October 24 under a so-called "early termination" procedure.

Wiz CEO Assaf Rappaport confirmed at an event on Tuesday that the U.S. Department of Justice has completed its review, but the deal is still under evaluation by other antitrust regulators.

The latest financial report from the "big brother of automobiles": Tariffs caused losses of tens of billions of yuan, but the company still raised its full-year profit forecast.

On Wednesday, Eastern Time, Toyota Motor Corporation, the world's largest automaker, released its financial results for the second fiscal quarter of fiscal year 2026 (ending September 30, 2025).

The financial report shows that US tariffs impacted the company by 1.45 trillion yen (approximately 67.29 billion yuan) in the quarter. However, the company still raised its profit forecast for the current fiscal year 2026 (ending next March).

In its financial report, Toyota stated, "Despite the impact of U.S. tariffs, strong demand, supported by the competitiveness of our products, led to increased sales in Japan and North America, and expanded value chain profits."

During its earnings call, Toyota stated that import tariffs remain the biggest factor dragging down its profits in the U.S. market. Meanwhile, exchange rate fluctuations and increased expenses also impacted Toyota's profits in Japan.

According to Liz Lee, associate director at Counterpoint Research, while Toyota has a large number of production lines in North America, about one-fifth of its sales in the United States still rely on imports from Japan. Currently, Toyota is trying to absorb the tariff costs of these imports itself, rather than passing them on to consumers.

Is Novo Nordisk throwing cold water on things as soon as it takes office? Lowering the dosage of weight loss drugs Growth expectations

Novo Nordisk released its third-quarter earnings report on Wednesday and warned that growth of its drugs Wegovy and Ozempic, used to treat obesity and diabetes, will slow.

The company's third-quarter sales reached DKK 74.98 billion, exceeding the estimated DKK 76.68 billion; third-quarter net profit was DKK 20.01 billion (approximately US$3.1 billion), exceeding the estimated DKK 20.8 billion. At constant exchange rates, Novo Nordisk 's sales increased by 15% year-on-year in the first nine months, and operating profit increased by 10%. In the third quarter alone, sales and operating profit increased by 11% and 21% year-on-year, respectively.

Looking ahead to the full year, at constant exchange rates, Novo Nordisk expects sales to grow by 8% to 11% in 2025, up from its previous forecast of 8% to 14%; operating profit is expected to grow by 4% to 7%, up from the previous forecast of 4% to 10%. Novo Nordisk President and CEO Mike Doustdar noted that despite strong sales growth in the first nine months of 2025, the company had to narrow its guidance due to downward revisions in growth expectations for GLP-1 therapies.

Novo Nordisk's shares, listed in Copenhagen, have fallen by more than 50% this year, as a series of adverse factors have shaken investors' confidence in what was once Europe's most valuable company.

(Article source: Hafu Securities) )