With the development of artificial intelligence The debate over the (AI) bubble is intensifying on Wall Street, and investors are now most concerned about when to exit.

A recent report from market research firm BCA Research provides the answer: when artificial intelligence begins to feel like a "metaverse," the most popular trades in the current stock market may run into trouble.

With tech giants investing hundreds of billions of dollars in artificial intelligence , the AI boom has pushed tech stocks to extremely high levels. In this process, BCA Research has been looking for a specific warning sign to alert investors to exit the market.

Peter Berezin, chief global strategist at the research firm, wrote in a report to clients that when artificial intelligence experiences a "metacosmic moment"—that is, when a large AI company announces "more capital expenditures" but its stock price falls instead—it may be time for investors to exit.

This type of stock price decline would signal the arrival of a "metaverse moment": a shift in market sentiment from enthusiasm to skepticism. This term originates from past metaverse experiences—a technological narrative initially generating high levels of hype, only to crumble due to a lack of tangible returns. A few years ago, this led companies like Meta to eventually report billions of dollars in losses.

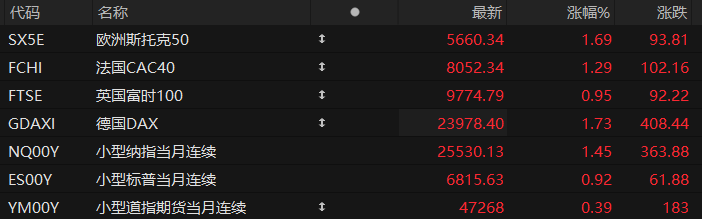

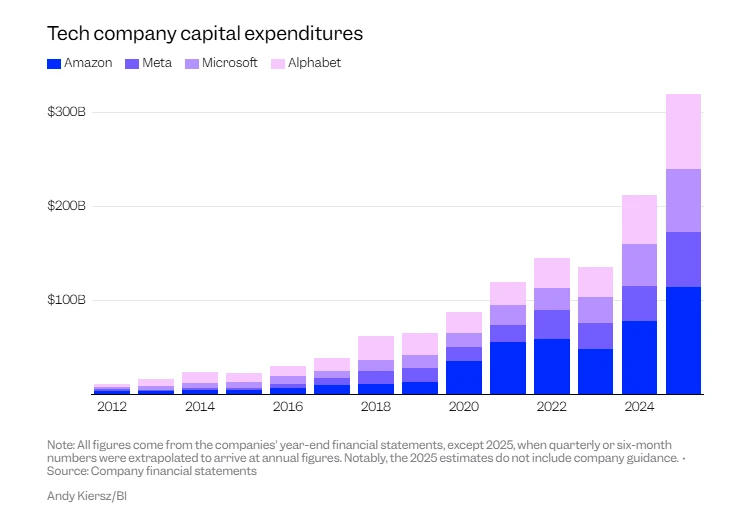

Therefore, some observers have compared it to the AI boom, with large tech companies investing heavily in chips and data centers. Amazon has invested heavily in this area. According to media analysis of its financial reports, this is just one example of the significant amount of money Amazon has invested. Meta, Microsoft These four companies, along with Google's parent company Alphabet, could generate up to $320 billion in related spending this year.

Berezin wrote in the report: "If this happens, it's time to get out. Until then, we are happy to maintain a slightly below-benchmark equity allocation for 12 months."

“Not all investors can react quickly to market shifts. In this case, I would suggest locking in some profits for now,” he added.

Two major signals

According to Berezin, tech stocks have recently shown two major warning signs.

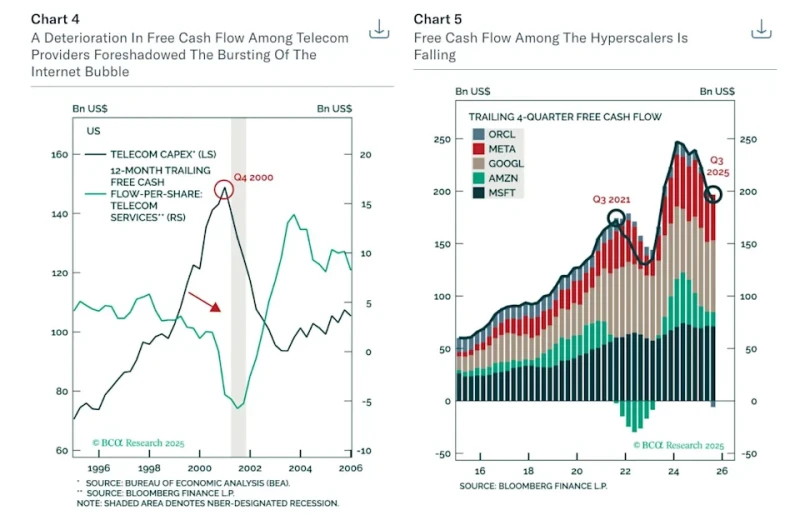

First, in recent months, the free cash flow of so-called hyperscalers—large tech companies that have invested heavily in artificial intelligence—has declined, which may indicate that these companies have weaker balance sheets. Berezin says this is similar to the situation of telecom stocks before the bursting of the dot-com bubble.

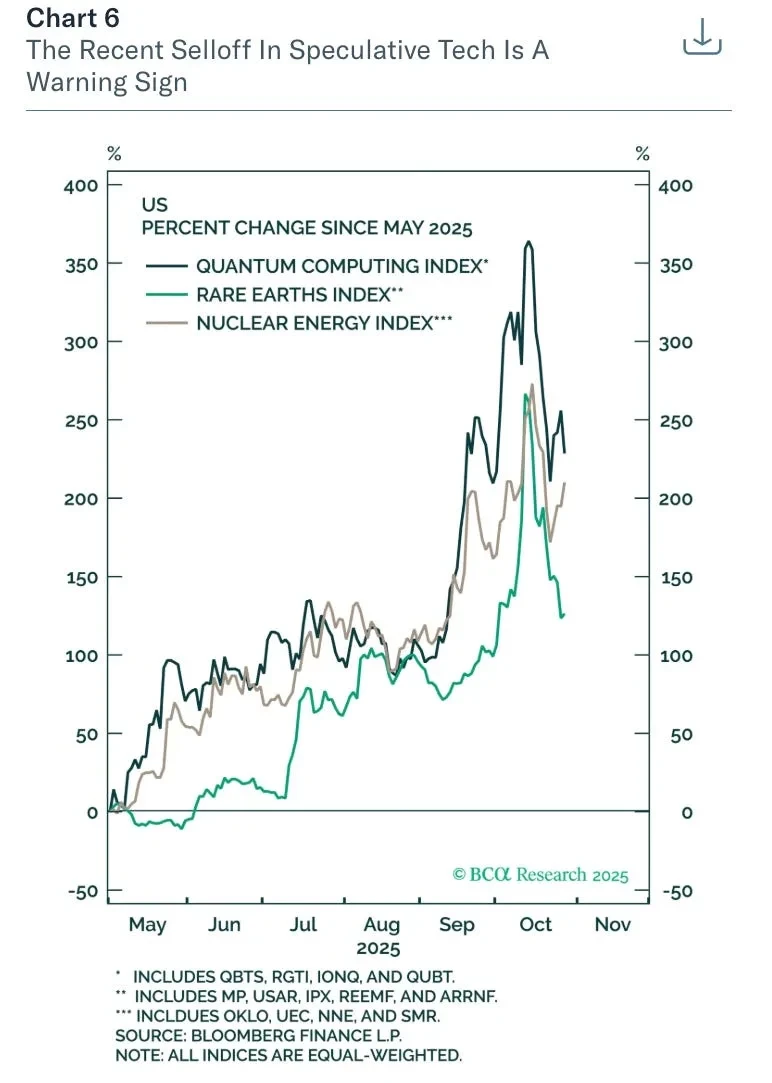

Secondly, speculative stocks that had been boosted by AI deals have been sold off in recent weeks. Berezin added that this is another worrying sign for the AI sector, noting that quantum computing, rare earth, and nuclear energy stocks have recently seen declines.

BCA Research warns that many investors may be overestimating both the transformative impact of AI and its profit potential: "AI may encounter 'growing pains' in its rollout, and while it is likely to have a significant positive impact on productivity in the end, this probability (or even high probability) does not directly equate to the rationality of current valuations."

This means that shareholders may not necessarily receive returns. The report concludes: "Current artificial intelligence systems bear some resemblance to the aviation industry. Without the aviation industry, there would be no globalized economy; however, because the aviation industry offers highly homogeneous products and is a capital- and energy-intensive industry, airlines can hardly make a profit except during periods of exceptionally high demand."

(Article source: CLS)