On Wednesday, U.S. social media company Snap reported its third-quarter earnings, with both revenue and profit exceeding analysts' expectations, and also announced a $500 million stock buyback program.

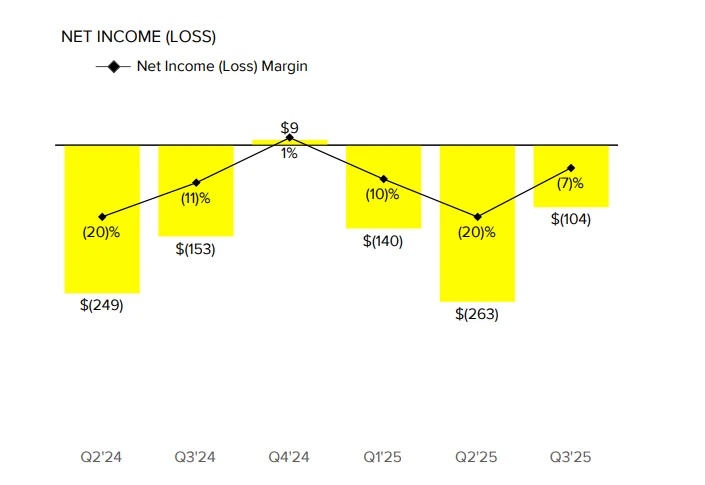

Snap Inc. reported third-quarter revenue of $1.51 billion, exceeding Wall Street's expectations of $1.49 billion; adjusted EBITDA was $182 million, compared to an estimated $124.2 million; however, the company posted a net loss of $104 million for the quarter, though this was a smaller loss than the $153 million net loss in the same period last year.

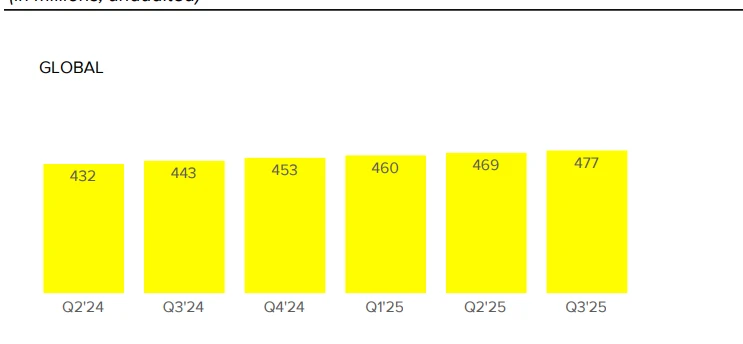

In addition, the company reported that its global daily active users reached 477 million, slightly higher than the expected 476 million and 469 million in the previous quarter.

At the same time, the company also provided guidance for the next quarter, expecting sales in the fourth quarter of this year to be between $1.68 billion and $1.71 billion, with a midpoint of $1.695 billion, slightly higher than Wall Street's expectation of $1.69 billion; adjusted EBITDA for the fourth quarter is expected to be between $280 million and $310 million, a figure higher than the forecast of $255.4 million.

AI integration

One of the biggest announcements during the earnings call was Snap's partnership with startup Perplexity AI, which will integrate its conversational search directly into Snapchat, a feature expected to launch in early 2026.

In a letter to investors, Snap stated, "Perplexity will pay Snap $400 million over one year in cash and equity in support of the global rollout. Revenue from the partnership is expected to begin contributing in 2026."

In a joint statement, the two companies said the collaboration "is the beginning of Snap's efforts to build a platform designed to enable cutting-edge artificial intelligence... " The company is able to connect with Snapchat’s global user base in innovative and reliable ways.

Snap CEO Evan Spiegel stated, "Perplexity's chatbot..." It will be placed in our chat inbox by default, and Perplexity will also control the content of its chatbot's replies within Snapchat.

While Snapchat users can still interact with the company’s “My AI” chatbot , the partnership with Perplexity will allow the latter’s AI service to provide users with “real-time answers from reliable sources and the ability to explore new topics within the app.”

Spiegel also pointed out that this collaboration "will help Perplexity increase its subscriber base, which I think is of great value to their business. We have a very rare opportunity to leverage our chat interface to promote our AI agent product."

In addition, Snap recently confirmed that it will be adding augmented reality. The development of (AR) glasses Spectacles has been moved to a subsidiary called "Specs," following the model of Alphabet and its self-driving car project Waymo.

Regarding Snap's move to invest heavily in developing augmented reality glasses, CEO Spiegel stated that the company plans to establish a separate subsidiary around the Specs AR glasses in order to accelerate the development process with partners.

The stock price surged after hours.

Year-to-date, Snap's stock price has fallen 32% on the Nasdaq . The index rose 22% overall. Following the release of this earnings report, the company's stock surged as much as 25% in after-hours trading on Wednesday (November 5th).

Snap's stock price retreated slightly after CFO Derek Andersen elaborated on some of the company's sales issues during the earnings call, but still rose 15% in after-hours trading.

Andersen stated that the LCS (Large Customer Solutions) division in North America remains a major drag on Snap's overall revenue growth.

In the third quarter, revenue from the LCS division accounted for approximately 43% of the company's global revenue, a decrease of about 10 percentage points compared to two years ago.

In a letter to investors, Snap stated that legislation such as Australia's minimum age restrictions for social media, and the advancement of related policies, could negatively impact Snap's user activity metrics, the extent of which cannot be predicted at this time. Furthermore, Utah and California in the US have also signed legislation concerning children's online safety . These bills require app store developers to verify users' ages, and this Utah law will officially take effect in May 2026.

In the letter, Snap also noted, "While we remain committed to serving 1 billion monthly active users globally, we anticipate a decline in overall daily active users in the fourth quarter due to these internal and external factors. Furthermore, as we have previously mentioned, certain regions are expected to be particularly negatively impacted."

(Article source: CLS)