1. US stock futures rose slightly in pre-market trading; 2. The situation in Venezuela triggered a rebound in oil prices, gold rose, and silver hit a new record high; 3. The largest IPO of 2025 will debut on Nasdaq tonight. 4. Micron Technology after market close Trump will release an earnings report, and his televised address is said to "reveal some policy details for next year."

U.S. stock futures edged higher in pre-market trading on Wednesday, while geopolitical tensions drove a significant rebound in oil prices, and the dollar and gold strengthened, with silver hitting a new all-time high.

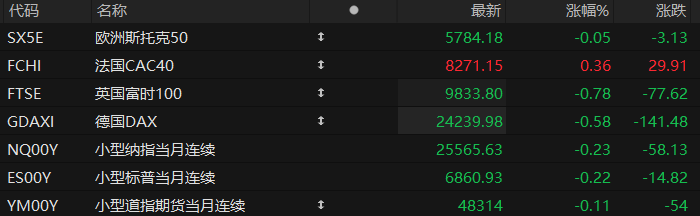

As of press time, Nasdaq 100 futures (2603 contract) were up 0.17%, S&P 500 futures were up 0.19%, and Dow Jones futures were up 0.23%. After the test of the non-farm payroll data, market focus has shifted to Thursday's CPI data.

(S&P 500 daily chart, source: TradingView)

Compared to the high levels of US stocks, the volatility in the oil market on Wednesday was more noteworthy. As of press time, WTI crude oil jumped over 2% today after hitting a new low since 2021 yesterday . On the news front, US President Trump stated that he had ordered a complete blockade of all sanctioned oil tankers entering or leaving Venezuela. Meanwhile, progress in the Russia-Ukraine peace talks also contributed to the market's volatility.

Geopolitical tensions also pushed spot gold to a high of $4,342 per ounce during the day , approaching the record of $4,381 set in October; spot silver broke through the $66 per ounce mark for the first time in history , and platinum also reached its highest point since 2008.

(Spot silver daily chart, source: TradingView)

Tonight, the largest IPO of 2025 will debut on the Nasdaq Stock Exchange. Medline, the world's largest manufacturer and distributor of medical consumables controlled by private equity giants Blackstone, Carlyle, and Herman Friedman, announced on Tuesday that its IPO, which involved additional share offerings, raised $6.26 billion .

According to LSEG data, prior to Medline's IPO, the largest fundraising in the US this year was for liquefied natural gas. The manufacturer Venture Global raised $1.75 billion. The previous record for fundraising in 2025 was held by CATL. (Approximately US$5.3 billion) is retained.

After Wednesday's market close, traders will also be watching the earnings report of another AI star stock , Micron Technology . Last week, Broadcom... and oracle bone script The consecutive sharp declines following the release of its financial report have had a dragging effect on the market to this day. Micron is different in that, due to the inherent limitations of its storage cycle, even after its stock price surged 177% this year, its forward P/E ratio for the next 12 months is only 12 times, far lower than other "AI bull stocks".

( Micron Technology daily chart, source: TradingView)

Traders will also be working overtime to watch US President Trump's nationally televised address. The speech is scheduled to begin at 9 p.m. local time on Wednesday (10 a.m. Beijing time on Thursday) .

According to Reference News, White House Press Secretary Carolyn Levitt revealed on Tuesday that Trump will talk at length about his achievements since taking office in January, and may also "reveal some policies that will be introduced next year."

Other market news

Amazon [Or invest in OpenAI and provide self-developed chips]

According to sources familiar with the matter on Tuesday (December 16), Amazon is working with artificial intelligence... OpenAI is in talks to raise at least $10 billion in an investment deal. As part of the collaboration, OpenAI will use Trainium, an AI chip developed by Amazon Web Services (AWS).

【 apple [First time considering packaging iPhone chips in India]

According to foreign media reports on Wednesday, Eastern Time, Apple is in preliminary talks with an Indian chipmaker to assemble and package components for its iPhones.

SpaceX reportedly notified employees to enter a pre-IPO quiet period.

Latest news on Wednesday afternoon Beijing time indicates that SpaceX, the leading US rocket and satellite internet company, has notified employees that the company is entering a "regulatory quiet period," a significant signal that the largest IPO in Earth's history is slowly unfolding. Following this news, as of press time, the Destiny Tech 100 closed-end fund holding SpaceX stock rebounded 5% pre-market, after falling 20% in the first two days of the week. EchoStar Communications and Rocket Lab, which have agreed to sell spectrum licenses to SpaceX, also rose more than 1%.

Google DeepMind CEO warns of an AI bubble

Demis Hassabis, CEO of DeepMind, Google's AI research firm, has warned that there may be a "bubble" in the current AI funding frenzy, especially among early-stage startups that are being funded at high valuations.

Tesla [US's largest market hit]

Tesla is facing new problems in the U.S. market. A California administrative law judge ruled that Tesla's marketing of its Autopilot and Full Self-Driving (FSD) systems was deceptive, and the company's licenses to sell and manufacture cars in California should be suspended for 30 days.

Waymo is reportedly in talks for new funding, potentially reaching a valuation of $110 billion.

According to market sources, Waymo, the global leader in robotaxi (autonomous taxis) and Alphabet's autonomous driving subsidiary, is in talks to raise $15 billion, with a target valuation of up to $110 billion, more than double its valuation of $45 billion in October last year.

Warner Bros. board recommends investors reject Paramount's "poor" offer.

Warner Bros. Discovery The company's board of directors released a letter to shareholders on Wednesday, urging them to reject Paramount's $108 billion hostile takeover offer. The board emphasized that Paramount's offer was "illusory" because it was backed by a revocable trust of the Ellison family, rather than a personal guarantee from American billionaire Larry Ellison, and the risk of default was far greater than that of Netflix. Part of the acquisition offer.

Netflix also released a letter to Warner Bros. Discovery shareholders, emphasizing that Netflix has almost no overlap with Warner Bros.' existing business and promising to release Warner Bros. films in theaters according to industry practice.

Other events/data to watch tonight

December 17

21:15 Federal Reserve Governor Waller delivers a speech

22:05 New York Fed President Williams Deliver a speech

December 18

00:30 US Short-Term Treasury Auction Data

01:30 Atlanta Fed President Bostic delivers a speech

10:00 US President Trump delivers a televised address

(Article source: CLS)