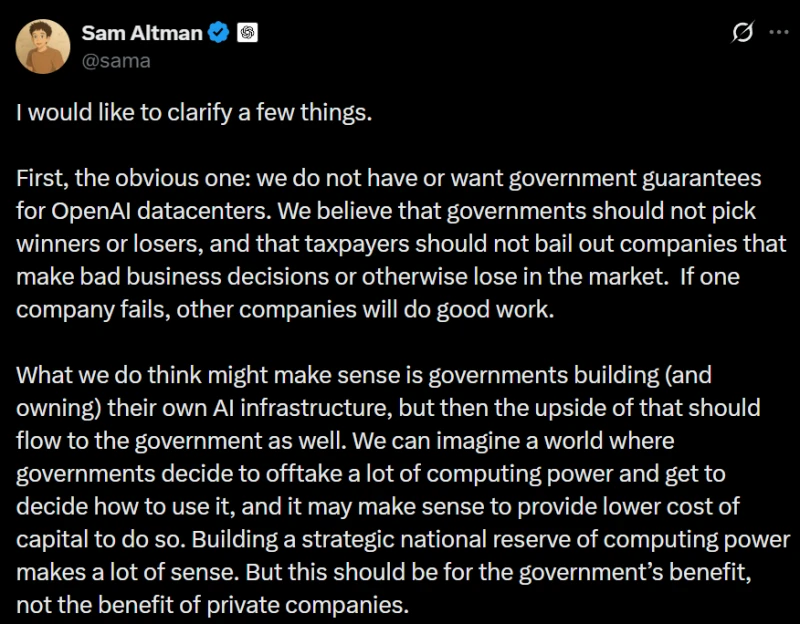

OpenAI quickly stepped in to clarify.

On November 6 local time, OpenAI CEO Sam Altman issued an urgent statement in response to the "seeking government guarantees" argument.

Altman stated: We do not own, nor do we intend to, provide data centers for OpenAI. We advocate for government guarantees. We believe the government should not pick winners or losers, and taxpayers' money should not be used to bail out companies that make poor business decisions or fail in market competition. If one company fails, others will do a good job.

Screenshot of Sam Ultraman's social media account

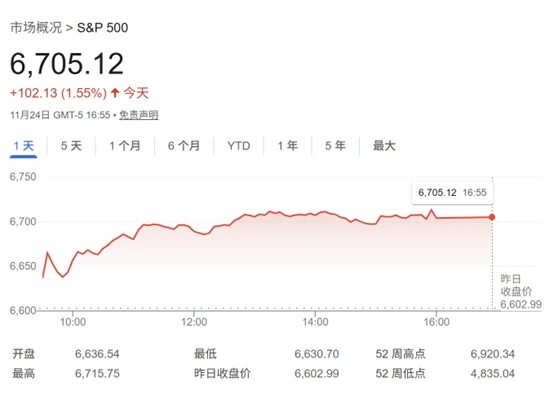

On the same day, talk of "AI giants needing government guarantees" exacerbated market concerns, causing a collective decline in US tech stocks. After various parties issued clarifications, the losses narrowed somewhat, with the S&P 500 down 1.12% and the Nasdaq down 1.12% by the close. The composite index fell 1.9%; the Dow Jones Industrial Average fell 0.84%. Technology stocks generally declined, with Nvidia among them. Tesla fell 3.65%. Amazon fell 3.5%. Down 2.86%, Facebook down 2.67%, Microsoft down Down 1.98%

Previously, OpenAI CFO Sarah Friar stated at a California technology conference that OpenAI is "looking for a bank- backed..." The use of an "ecosystem of private equity and other private equity to support its infrastructure development" is seen as an indication that the U.S. government could guarantee the financing of OpenAI's data centers .

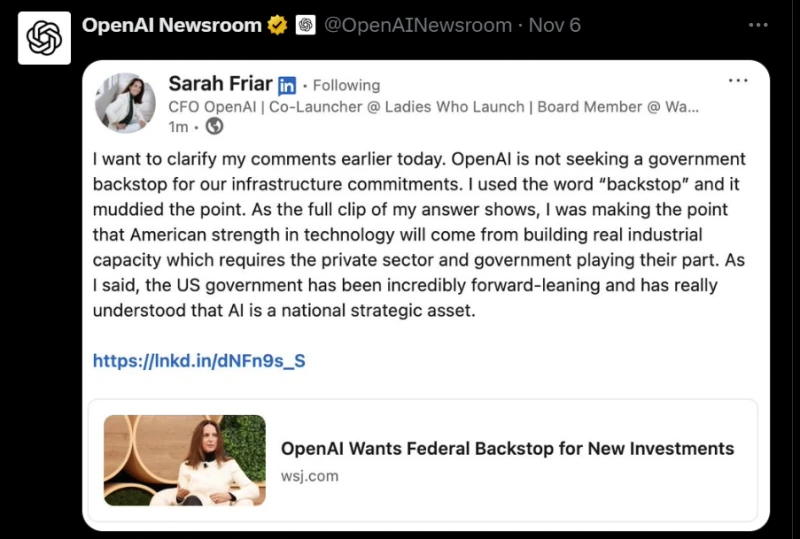

Subsequently, Fryer also clarified on social media that the US media reports "blurred the focus" and that OpenAI does not seek government guarantees for its infrastructure investments. "I used the word 'backing,' and as you can see from the full video of my response, my core point is that America's strength in the technology field comes from building real industrial capacity, which requires the private sector and the government to each play their respective roles."

OpenAI forwarded a clarification statement from its Chief Financial Officer, Sarah Fryer.

David Sacks, the White House’s AI and cryptocurrency director, later responded on social media, saying that there are at least five major cutting-edge AI model companies in the United States, and if one goes bankrupt, the others will take its place.

He stated that the US government does indeed want to streamline approval processes and increase electricity supply, with the goal of rapidly advancing infrastructure construction without raising residential electricity prices. However, "to avoid misunderstanding, I don't think anyone is actually asking the US government for a bailout. (That's absurd.) But company executives can clarify their statements themselves."

Sachs emphasized: "Currently, regarding artificial intelligence... " The two most prevalent theories are: one, that this is a massive bubble (i.e., completely false); and two, that it will soon trigger superintelligence (i.e., completely real). Both theories may be false (which is also my view), but the likelihood of both being true simultaneously is extremely low.

In his lengthy article, Altman stated, “We do think it might be reasonable for the government to build (and own) its own AI infrastructure, but in that case, the benefits should also flow to the government. We can imagine a world where the government decides to purchase large amounts of computing power and decide how to use it, and it might make sense to provide lower funding costs for this. Establishing a strategic national computing power reserve makes a lot of sense. But this should be for the benefit of the government, not for the benefit of private companies.” Altman further explained, “One area we discussed was as support for the U.S. semiconductor industry .” This is part of the wafer fab construction. In this regard, we and other companies responded to the government's call, and we were happy to offer our assistance (although we did not formally apply)... This is certainly different from government-guaranteed construction of data centers for private benefit.

At the same time, Ultraman also responded to three major concerns raised by the outside world, including whether OpenAI is "too big to fail".

How will OpenAI pay for all the promised infrastructure costs? Altman stated that OpenAI expects its annualized revenue to exceed $20 billion by the end of this year and grow to hundreds of billions of dollars by 2030. "We're considering investing approximately $1.4 trillion over the next eight years, which requires sustained revenue growth, and each doubling requires tremendous effort, but we feel good about the outlook. For example, we're about to launch enterprise-level products, and we also anticipate new consumer devices and robots." Technology will also be very important. There are also some new categories that are difficult to specify, such as artificial intelligence that can make scientific discoveries.

He emphasized that OpenAI is also exploring how to sell computing power more directly to other companies and individuals. "We are fairly certain that the world will need a lot of 'AI cloud,' and we may raise more equity or debt capital in the future. Everything we are seeing now indicates that the world will need far more computing power than we have already planned."

Is OpenAI trying to become "too big to fail"? Altman explicitly denied this, emphasizing, "If we mess up and can't fix it, we should fail, and other companies will continue to do their jobs and serve customers. That's how capital works, and the ecosystem and the economy will be fine. We plan to be an extremely successful company, but if we make a mistake, that's our own responsibility."

So why is OpenAI investing so much now, instead of growing more slowly? Altman explained that the company is working to build the infrastructure for an AI-driven future economy, and based on everything seen in its research projects, now is the time to invest to truly scale the technology. Large infrastructure projects take a considerable amount of time to build, so it has to start now.

For OpenAI, the risk of insufficient computing power is greater and more likely to occur than the risk of excess computing power. Even today, OpenAI and other companies have to rate-limit their products and are unable to provide new features and models due to severe limitations in computing resources.

“This is a bet we’re taking, and we feel good about it given our position. But we could certainly make a mistake, and if we do, the market will handle it, not the government,” Altman said.

(Source: The Paper)