Deutsche Bank A report released on Monday predicted that strong corporate earnings and artificial intelligence would drive growth. Driven by positive growth factors, the S&P 500 is expected to climb to 8,000 points by the end of 2026. This is the most optimistic forecast on Wall Street.

This target price was proposed by Matthew Luzzetti, a U.S. equity strategist at Deutsche Bank. The report calls him "our bank's most optimistic analyst" and points to his "strong track record" as evidence of the forecast.

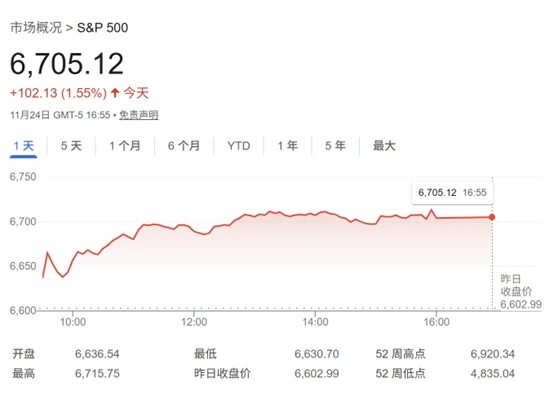

Deutsche Bank's target price is nearly 20% higher than the latest closing price of the S&P 500.

U.S. stocks closed higher on Monday, extending gains from Friday, as increased likelihood of a Federal Reserve rate cut in December helped investors shrug off concerns about overvaluation of tech stocks. The S&P 500 rose 102.13 points, or 1.55%, to close at 6705.12.

At the same time, Deutsche Bank also predicts that earnings per share for S&P 500 companies will reach $320.

“Rapid investment in and adoption of artificial intelligence will continue to dominate market sentiment,” Deutsche Bank strategists said in their 2026 Global Outlook report, predicting that the pace of technological progress will lead to “significant productivity gains.” They also emphasized, “We believe that the positioning of (US) autonomous decision-making investors is a source of potential upside for the market.”

Benefiting from optimism surrounding artificial intelligence , strong corporate earnings, and expectations of a Federal Reserve rate cut, the S&P 500 has risen more than 14% year-to-date. Nvidia , Microsoft Large tech stocks like Alphabet remain the main drivers of this rally.

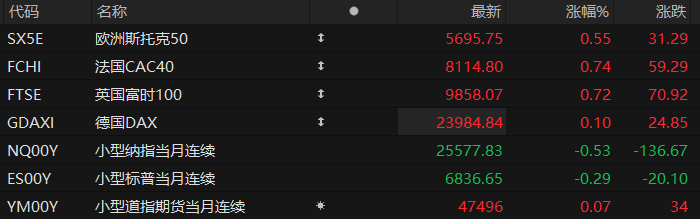

Despite the recent significant pullback in the US tech sector due to growing concerns about an AI bubble and uncertainty surrounding a December rate cut by the Federal Reserve, major international banks are generally optimistic about the outlook for US stocks, giving bullish targets for the S&P 500 index .

In another report on Monday, HSBC HSBC has set a year-end target price of 7,500 for the S&P 500 , with its core bullish logic also focusing on the growth potential of the artificial intelligence industry.

“Regardless of whether a bubble exists—historical experience suggests that rallies can last for a considerable period (both the dot-com bubble and the real estate boom lasted 3-5 years), so we believe there is still room for further gains and recommend that investors expand their allocation to AI-related trades,” said an HSBC analyst.

Morgan Stanley Chief U.S. equity strategist Michael Wilson said on Monday that the "darkest hour" of the current U.S. stock market sell-off may be over, and any short-term dips should be seen as good opportunities to position for 2026. Wilson reiterated that the S&P 500 will trade around 7,800 points by the end of 2026 .

(Article source: CLS)