Several major news items emerged from the chip industry over the weekend!

On November 9th, media reported that memory chips SanDisk, a major manufacturer SanDisk has significantly increased its NAND flash memory contract prices by as much as 50%.

In the US stock market, SanDisk fell on November 7th due to data center... SanDisk's stock price surged over 15% on strong memory chip sales, hitting a new all-time high. The company stated that it expects the NAND product supply shortage to continue until the end of 2026, with data centers becoming the largest application market for NAND.

In addition, Nvidia Blackwell CEO Jensen Huang recently stated that demand for Blackwell chips is very strong. When asked about the shortage of memory chips , Huang said that the entire industry is experiencing strong growth, leading to "shortages of various different things."

In addition, according to Bloomberg, AI giant OpenAI sent a letter to the White House Office of Science and Technology Policy (OSTP), urging the U.S. government to extend the tax credits under the Chip Act to AI data centers .

Price increase of 50%

According to multiple media reports, SanDisk, a leading flash memory manufacturer, significantly raised its NAND flash memory contract prices by as much as 50% in November. This move highlights the tight supply in the storage market, primarily driven by artificial intelligence. Driven by both the continued surge in demand for data centers and the severe constraints on wafer supply.

The report points out that the price increase has shaken the entire storage supply chain, leading module manufacturers such as Transcend, Innosilicon, and Apacer to suspend shipments and reassess their prices. Transcend, in particular, suspended its quotations and deliveries starting November 7, citing "expectations that the market will continue to improve," implying that "prices may rise further."

SanDisk recently announced better-than-expected results for its first fiscal quarter of 2026 (ending October 3, 2025), which boosted the company's stock price by over 15% on November 7, pushing its total market capitalization to a record high of $35.1 billion. Since the beginning of this year, SanDisk's stock price has increased by over 560%.

In terms of specific performance, SanDisk's revenue for the first fiscal quarter was $2.31 billion, up 22.6% year-over-year and 21% quarter-over-quarter, exceeding analysts' expectations of $2.15 billion; GAAP net income was $112 million, down 47% year-over-year but up 587% quarter-over-quarter; GAAP earnings per share were $0.75, down 49% year-over-year but up 569% quarter-over-quarter; adjusted earnings per share were $1.22, far exceeding analysts' expectations of $0.88 per share.

SanDisk stated that demand for NAND products exceeded supply in the first fiscal quarter, and inventory turnover days decreased from 135 days to 115 days, a trend expected to continue until the end of 2026. SanDisk CEO David stated that by 2026, the data center market will become the largest market for NAND flash memory for the first time.

SanDisk expects second-quarter revenue to be between $2.55 billion and $2.65 billion, higher than analysts’ expectations of $2.36 billion; it expects non-GAAP diluted earnings per share to be between $3.00 and $3.40, significantly exceeding analysts’ expectations of $1.82.

Following SanDisk's better-than-expected earnings report, at least 11 Wall Street analysts raised their price targets for the company. Among them was Citigroup. Morgan Stanley has significantly raised its price target for SanDisk from $150 per share to $280 per share. Analyst Joseph Moore maintained his "overweight" rating on the stock and raised his price target from $230 to $263 per share. Moore noted, "SanDisk delivered strong results despite high market expectations, and the robust growth momentum in its data center business appears sustainable. Coupled with limited supply growth, this upward cycle seems to be just beginning."

New Developments at NVIDIA and OpenAI

Nvidia CEO Jensen Huang recently stated that the company's most advanced Blackwell chips are facing "very strong demand," thus impacting TSMC's [relationship with TSMC]. The demand for wafers is also growing.

Jensen Huang stated, "Nvidia manufactures GPUs, and we also manufacture CPUs, network equipment, and switches, so there are many chips related to Blackwell. Furthermore, the company is working hard on the next-generation Rubin chip." TSMC CEO C.C. Wei revealed that Huang "did indeed submit a wafer request," but the specific quantity is a trade secret.

When asked about the memory chip shortage, Jensen Huang stated that the entire industry is experiencing strong growth, leading to "shortages of various things." He added, "We have three outstanding memory manufacturers—SK Hynix, Samsung, and Micron—who have all significantly increased their production capacity to support us." Huang also confirmed that he had received advanced chip samples from these three companies. Regarding the potential for memory price increases, he stated, "That will be up to the companies to decide their own business strategies."

SK Hynix recently announced that its production capacity for next year is fully sold out and it plans to significantly increase investment, anticipating that the artificial intelligence boom will continue to fuel the chip "supercycle." Samsung Electronics also stated that it is in "close discussions" with Nvidia regarding the supply of its next-generation high-bandwidth memory, HBM4.

Of particular note is the news of a major move by AI giant OpenAI. According to a Bloomberg report on November 8th, OpenAI sent a letter to the White House Office of Science and Technology Policy (OSTP), urging the government to expand the tax credits under the Chips Act, originally intended for semiconductors. The 35% tax credit for manufacturing has been extended to artificial intelligence data centers, AI server manufacturers, and related power infrastructure sectors.

According to reports, OpenAI's open letter, signed by Chris Lehane, the company's head of global affairs, on October 27 and sent to Michael Kratsios, the White House Director of Science and Technology Policy, states that expanding tax credits would help "reduce the cost of capital, mitigate early-stage investment risks, and free up private capital to alleviate infrastructure bottlenecks and accelerate the development of the U.S. AI industry."

OpenAI believes that the high costs of investment in AI require public policy to play a risk-mitigating role in the early stages. OpenAI previously pledged to invest approximately $1.4 trillion in data center and chip construction to support the development of more advanced AI systems and broader technology applications. Because the company is not yet profitable, its fundraising methods have attracted attention, with some industry insiders criticizing its financing structure as "circularly complex."

In its letter, OpenAI also suggested that the U.S. government could support the “manufacturing side” of the AI industry through grants, cost-sharing, loans, or loan guarantees, but did not specify the types of companies that would benefit.

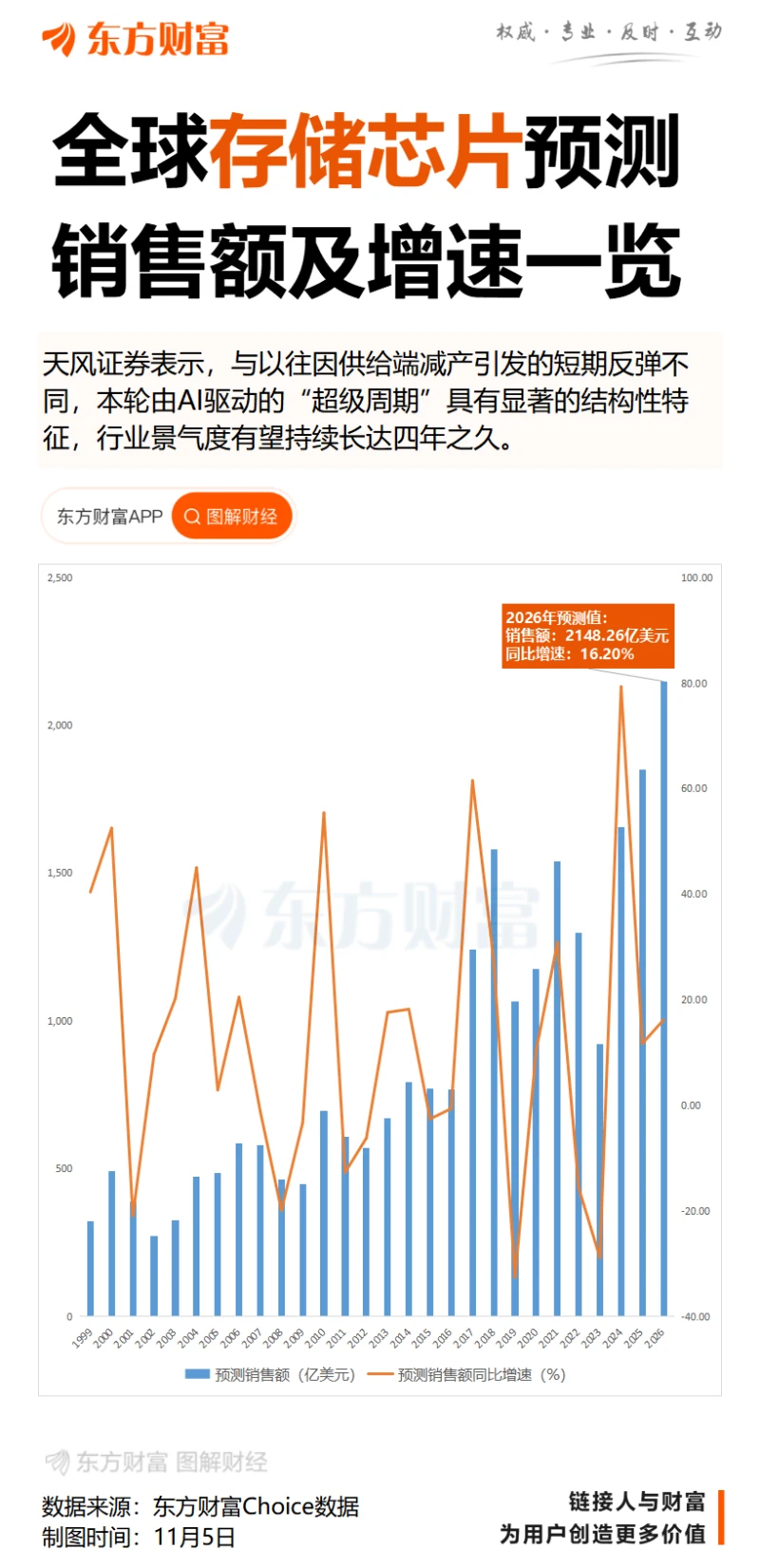

Dongcai Illustrated Guide: Some Useful Tips

(Source: Securities Times) (Times.com)