① Amid growing market concerns about the high valuations of AI concept stocks, SoftBank Group, a well-known Japanese technology investment company, made a surprising move: it liquidated its entire stake in " AI chips". Nvidia, the "dominant player" ① Shares were sold for $5.8 billion; ② SoftBank's second-quarter fiscal 2025 earnings, released Tuesday, showed profits far exceeding expectations, driven by aggressive artificial intelligence... The investment brought it a substantial return.

Amid growing market concerns about the high valuations of AI concept stocks, SoftBank Group, a well-known Japanese technology investment company, made a surprising move: it sold off its entire stake in Nvidia , the " AI chip giant," cashing out $5.8 billion.

SoftBank released its financial results for the second quarter of fiscal year 2025, ending in September, on Tuesday. The report showed that the company's second-quarter profit far exceeded expectations, driven by substantial returns from aggressive investments in artificial intelligence .

SoftBank also stated that it sold all of its Nvidia shares in October, totaling approximately 32.1 million shares, for a total value of approximately $5.83 billion (approximately RMB 41.5 billion). This sale was not reflected in SoftBank's second-quarter financial report, and the company did not disclose the reasons for the sale.

The stake in Nvidia, coupled with profits from SoftBank's Vision Fund, helped SoftBank achieve a net profit of 2.5 trillion yen (approximately US$16.2 billion) in the second quarter of fiscal year 2025, far exceeding the average analyst expectation of 418.2 billion yen.

On Tuesday, SoftBank also announced that it will implement a 1-to-4 stock split starting January 1 next year.

Currently, SoftBank's portfolio includes several of the world's most sought-after AI companies, including OpenAI, the developer of ChatGPT. These holdings have brought SoftBank substantial paper profits and driven its share price up 78% in the three months ending in September, marking its best performance since the fourth quarter of 2005.

Citigroup In a report ahead of SoftBank's earnings release, analyst Keiichi Yoneshima wrote that the number of venture capital projects where SoftBank has successfully recouped its investments is increasing, "therefore we have raised our expectations."

Citigroup analysts set a target price of ¥27,100 for SoftBank, a figure linked to OpenAI's valuation, assuming the ChatGPT operator will be valued between $500 billion and $1 trillion in the future.

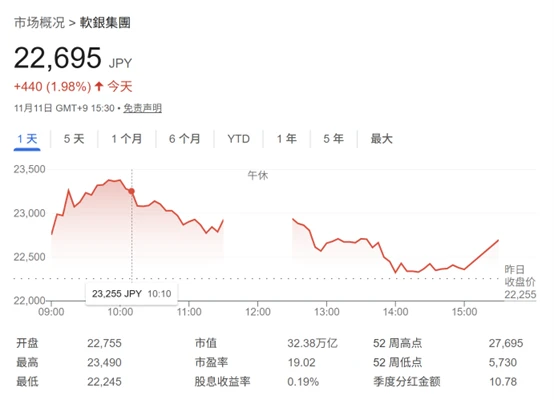

On Tuesday, SoftBank shares rose nearly 2% to 22,695 yen, bringing the year-to-date gain to 145%.

It remains unclear what SoftBank's motives were for selling off its entire stake in Nvidia. On Monday, Nvidia's stock price rose 5.79% to $199.05, not far from its all-time high, with a market capitalization of $4.84 trillion.

At the end of last month, Nvidia's market capitalization broke through the $5 trillion mark, making it the first company in history to cross this threshold.

Nvidia's stock price has risen more than 40% this year. Since the launch of ChatGPT in 2022, which sparked the AI craze, Nvidia's stock price has increased more than tenfold. Some analysts are beginning to worry about the risk of an AI bubble behind Nvidia's high valuation .

It's worth noting that this isn't the first time SoftBank has sold off its entire stake in Nvidia. In 2017, SoftBank acquired nearly 5% of Nvidia's shares for $4 billion, becoming one of its major shareholders. However, in 2019, it chose to sell all its holdings for $7 billion, missing out on the company's phenomenal growth from a market capitalization of hundreds of billions to $4 trillion. But starting last year, SoftBank began buying back Nvidia shares, holding $1 billion in the fourth quarter. As of the end of March this year, SoftBank had increased its Nvidia stake to approximately $3 billion.

Last November, Masayoshi Son said he "regretted selling his Nvidia shares," and now it has been almost a year since he publicly expressed his regret.

However, SoftBank founder Masayoshi Son clearly sees the potential of artificial intelligence . Currently, Son is planning a series of investments to expand the company's influence in the field of AI.

Masayoshi Son is actively seeking to capitalize on the investment boom in AI and chip technology, and his ambitions have spurred several major projects, including the Stargate data center. The deployment of [the technology/organization], plans to invest $30 billion in OpenAI, and lobbying TSMC. Companies like these are working together to build a $1 trillion AI manufacturing center in Arizona.

(Article source: CLS)