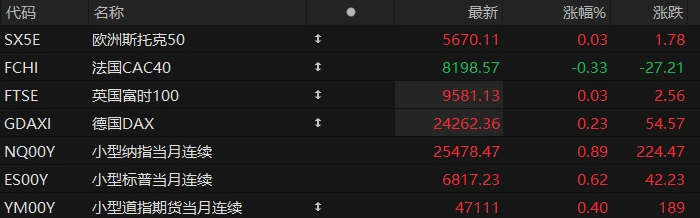

U.S. stock index futures rose across the board in pre-market trading on Friday, while most major European indices also gained. As of press time, the Nasdaq... S&P 500 futures rose 0.89%, S&P 500 futures rose 0.62%, and Dow Jones futures rose 0.40%.

In terms of individual stocks, popular Chinese concept stocks showed mixed performance in pre-market trading, with Bilibili among them. Pony.ai Baidu rose 1%. Alibaba Pinduoduo rose 0.8% Up 0.2%, JD.com Flat, Li Auto NIO It fell by 1%.

Intel The stock rose 8% in pre-market trading after the company returned to profitability in Q3, with revenue resuming growth and optimistic guidance.

U.S. Treasury yields fell briefly, with the 10-year Treasury yield dropping more than 2 basis points to 3.978%. The U.S. dollar index fell below 99. Spot gold fell nearly 1.5% to $4,060 per ounce. Brent crude oil rose more than 0.3% to $65.52 per barrel. Bitcoin rose more than 1.7%, and Ethereum rose more than 2.3%.

US CPI data showed inflation was lower than expected, boosting Wall Street's confidence in a Federal Reserve rate cut next week. US stock futures rallied briefly, with Nasdaq futures rising nearly 1% intraday. US Treasury yields fell sharply, with the 10-year Treasury yield dropping more than 2 basis points, and the US dollar index plunged.

Hot News

U.S. inflation data for September fell across the board, increasing the likelihood of a Federal Reserve rate cut.

On Friday (October 24), local time, the latest data released by the U.S. Bureau of Labor Statistics showed that September inflation data was lower than expected across the board.

Data shows that the U.S. Consumer Price Index (CPI) rose 0.3% month-on-month in September, lower than the 0.4% in August and the market expectation; the year-on-year increase was 3%, also 0.1 percentage points lower than expected, but 3% is still the highest level since June 2024.

Excluding volatile food and energy prices, the core CPI rose 0.2% month-on-month and 3% year-on-year in September, both 0.1 percentage points lower than the previous month's increase and market expectations.

Goldman Sachs Hedge funds have reached a near 9-year high in AI investment exposure, betting on a rise in Asian and US stocks.

Goldman Sachs stated in a client report that since the bank Since starting to track data in 2016, hedge funds have been investing in artificial intelligence. Exposure to related technology hardware reached its peak in October of this year. This suggests that speculative funds may believe the artificial intelligence market will continue to rise.

Goldman Sachs stated that global hedge funds made significant purchases of semiconductor stocks in October. Stocks in the semiconductor and related chip industries saw buying concentrated in long positions, betting on gains in Asian and US companies. Hedge funds' enthusiasm began to shift increasingly towards semiconductors and related equipment in September.

Furthermore, the report states that these hedge funds are no longer generally focusing on the largest tech companies, the so-called "Magnificent Seven," but are instead paying more attention to smaller companies related to the AI concept.

The bank stated that purchases of Asian technology companies have driven overall capital inflows into emerging markets (excluding China), while hedge funds' bets on the Chinese market have reached "multi-year highs."

There's no turning back for Wall Street: JPMorgan Chase reportedly to allow cryptocurrencies as collateral for loans.

Latest news indicates that global banking giant JPMorgan Chase... The plan is to allow institutional clients to use their Bitcoin and Ethereum holdings as collateral for loans by the end of this year.

Sources familiar with the matter revealed that JPMorgan Chase 's new plan will be rolled out globally, relying on third-party custodians to hold the collateralized tokens. This move expands upon JPMorgan Chase's previous acceptance of cryptocurrency-related ETFs as collateral, marking a new phase in the integration of Wall Street and the crypto space.

This expansion demonstrates that cryptocurrencies are rapidly being integrated into the core operations of the global financial system. This year, Bitcoin's strong rebound and the Trump administration's easing of regulatory barriers have allowed major banks to begin more deeply integrating digital assets into their lending systems.

For JPMorgan Chase, this is both a symbolic shift and a substantial action: CEO Jamie Dimon, who once denounced Bitcoin as a "hyped scam" and a "pet stone," no longer views cryptocurrency as a fringe speculative asset. Instead, it will be used as collateral for loans, just like traditional assets such as stocks, bonds, and gold.

US Stocks Focus

Google secures a major contract: a multi-billion dollar partnership with Anthropic to deploy 1 million TPU chips.

On October 23 local time, AI startup Anthropic announced a partnership with Google to deploy up to 1 million Google TPU chips to train its AI model Claude. This expansion plan is worth tens of billions of dollars, with a projected computing capacity of 1GW (gigawatt) by 2026.

Regarding this collaboration, Google Cloud CEO Thomas Kurian stated, "Anthropic's decision to significantly expand its TPU usage reflects its team's long-standing recognition of the TPU's cost-effectiveness and efficiency. We will continue to innovate, further improving the efficiency and capacity of TPUs, building upon our mature AI accelerator portfolio, including the seventh-generation TPU Ironwood." Anthropic's CFO, Krishna Rao, said, "Anthropic and Google have a long-standing partnership, and this expansion will help us continue to enhance computing power to define the forefront of AI."

For Google, this collaboration not only strengthens its partnership with Anthropic but also helps demonstrate the versatility of its self-developed TPU chip. The TPU (Tensor Processing Unit) is Google's self-developed AI-specific ASIC, unveiled in 2016, primarily used to accelerate the training and inference of machine learning models, especially deep learning tasks based on Google's open-source machine learning platform, TensorFlow. On the 23rd, Google (Nasdaq: GOOGL) shares rose 0.55% to close at $253.08 per share, with a total market capitalization of $3.07 trillion. Following the news of the collaboration with Anthropic, Google's after-hours stock price rose by more than 1% at one point.

Goldman Sachs significantly raises its forecast for Alibaba's capital expenditure to 460 billion yuan: Explosive growth in inference demand and improved AI efficiency drive stronger revenue.

Goldman Sachs believes that the explosive growth in demand will continue to drive up capital expenditures (Capex) for cloud service providers. The strategic paths of Chinese internet giants in the AI field are increasingly diverging: Alibaba (BABA.US) is betting on the enterprise AI cloud market with its full-stack capabilities, while ByteDance is focusing its efforts on consumer (To-C) applications.

In a report released on the 23rd, Goldman Sachs raised its capital expenditure forecasts for leading Chinese cloud vendors, predicting that Alibaba's total capital expenditure for fiscal years 2026-2028 will reach 460 billion yuan, far exceeding the company's previous target of 380 billion yuan. The bank believes that the surge in demand for AI inference is the core logic supporting this judgment; higher computing efficiency may actually increase the conversion rate of capital expenditure into cloud revenue, thereby accelerating revenue growth.

Meanwhile, the strategic differences among these giants are becoming increasingly apparent. Goldman Sachs points out that Alibaba leads in external AI cloud revenue and enterprise (To-B) services, with a clearer commercialization path. ByteDance, on the other hand, relies on its chatbot... "Doubao" holds the largest share in the To-C sector and daily token consumption, demonstrating its determination to explore AI applications for consumers.

The report argues that current valuations of major Chinese tech stocks remain attractive. The market has not yet entered an AI bubble, and the valuations of Tencent and Alibaba are relatively attractive compared to their earnings growth prospects and global peers such as Google and Amazon. (AMZN.US) still has room for a discount. Based on this, Goldman Sachs reiterated its "buy" rating on Alibaba and Tencent.

Intel is on a new beginning! Q3 revenue exceeded expectations and the company returned to profitability.

Intel's Q3 revenue rose 3% year-over-year to $13.7 billion, marking its first positive year-over-year growth in a year and a half, exceeding market expectations of $13.2 billion. Adjusted earnings per share were 23 cents, far exceeding market expectations of 1 cent.

The adjusted operating profit margin reached 11%, compared to -17.8% in the same period last year. Furthermore, the company's management stated that the supply shortage of its chips will continue into next year, primarily due to the unprecedented AI boom in data centers. The surge in demand for high-performance server CPUs and AIPCs equipped with Intel PC chips Demand is strong.

(Article source: Hafu Securities) )