As November arrived, the US stock market, much like the weather, finally began to feel a bit chilly. Major short seller Michael Burry shorted Nvidia. The news of SoftBank selling off its Nvidia shares has dampened market sentiment. After all, for ordinary investors, the actions of these investment gurus can be seen as a market indicator. It is understandable that market doubts about this sector have gradually increased after these professional investors chose to be bearish on the AI sector.

Although the US stock market has maintained a strong overall trend without significant correction, these are temporary. With increasing bearish and short-selling forces, a further market correction is highly probable.

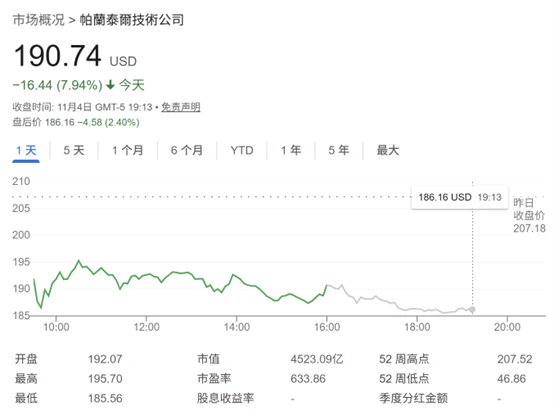

This is the second in-depth analysis of Meta Platforms in our "Top 50 US Stocks" series. Since our initial report on February 17th, when the stock closed at $736, Meta's performance has been a rollercoaster ride. In the following months, driven by both a recovery in its advertising business and an accelerated AI strategy, the stock price climbed to nearly $800, a cumulative increase of almost 9%. However, in the second half of the year, market concerns about AI capital expenditures and rising US Treasury yields triggered a correction in tech stocks, causing Meta's stock price to fall from its peak to approximately $621, a staggering drop of 22%.

On the surface, this has been a period of dramatic volatility; however, from an investment perspective, this correction, by lowering valuations, has actually opened up new opportunities. This article will re-examine Meta's long-term potential from four angles: why AI investment is a necessity for survival, rather than a gamble on the future; why AI investment is yielding substantial returns; why the current decline is more of a misjudgment by market sentiment; and how to understand Meta's strategic advantage in seizing the next generation of AI platforms.

We remain convinced that Meta is one of the most cash-generating technology companies in the global digital advertising and social ecosystem. The current correction does not signify the end of its growth, but rather a healthy adjustment after a period of high valuations. More importantly, with the stock price falling and earnings maintaining high growth, Meta's valuation has re-entered an attractive range—making it a core stock in our "Top 50 US Stocks" list that is worth holding long-term and buying on dips.

[Company Profile]

MetaPlatforms, Inc. (META), founded in 2004 and headquartered in California, USA, is one of the world's leading social media and digital advertising technology companies. Formerly known as Facebook, Inc., the company officially changed its name to Meta in October 2021 to reflect its strategic transformation towards the metaverse and future platforms.

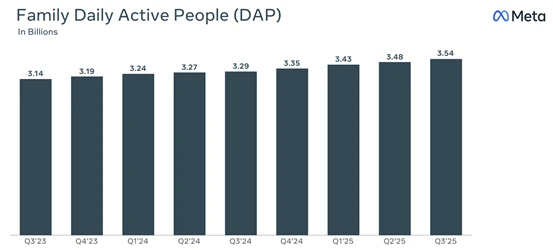

Meta's business covers global social networking, advertising and marketing, and virtual reality. (VR/AR) devices and artificial intelligence Meta is a technology platform. Its mission is to empower people to build communities and make the world more connected. The company's founder and CEO is Mark Zuckerberg. To date, Meta boasts over 3 billion global users, making it the world's largest social networking ecosystem. Its main products include platforms such as Facebook, Instagram, Messenger, WhatsApp, and Threads. These products not only support a vast social network but also constitute one of the world's largest digital advertising ecosystems.

【Scope of Services】

Meta's business structure can be divided into three core segments: Family of Apps (social and advertising ecosystem), Reality Labs (metaverse/hardware/XR technology), and AI and infrastructure investment. These segments work synergistically to form the company's diversified technology ecosystem.

1. Family of Apps (Social and Advertising Business)

This is Meta's core and cash flow source, encompassing products such as Facebook, Instagram, Messenger, and WhatsApp. This ecosystem reaches billions of users globally, forming a powerful foundation of social networks and data assets.

The company's main source of revenue is digital advertising. Through algorithm optimization and targeted delivery technology, the company provides advertisers with efficient advertising conversion and data analysis services.

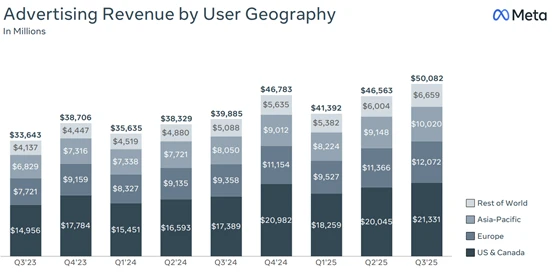

As of the end of 2024, the company had 3.35 billion daily active users, and advertising revenue still accounted for over 95% of its total revenue. Ad impressions increased by 11% year-on-year, and the average ad price rose by 10% year-on-year, demonstrating continued improvement in advertising demand and campaign effectiveness.

2. RealityLabs (Metaverse/VR/AR/Hardware Business)

This section focuses on the research and development of VR/AR hardware, metaverse platforms, and future interactive technologies, including the Quest series headsets, Ray-Ban Meta smart glasses, and Horizon Worlds virtual social spaces.

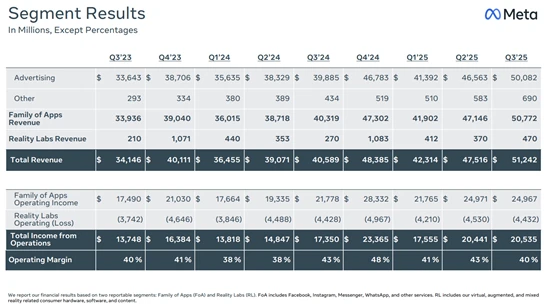

In fiscal year 2024, Reality Labs invested approximately $19.88 billion, representing about 21% of its total expenditures, but its revenue contribution was relatively low, and it is still in the long-term investment phase. Meta believes that this part is a strategic platform that will not mature until the next ten years, and will continue to drag down the overall profit margin in the short term.

3. AI and Infrastructure (Future Platforms and Long-Term Investments)

Meta significantly increased its investment in AI and data centers after 2024. The company will invest in building its own AI training infrastructure (Meta AISupercluster) and promote the commercial application of the multimodal model LLaMA.

These investments aim to enhance the platform's recommendation algorithms, advertising accuracy, and content security capabilities, and lay the foundation for future AI products such as AI assistants and smart glasses.

The company expects a significant increase in capital expenditure in 2025, primarily for AI chips. Server and data center expansion.

Financial Status

In Q3 2025 (ending September 30, 2025), Meta achieved revenue of $51.24 billion, a 26% year-over-year increase, primarily driven by strong advertising demand and increased revenue from Reels video ads. Total costs and expenses were $30.71 billion, a 32% year-over-year increase, reflecting rising costs associated with AI and infrastructure expansion. Operating profit was $20.53 billion, an 18% year-over-year increase, with an operating margin of approximately 40%. Net income was reported at $2.71 billion, but this includes one-time tax expenses of approximately $15.9 billion; excluding this, adjusted net income would be approximately $18.6 billion, or approximately $7.25 per share (EPS).

In fiscal year 2024 (ending December 31, 2024), Meta achieved annual revenue of $164.5 billion, a 22% year-over-year increase; net profit for the year was $46.4 billion, a 69% year-over-year increase. Under its efficiency-focused strategy, the company controlled expense growth (+8%), resulting in a significant improvement in operating profit margin. Free cash flow reached $52.1 billion, and cash and cash equivalents were approximately $77.8 billion, indicating a robust financial structure. Long-term debt was $28.8 billion, resulting in a low debt ratio and ample room for future investment. In terms of revenue structure, Family of Apps contributed over 97% of revenue, serving as the core source of the advertising ecosystem; Reality Labs had smaller revenue but significant investment, resulting in an annual loss exceeding $16 billion. Total capital expenditures in fiscal year 2024 amounted to $95.1 billion, with approximately 80% allocated to the expansion of core social and advertising systems, AI servers, and data centers . Overall, Meta achieved double-digit growth in both revenue and profit in fiscal year 2024, demonstrating the resilience and cash generation capabilities of its social advertising ecosystem. While investments in AI and Metaverse may have dragged down profits in the short term, they have laid the foundation for the company's long-term strategy.

In summary, Meta remains a core player in the global digital advertising and social media platform landscape, maintaining strong cash flow thanks to the massive user base of Facebook and Instagram. After undergoing cost reduction and efficiency improvement initiatives and an AI transformation, the company is entering a new growth cycle: its advertising ecosystem maintains steady growth, and AI investment is enhancing efficiency; while Reality Labs remains unprofitable, it is considered a potential growth engine for the platform's future. In the short term, Meta needs to balance AI infrastructure spending with profit margin pressures; in the long term, its vast user data, AI algorithm capabilities, and synergistic social ecosystem will continue to support its leading position among tech giants.

Reasons for optimism

AI investment is a necessity for survival, not a gamble on the future.

Market concerns about Meta often stem from a misunderstanding: conflating current AI investments with past Metaverse spending. In reality, these are fundamentally different. Metaverse investments are explorations driven by a long-term vision, while AI investments are necessary expenditures to maintain core competitiveness in social media and advertising—money that must be spent.

Meta's advertising system and content recommendation rely almost entirely on algorithms. Every dollar invested in AI upgrades algorithms, strengthens models, and improves recommendation accuracy and ad conversion efficiency. In other words, these expenditures are not betting on the future, but rather laying the foundation for strengthening the existing profit model.

In the AI era, algorithms determine traffic distribution, and distribution determines advertising revenue. If Meta doesn't continue to invest, it will be overtaken technologically by competitors. Therefore, this type of investment is both defensive and offensive. In the short term, it may lower profit margins, but in the long term, it can improve platform efficiency and solidify its ecosystem barriers. Meta is laying the foundation for its dominance over the next five to ten years through this necessary capital expenditure. This is not a gamble, but a systemic upgrade of its competitive moat.

AI investments are yielding returns.

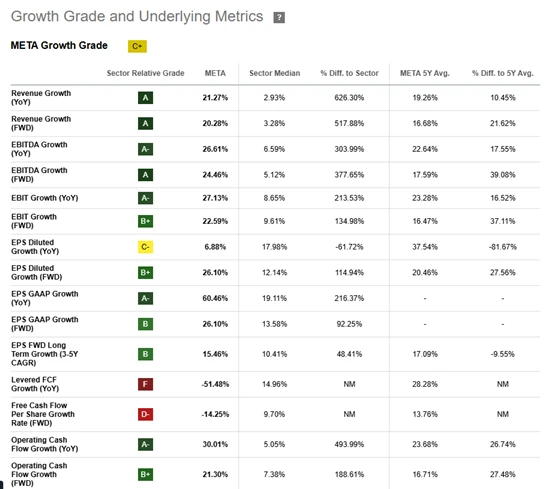

AI is no longer a distant story for Meta, but a real driver improving the company's core business. Over the past year, AI recommendation systems have significantly increased user engagement—average Facebook usage time has increased, Instagram video views have grown by 30%, and Threads has also achieved double-digit growth in activity.

This growth wasn't driven by marketing, but rather a natural consequence of leaps in algorithmic capabilities. More precise content distribution and longer user engagement lead to increased conversion rates for advertisers. AI tools like Advantage+ have reduced customer acquisition costs by over 10%, while improvements in ranking and matching models have further enhanced ad quality and click-through rates.

AI has also driven product innovation. Meta's AI assistant and generative image features have attracted hundreds of millions of users, and the amount of user-generated content is growing exponentially, providing new scenarios for future commercialization. It can be said that AI investment is driving the efficiency and output of the entire ecosystem from the ground up. Compared with the investment in Metaverse in the past, this type of investment is not only closer to the core cash flow business, but also has more verifiable short-term returns.

The decline was a misjudgment based on sentiment; the risk had already been priced in.

The recent stock price decline is more likely a fluctuation in market sentiment than a fundamental issue. Investors, influenced by the metaverse, have overreacted to AI capital expenditures, misinterpreting rational investment as repetitive recklessness.

In fact, Meta's financial structure remains robust, with strong cash reserves and consistent free cash flow. Its AI investment program is also flexible, allowing for adjustments to the pace based on investment returns. The company is not indulging in bottomless expansion but is prudently balancing growth and profitability.

Meanwhile, the advertising business continues its high growth rate, and core profitability remains unaffected. The stock price decline stems more from market panic over increased spending than from a decline in company value. Once this short-term fear dissipates and performance further validates the effectiveness of AI investments, the space for valuation repricing will naturally open up. The current price range actually provides a better entry point for medium- to long-term investments.

Seize the first-mover advantage of the next-generation AI platform

Meta's strategic focus is evolving from social platforms to AI platforms. The company aims to be not only a user of applications but also a provider of underlying capabilities in the next wave of technological revolution. The emergence of AI superintelligence may bring entirely new platform-level opportunities, much like the mobile internet did in 2010. Meta is paving the way for this.

Its three major advantages are its open model strategy, continuous investment in computing power, and massive social data assets. The open ecosystem attracts developers and partners to participate, expanding its technological influence; the investment in computing power and algorithms ensures that the company stays ahead in model iteration; and the data resources of billions of users worldwide become a scarce raw material for training social AI.

This model of early deployment—waiting for maturity—and then dominating the cycle is precisely Meta's consistent path to success. From desktop to mobile, from text and images to video, it has won with each platform migration through upfront investment. Its AI investment continues this logic: prepare in advance and wait for the inflection point. In the next three to five years, if AI super-intelligence becomes commercially viable, Meta is highly likely to become the core infrastructure provider for the next generation of social and content ecosystems.

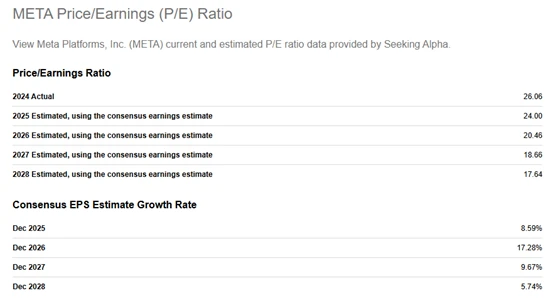

Valuation

From a price-to-earnings ratio perspective, Meta's current forward P/E ratio is only around 17–19 times, significantly lower than other companies in the same group of seven tech giants. Microsoft Amazon Driven by the AI concept, companies like Nvidia generally trade in the 30-40 P/E ratio range, while Meta's valuation multiple remains relatively low, even with continued high revenue and profit growth. This mismatch doesn't stem from deteriorating fundamentals, but rather from the market's emotional reaction to high capital expenditures. Since its February high, Meta's stock price has corrected by about 20%, but earnings expectations haven't declined; instead, they've steadily risen as its advertising business recovers. This means the company's performance is strengthening while its valuation is declining, presenting a typical disconnect between fundamentals and sentiment. Historically, Meta's current valuation is close to the panic lows of late 2022, significantly undervalued given similar earnings growth potential. For long-term investors, this combination of high growth and low multiples often signifies the starting point for valuation repair.

Even at the peak of AI investment, Meta has maintained strong free cash flow. Over the past twelve months, its free cash flow yield has exceeded 6%, significantly higher than the typical 3%–4% for large-cap tech stocks. This means the market is currently buying a high-growth company that continues to generate cash at a discount. More importantly, AI investment is not a cash-devouring black hole, but rather a delayed growth engine. As data center construction and algorithm training are completed, the company's future capital expenditure will slow down, and free cash flow will expand again. At that time, the free cash flow yield at the current price will be extremely attractive.

This indicates that downside risks have been hedged by cash flow, while upside potential is driven by both earnings and multiples. In other words, Meta not only possesses the speed of a growth stock but also the defensiveness of a value stock, a trait extremely rare among tech giants.

In terms of enterprise value multiple (EV/EBITDA), Meta is currently trading at around 10–11 times, lower than its historical average (around 13–14 times) and significantly lower than the 15–18 times levels of its peers such as Google and Microsoft . Considering that the company's EBITDA is still in the double-digit growth range and that advertising efficiency and video monetization capabilities are continuously improving, this valuation discount lacks fundamental support.

As AI tools play an increasingly important role in advertising and content distribution, Meta's revenue per unit of traffic and overall operational efficiency are expected to continue to rise. If market sentiment returns to neutral, a valuation multiple recovery to historical averages alone would provide a 20%–30% upside potential for the stock price. Furthermore, if this is coupled with earnings growth momentum, the potential upside will be even greater.

Based on a combination of price-to-earnings ratio, free cash flow yield, and enterprise value multiple, Meta's reasonable valuation range is roughly as follows:

Price-to-earnings ratio: A reasonable multiple is 22-25 times, corresponding to an upside of about 25% in the stock price;

Enterprise value multiple: A reasonable multiple is 13-14 times, corresponding to an upside potential of 20%-30%;

Free cash flow: If the yield returns to 5%, the corresponding stock price will increase by about 30%.

The three sets of results are highly consistent—Meta's current valuation is significantly below its fair value range. The stock price decline is more of an emotional compression than a decline in profitability. As AI investment gradually translates into operating results and the market reassesses its cash flow resilience, the valuation is expected to return to a reasonable level.

This round of adjustments since February has essentially opened a rare valuation window for long-term investors: a leading technology company that is still growing rapidly, has strong cash flow, and whose AI investments are paying off is trading at a historically low valuation. For medium- to long-term funds, this is a classic high-growth opportunity undervalued.

(Article source: CLS)